Why buybacks of cyclical stocks make no sense

Management buys when stocks are overvalued, ignores times when they are undervalued

Eugene Fama became famous for his efficient market hypothesis (EMH), a theory that the current stock price incorporates all information known to investors and that the stock price at any point in time is “price discovery” pointing to the intrinsic value of the company. A plethora of Nobel Prize winning economists followed making the EMH mainstream (Harry Markowitz, Franco Modigliani, James Merton, Merton Miller, Myron Scholes, to name a few). That theory makes the concept of share “buybacks” an impossible dream.

But impossible dreams can come true, just not often. Nobel laureate Bob Shiller found evidence that markets undervalued and overvalued stocks creating the Case-Shiller cyclically adjusted price earnings multiple as an indicator of market error. Nobel laureate Richard Thaler demonstrated that investors systematically over react to bad news and under-appreciate positive developments. Even Fama adjusted his own Capital Asset Pricing Model (CAPM) to recognize that investors could benefit from buying small capitalization stocks and stocks with high book value to market prices ratios, but still hanging on to his EMH.

Cyclical stocks, and particularly energy and mining stocks, suffer from investor over-enthusiasm when commodity prices are high and excess pessimism when they are low. In March 2020, when COVID emerged energy stocks slumped as the investing public feared calamity and oil & gas prices tanked. Investors ignored the old maxim - the best cure for low energy prices is low energy prices, since production has inherent decline rates and low prices see capital flee the space, output fall, and shortages emerge rather quickly.

I was able to buy shares of Birchcliff Energy (BIR.TO), Whitecap Resources (WCP.TO) and Peyto Exploration (PEY.TO) below CAD$1.00 per share and I bought plenty of each. None of these companies bought back any stock in 2020. Predictably, energy prices recovered as shortages emerged and Birchcliff and Whitecap trade today at about CAD$10 a share and Peyto around CAD$13.00, with all three paying dividends in the 6% to 10% range. But management is under pressure to consider “buybacks” based on sell-side analysts and fund managers opinion that these stocks are “undervalued”. I find it laughable that a stock trading at CAD$1 a share in 2020 was not seen as “undervalued” when the same stock trading at CAD$10 share only two years later is touted as “undervalued” and “buybacks” are the rage.

The list goes on. I paid CAD$0.10 a share for Athabasca stock (ATH.TO), less than CAD$1.00 a share for Baytex Energy (BTE.TO) and about CAD$4.00 a share for Paramount (POT.TO). They now trade at about $CAD2.00 for ATH; CAD$6.00 for BTE and close to $30 for POT.

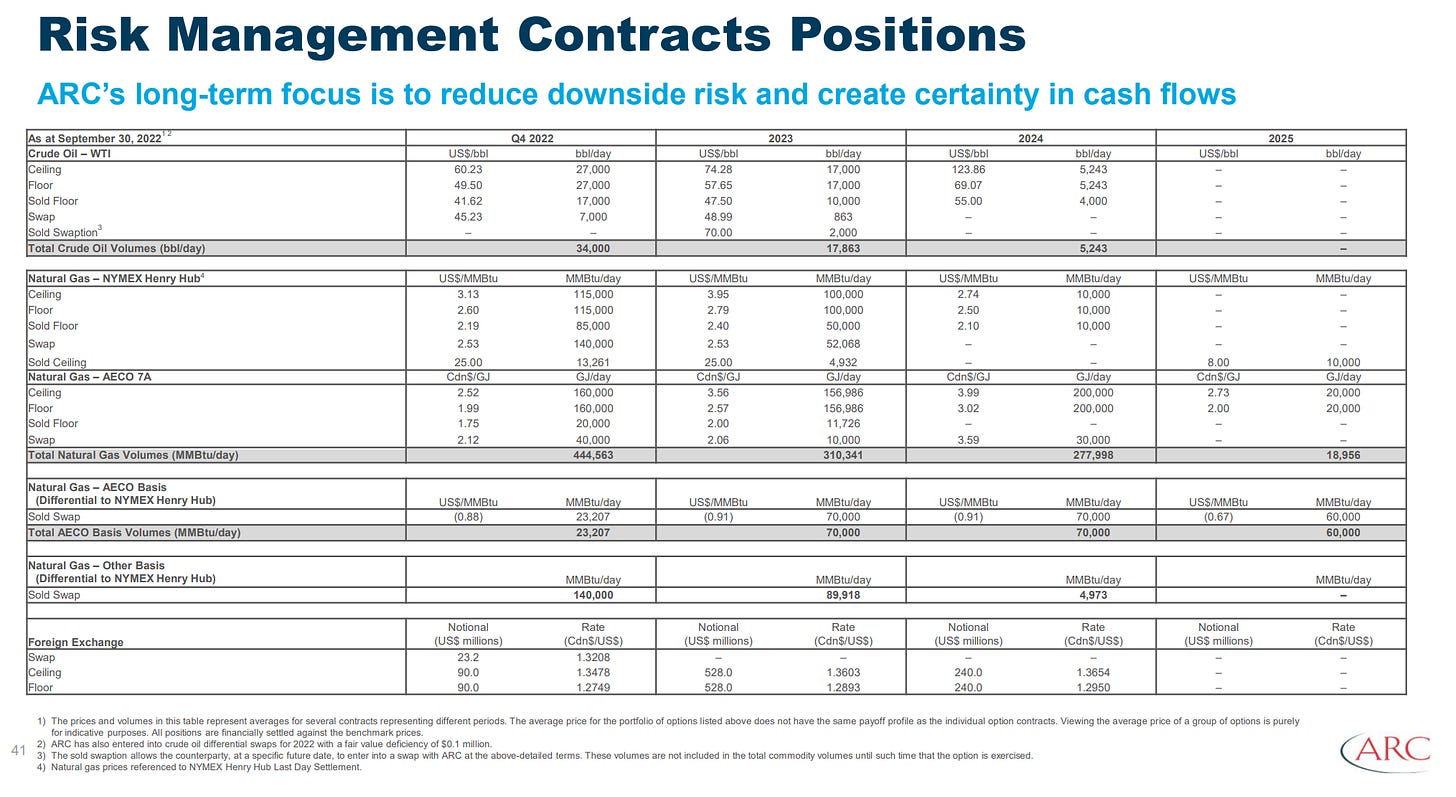

My favorite gripe about the “buyback” charade is ARC Resources (ARX.TO), a fine company with some of the best assets in the Montney. ARC’s schizophrenic management has lost about CAD$2.2 billion on its “hedge book” motivated by a belief that energy prices might tumble while spending over CAD$1.1 billion buying back stock in the implicit belief energy prices will remain robust and support a conclusion that ARX.TO stock is “undervalued”. It can’t be both.

Last year in the first 9 months, ARC has repurchased and canceled 58 million shares at a cost of CAD$975 million, about CAD$16.90 a share. The market prices the shares today CAD$16.68. I guess the “benefit” of these buybacks is sometime in the future, presuming EMH is wrong. ARC’s CAD$1.5 billion of debt would be gone by now if the company hadn’t “hedged” and had eschewed the share buybacks - in fact the balance sheet would sport about CAD$1.8 billion of cash.

ARC sells natural gas and condensate primarily, plus a small amount of oil and natural gas liquids. In the past 6 months, the price of natural gas (Henry Hub) has fallen almost 40%.

You would think ARC’s “hedge book” would have offset some of this plunge but, alas, the hedges largely capped the price ARC receives at even lower prices than today’s.

ARX.TO shares traded under CAD$6.00 a share in 2020, but no buybacks. This year ARC has paid three times that to buy back a billion dollars worth of stock. Think ARC management are experts in valuation? Think again.

ARC’s share buybacks may work out. Commodity prices are log-normally distributed and there is as much reason to believe they will rise as fall. The “buybacks” are a gamble that they will rise. The gambler would rather bet $1 billion of shareholder funds on that outcome while losing $2 billion on “hedges” betting the opposite. Am I the only one who sees the lunacy of this approach?

I like ARC’s assets and don’t see any risk of the company failing. If anything, the shares are a call option on future natural gas and condensate prices and given Canada is on the verge of having its first LNG plant in operation and imports condensate for its oil sands operators, there is a good case that ARC’s excellent asset base is good enough to offset its weak management decisions and ARC investors will be fine. We will see.

I’m making pancakes for breakfast and throwing in my gold bars because eggs are too expensive.

ridiculous article from someone who doesnt understand the benefits of buybacks

exact same argument can be made about how dividends make no sense, why hand out cash when you can reinvest in the business???