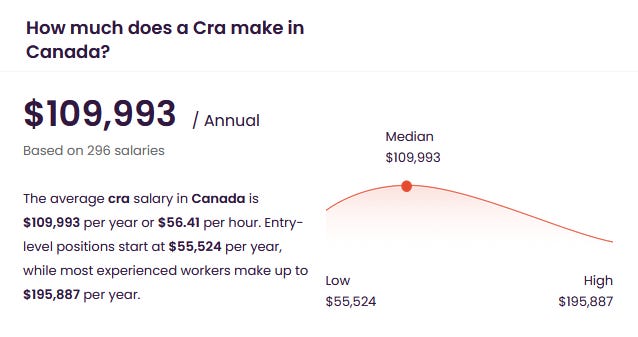

In the most recent year, 27.5 million Canadians filed tax return and 9.1 million of those paid no taxes according to Canada Revenue Agency data. Canada Revenue Agency (CRA) employs 59,155 people. CRA employs one person for every 465 taxpayer who file a return, at an average salary of $110,000.

Presumably it takes as long to assess and administer a tax filing for a taxpayer who pays no taxes as it does for one who has taxes to pay. One way to reduce costs at CRA (which amount to $6.5 billion) is to let people with no taxes to pay refrain from filing a return. With one third less work to do, CRA could cut costs by 20,000 employees and save over $2 billion.

The cost of CRA salaries of $6.5 billion comprises 3.1% of the $208 billion in taxes collected last year. The average tax rate of the lowest 20% of tax filers is less than 3.1%. Does it make sense to employ people at CRA to churn a pile of tax filings by millions of Canadians who owe no income taxes at all?

The Internal Revenue Service (IRS) in United States employs about 80,000 people although that may have risen to the 100,000 range since in 2023 IRS planned to hire 20,000 people. IRS collects about $4.7 trillion in various taxes. Tax collected per employee in United States IRS is some $47 million while the tax collected per CRA employee is a paltry $3 million. It seems likely CRA has a productivity problem.

Canada’s Parliament needs to re-enact our Income Tax Act, simplify it materially and reduce its size from thousands of pages that no one has ever read to few pages with simple descriptions of the tax code that anyone can understand. Here’s a suggested tax code.

Set the tax rate for Canadians earnings less than $35,000 a year at nil. People with incomes less than $35,000 need not file a return. Since CRA receives T4 and T5 slips from employers and investment banks, not filing does not mean escaping review, but the review can by electronic and contact only those taxpayers that CRA identifies as (a) having income over $35,000 and (b) having failed to file.

Set the tax rate for Canadians earning more than $35,000 a year but less than $110,000 a year at a flat 20% of the amount by which their income exceeds $35,000 without deductions. Basically, if you earn $50,000 you pay $3,000 in taxes or if you earn $100,000 you pay $19,500 in taxes.

Set the tax rate for Canadians with incomes over $150,000 at a flat 30% with no deductions.

Eliminate all the nonsensical attempts by government to interfere in the economy by enacting tax deductions, tax credits, tax shelters, etc. and get rid of all deductions. They are unnecessary.

The above tax code will have two outcomes. First, more federal tax will be collected. Do the math yourself, it is not complex and the data on how many Canadians fall into each tax bracket are readily available from Statistics Canada. Here are my estimates, done quickly and roughly but representative. About 12 million Canadians have incomes below $35,000; 14 million have incomes between $35,000 and $110,000; and, about 3 million have incomes over $110,000.

For the top 4 million, their federal tax bill will amount to $139 billion, up from about $85 billion today; for the middle group their tax bill will be about $75 billion [just over $5,300 per taxpayer), more or less where it is today; and, for the lower income segment no taxes at all (except HST of course, but no income taxes).

Second, the cost of CRA will fall by at least $2 billion as needless headcount is removed.

Provincial taxes will apply as percentages of federal taxes just as they do today, the amounts the provinces will receive will be equal to or higher than the amounts they collect today. Both federal and provincial governments can tweak the percentages applied to each group (up and down) as the population grows and the economy expands, but the basic structure can be left untouched.

Imagine, a tax regime in Canada that even grade school kids can understand. We can dream.

Makes too much sense... it seems to be the Canadian way

Expecting the Govt. to cut employment and simplify regulations to save money (and reduce the deficit a little bit) is quite logical.

Of course, the political donations of all the surplus govt. employees and the 1000s of tax accountants no longer making a good living by having interns run client data through their tax software, would have to find new jobs. Perhaps they'd get positions in the administration of the "Employment" Canada unemployment payment program, or the Liberals or NDP could start a new low productivity Govt. program.

Obviously, your logical idea will not be implemented.

The last 50 years of increasing complexity and abandonment of principles in the Income Tax system, and its increasing use to social engineer Canadian life suggests little support among the Political Class, and for the Mandarins, the whole idea of cutting staff to save money is anathema.

While you are asking for intelligent reforms that will never be implemented, please ask for a law that makes "Citizenship Economics" a required course for all High School students living in Provinces that get any Federal money for any Educational Program. After all, it would be nice if all Canadians understand the items on a Tax Return, understand what tax incentives are, comprehend compound interest and the difference between GIC and "investing" (for example).

Of course, banks, accountants, lawyers, and probably teachers would oppose the new regulation.