The sad history of Athabasca Oil

And the sadder history of retail investors that keep plugging its shares

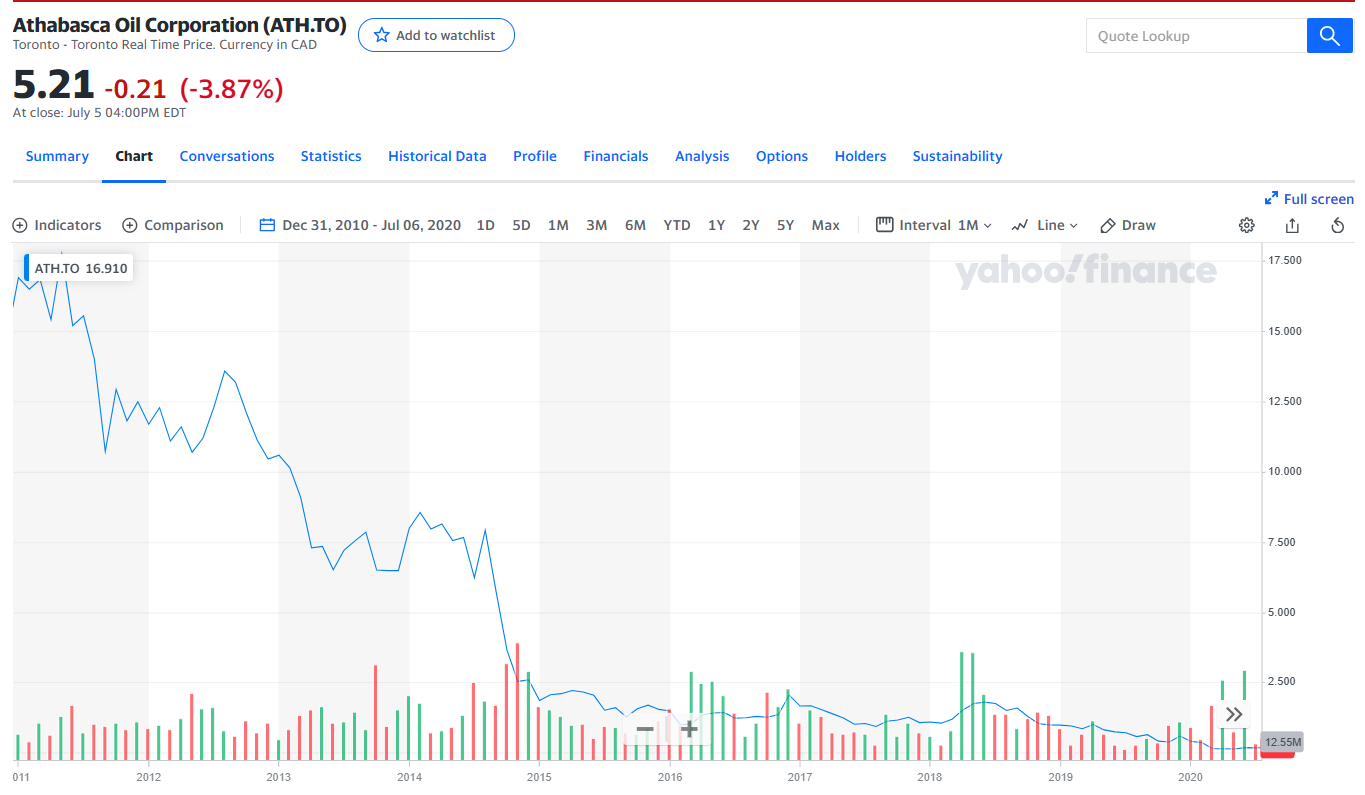

Athabasca Oil (ATH.TO) went public less than fifteen years ago at CDN$18 a share. By the end of 2020 the stock was at CDN seventeen cents a share. I am pretty old fashioned about value but when a company’s shares lose 99.9% of their value in a decade or so I am less a fan of their management team than most. During that period the company never paid a dividend.

Today the shares are CDN$5.21 a share and the company’s fans are legion on Twitter. I guess a “dead cat bounce” is evidence of great thinking by a team who made sure they made out fine while investors lost a pile of money.

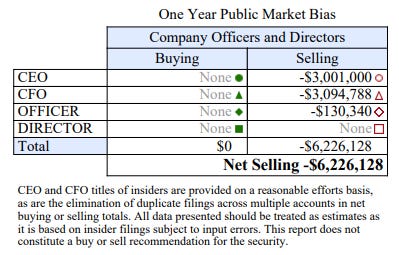

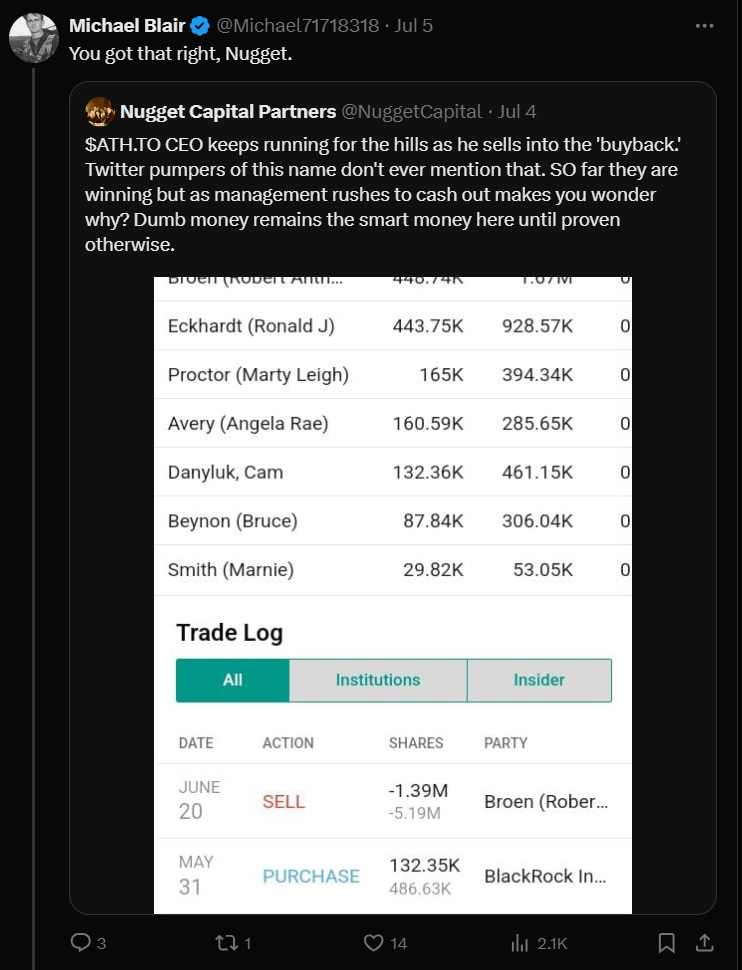

In the last year, insiders have sold over CDN$6 million in stock and purchased none. There is a team of managers who really think their company is going somewhere, right?

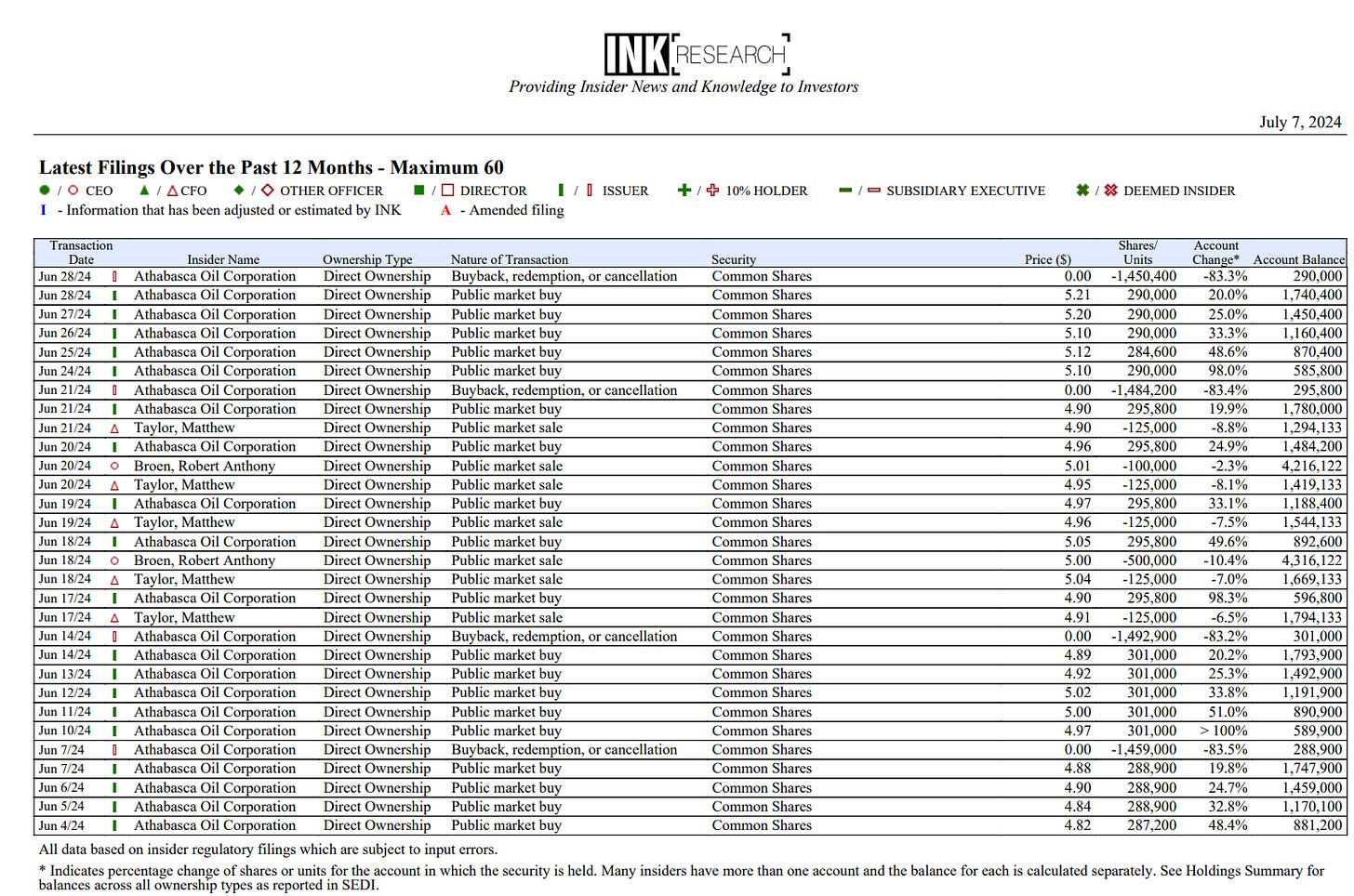

Equally fascinating is that the company has been aggressively “

buying back” shares at about the current market price of CDN$5.00 a share or so while CFO Matthew Taylor has been dumping his stock at the same price, more or less. Taylor has sold 625,000 shares in the last month at an average price approximately equal to what the company paid on its buybacks. I will send a copy of this article to Naizam Kanji at the Ontario Securities Commission and ask if those sales conformed to insider trading rules, since they seem to have taken place immediately before a quarterly earnings release which in my opinion is a bit “iffy”. CEO Robert Broen has been selling shares as well.

Athabasca has a pretty standard “insider trarding” policy. There seems little doubt that the CEO and CFO have insight into the quarterly results for Q2 2024 this close to the end of the quarter, yet the public does not.

Why is it in the interests of the corporation to buy shares for cancellation the same day as the CEO and CFO are selling their own shares into the marketplace? Grade school kids would understand the obvious conflict of interest, but apparently the geniuses who follow the company on the X platform do not.

In 2021, the company issued US$350 million in secured notes with a coupon of 9.75% together with 79 million warrants to buy treasury shares at CDN$0.94 per share. Now the warrants are being exercised by their holders and the company is buying back shares at ~CDN$5.00 a share. Let me see - issue 79 million shares at less than $1 and buy them back at $5 and tell me that is “great management”. That roughly CDN$320 million loss (that does not flow through the income statement but is nonetheless a real loss) adds to the 9.75% coupon bringing the cost of the financing over its 5-year life to a total of over CDN$550 million of effective interest, an average annual (implied) rate of interest of about 14%. Great financial management.

Athabasca has survived poor management owing to two factors - a strong recovery in oil prices (over which management has no control) and excellent assets (which existed at the time the selling shareholders took the $18 a share IPO price and walked away.

Nugget Capital Partners got this one right on X, and were immediately deluged with a pile of posts defending management.

It is no wonder retail investors rarely make money in the market - stupidity is rampant.

A now deceased friend of mine from Karachi once said to me ‘the first squeeze of the lemon yields the most juice’ In 2021 when oil and economies in general were recovering #COM were an interesting and lively bunch. As a generalist I listened and read for clues as to who might be the best players in oil & gas going forward. At first I bought a broad basket but have whittled many away and settled on Cardinal and Suncor in Canada and Exxon and Occidental in the USA. With oil somewhat stabilized from $70-$80 it seems that first squeeze has occurred. #COM were fun but a year was sufficient and I have long since began to hunt for the next lemon so to speak.

More of the SBC junk. They are not friendly to common equity holders.