Why I am short MEG Energy

And why MEG's disclosure needs improvement

MEG Energy (MEG.TO) is an oil patch darling with excellent SAGD assets and an improving balance sheet after a near death experience when oil prices tanked during the early days of COVID. MEG shares got as low as CDN$1.67 on March 1, 2020 as investors fled the company’s shares with a looming risk of bankruptcy if the commodity prices stayed depressed long enough to imperil MEG’s approximately CDN$3 billion debt at that time. Prices improved, MEG did not become insolvent, and the balance sheet repair has been substantial with commodity prices high enough to provide MEG with enough cash flow to fund its CDN$300 to $400 million capital budget, repay debt and even (sadly) buy back shares.

MEG’s debt dropped to CDN$1.6 billion by December 31, 2022 and cash flow for the last twelve months has been CDN$1.4 billion of which CDN$446 million was used to fund capital outlays and CDN$457 million used to buy back stock, with the rest contributing to the lower debt. MEG shares recovered and now trade close to CDN$27. What could possibly go wrong?

Plenty.

CEO Derek Evans is rolling the dice with buybacks which since January 1, 2022 have totaled CDN$839 million for 30,957,000 shares for an average repurchase price of CDN$27 a share. During the same interval Evans’ board has issued over 7 million shares to management at discounted prices, so the total reduction in share count was only 23,575,000 million shares. MEG shares today trade ~CDN$27 a share so any benefit of the buybacks in current share prices is illusory.

Absent the buybacks, MEG’s debt would soon disappear and the approximately 100,000 Boe/day of production become an annuity generating plenty of free cash flow that could be paid in dividends to shareholders for at least 30 years, if not more.

Will the buybacks pay off for shareholders? The jury is out on that question, but we are heading into a period of soft economic growth and there is the potential for a lot lower commodity prices. MEG sells a blend of bitumen called Access Western Blend (AWB) and buys natural gas to power the steam generation needed for its SAGD operations. Natural gas prices are relatively low at CDN$2.40 a gigajoule which is a tailwind for MEG, but AWB is under pressure, falling from over CDN$85 a barrel to about CDN$71 a barrel in the past three weeks.

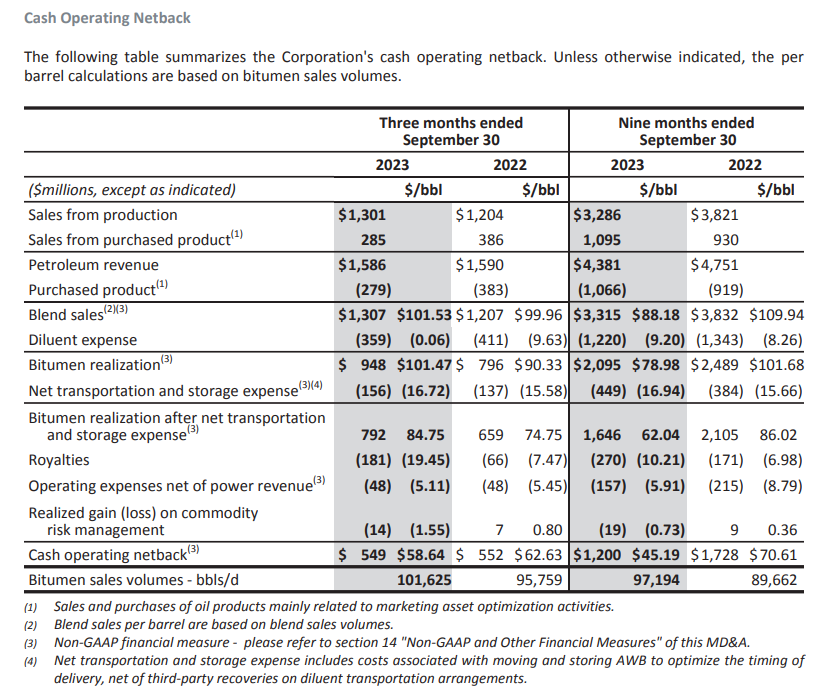

I have tried to model MEG’s operations with limited success since the company’s financial disclosure is murky at best. Here is an example as I try to reconcile the netback calculation. First, here is the netback calculation from the MD&A as reported by MEG.

The CDN$4.4 billion petroleum revenue does not include about CDN$98 million of power sales which makes sense. But the CDN$4.4 billion number does not. Since sales of purchased product and sales of power are either reported separately or excluded, petroleum revenue must be the result of sales of AWB at $88.18 a barrel. But 273 days x 97,194 barrels a day x $88.18 a barrel equals only $2,339,764,769 or rounded to millions to conform to the MD&A chart, $2,340, not the $3,315 reported.

Help me out. Where is the other $865 million coming from? Nowhere in the financial statements or MD&A can I find any explanation of this phenomenon.

I don’t doubt the financial statements are reasonably accurate nor that the audited financial statements at year end are reasonably accurate. But as an investor I prefer clear, concise and accurate statements. I must be old-fashioned.

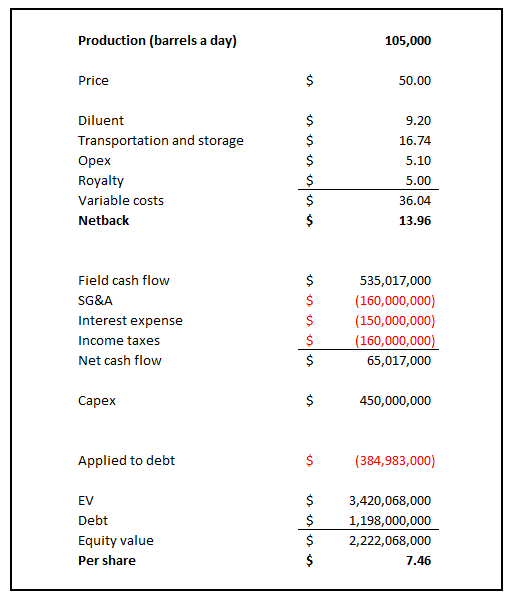

The real issue is economics, not just disclosure. At CDN$71 per barrel, I estimate MEG cash flow to be more than enough to cover capital expenses and debt and still leave a few hundred million to clear away the remaining debt. MEG plans higher output at about 105,000 barrels a day for 2024. Using that volume but realized price of CDN$50 a barrel, I estimate MEG will begin to bleed cash once again and the share value to drop to the CDN$7.50 range, as set out below.

I don’t expect that sort of collapse in oil prices but don’t rule it out either. I have substantial holdings in other oil based E&P’s such as Baytex (BTE.TO), Rubellite (RBY.TO), Whitecap (WCP.TO), and Bonterra (BNE.TO) and they will be beneficiaries of higher oil prices and a short position in MEG is a sensible hedge since MEG is not paying dividends and its leverage to oil prices is considerable both ways. My cost base on my holdings is low and I have no intention to sell any of them, so my MEG short position is a bet that 2024 will see economic weakness, lower commodity prices and gains on my MEG short position (if any) can fund added holdings of companies where I admire management, like their financial management, think they have strong balance sheets and solid operations, and like their complete and lucid disclosure. Any losses I suffer on my MEG short will be more than offset by gains on the other postions.

I have no doubt MEG shares will keep rising if oil prices keep rising. That environment is perfect for me to set up a short position.

didn't you also say companies that do buybacks don't perform as well as companies that pay dividends

Well Meg energy has really shot a hole in that horrible thesis

How has Birchcliff energy done? it pays a 10% dividend and its down 20%+ this year

why would you short one of the best oil sands producers in canada that is also likely on the M&A targets by larger producer

Shorting MEG makes no sense when there are much weaker E&PS with much worse balance sheets and less profitability.

Birchiff energy is a great example. That has been a HUGE turd and I believe you hold that too