Weakness in natural gas prices in North America spells opportunity

Warm weather doesn't last forever and supply is limited

As energy investors run for cover dumping their natural gas weighted stocks as warm weather drives down North American natural gas prices at most hubs, I am adding to my natural gas weighted holdings. North American gas prices may be soft but prices in Europe remain at nosebleed levels and LNG exports are highly profitable.

Traders will focus on the short term and revel in headlines saying there is no evidence of any interest in buying the commodity. Natural gas is a commodity I like to describe as “frictionless” by which I mean the price can move sharply in both directions depending on the local supply-demand picture and the daily price is often irrelevant to next week’s price. Warm winter weather pretty well always sees natural gas prices come under pressue and cold snaps see the price of the commodity spike upwards, often overnight. Forecasting the price is about as useless as forecasting the weather.

The U.S. Energy Information Administration (EIA) reports rapidly increasing exports of LNG in recent years, with the volumes constrained by the capacity of LNG facilities and not by demand. More LNG is going to Europe than Asia today, not because Asian demand is falling but because the severe shortage in Europe sees higher prices.

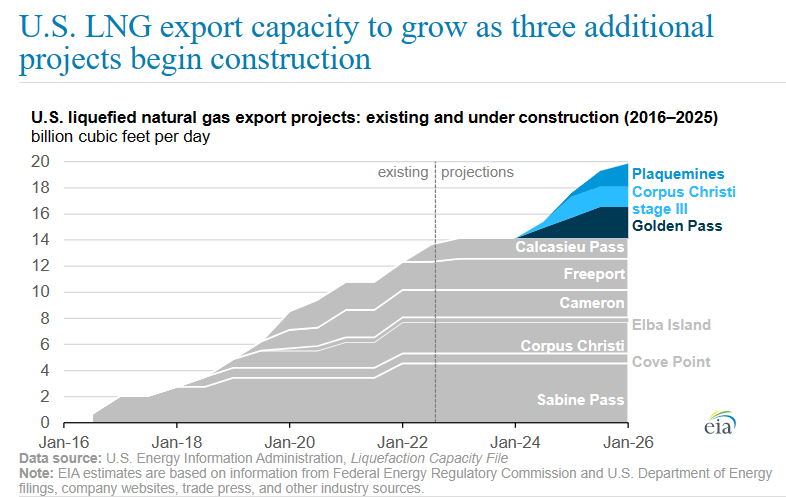

U.S. LNG exports should rise about 50% over the next three years as new LNG facilities now under construction come onstream.

LNG exports suffered a setback when the massive Freeport LNG terminal caught fire and curtailed about 2 Bcf/day of exports, but that facility has been repaired and has applied for a permit to resume exports. According to the September 2022 EIA projection shown in the chart above, LNG exports from United States should reach 20 Bcf/day by 2026 and the Kitimat LNG facility in Canada will add another 2 Bcf/day of exports when it starts up in late 2023 or early 2024. For context, total U.S. demand for natural gas runs around 90 Bcf/day (less in summer, more in winter) and Canadian demand about 12 Bcf/day (about 80% of Canadian production, the balance being exported by pipeline to United States).

TD Waterhouse reports that U.S. natural gas production is about 98 Bcf/day and Canadian gas runs about 16 Bcf/day so supply in North America is roughly 114 Bcf/day. Pipeline exports from U.S. to Mexico are on the order of 5 Bcf/day. The supply-demand balance will come under pressure without added supply. Without added supply, the 2026 balance looks like this.

Supply:

98 Bcf/day United States

16 Bcf/day Canada

114 Bcf/day TOTAL SUPPLY

Demand:

12 Bcf/day from Canada

90 Bcf/day from United States

26 Bcf/day LNG exports

5 Bcf/day Mexico exports

133 Bcf/day TOTAL

Natural gas wells have a decline rate of approximately 25% (can be as high as 40% for shale wells). To add 19 Bcf/day and offset a decline of 25% x 114 = 28.5 Bcf/day will require new production of close to 50 Bcf/day.

As it stands, current industry capital spending is barely enough to maintain existing production levels and there isn’t much evidence the industry is willing to increase capital spending by about the 40% needed to meet the demand unless prices rise materially.

I see a natural gas shortage in the cards auguring for higher prices over the next few years. The current slump in short term gas prices won’t motivate any new supply this winter so the impending shortage is going to get worse, not ease. Governments concerned about energy cost inflation better hope that global warming is occurring and soon or the shortage of fossil fuels, particularly natural gas, is going to drive up inflation and force higher interest rates.

As an investor, I think natural gas is a sound bet if you select low cost, low debt E&P companies like Birchcliff (BIR), NuVista (NVA), Tourmaline (TOU) and Canadian Natural Resources (CNQ). I admire Peyto (PEY) for its low cost structure but think it has not paid enough attention to debt reduction preferring to pay high dividends. I am not a fan of ARC Resources (ARX) despite its excellent asset base owing to what I see as weak financial management. Tiny debt free Pine Cliff (PNE) is a good long term hold although its dividend is vulnerable if the company wants to remain debt free during a slump in gas prices.

I hold 125,000 shares of Birchcliff and nominal positions in Tourmaline, Peyto, ARC and Pine Cliff. I also hold a few shares of Precision Drilling (PD) which I see as a beneficiary of any increase in drilling activity and quite profitable at current rig utilization rates.

Mr. Blair:

Once again you share your wisdom by arguing for patience when investing. From what I can see natural gas prices in the US will probably remain low for the next few months. Buying the companies you have selected (I do own a few of the companies mentioned but I trim 90% of my positions about 2 months ago based my my understanding of the price charts). I have recently started to rebuy those positions but at about 20-25% lower basis. I expect to be fully invested by April-May time period.

Thank you

Jack

Is there a chance natural gas will stay in this lower price range because the shale wells are becoming gassier across the US?