Musk's brilliance shows through again

Why do other car assemblers display little foresight?

Elon Musk is once again the world’s richest man, despite so many investors writing him off when he bought Twitter for $44 billion. Twitter may be the most valuable property on Earth if Musk can turn it into a reliable “public square” where news hits the street faster and more accurately than any other news agency in existence, without ever becoming a news agency.

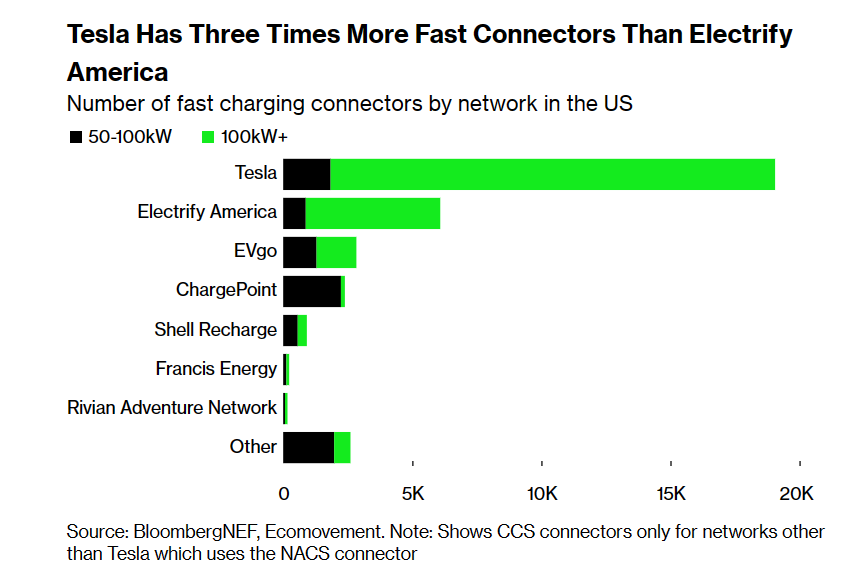

But his foresight is evident in the development of an electric vehicles (EV) charging network years ahead of his global competitors. Today, the number of Tesla charging stations outnumbers everyone else’s put together.

Not only has Tesla more charging stations, most of those are “superchargers” providing much faster charge times than charging stations with less than 100kW. Ford and GM made a good move by joining the Tesla network and Musk made his network capable of charging not only Tesla’s but also EV’s from other assemblers. Consumers win and Tesla wins. Piper Sandler estimates the charging network could be a source of $3 billion annual revenue for Tesla by 2030, according to reports in Bloomberg. That estimate is almost certainly low as the climate nutters in Washington and Ottawa drive up the cost of electricity with stupid “climate” policies that pretend CO2 causes climate change, and the charging stations charge higher margins for the electric power the EV’s are useless without.

Charging stations are a growth market. With over 1 billion vehicles on the road globally, and each needing to refuel about once or twice a month whether EV or internal combustion engine (ICE), somewhere around 24 billion “fill-ups” are needed annually. If half of the vehicles on the road become EV’s (the leftist dream is 100%) 12 billion vehicle recharges with a charging “fee” of $5 a re-charge is a $60 billion market with almost 100% margins likely to keep growing as EV’s displace ICE vehicles for decades to come. At twenty times revenue, EV charging could easily become a $1.2 trillion industry and Tesla is in the pole position to capture a major share of that.

Competition will strengthen and Tesla will need luck to maintain its leading market share without sacrifice of margins, but Musk has been reducing assembly costs rapidly and pricing dynamically while old line assemblers like Ford, GM, and Toyota still have a culture that makes them as vulnerable to competiton from Tesla as Tesla may be from them. Asian assemblers like Hyundai and BYD are flexing some muscle and are more serious competitors not only for Tesla but also for Stellantis, Ford, GM and Toyota. The markets will shake out and car buyers will be the beneficiaries. Toyota has sensibly seen the risks of an all EV fleet and will focus on its own lane building plug in hybrids that combine many of the benefits of both ICE and EV technologies and provide speed, acceleration, range, and fuel flexibility which should keep them in the fray.

I wrote a while back suggesting Tesla stock was undervalued as it approached $180 a share after the Twitter purchase by Musk. Today it has run past that value but in my opinion the stock remains a good hold for many years to come. It should be clear to most by now - it is risky to bet against Elon Musk.

One problem that GM/Ford etc have is their legacy obligations, pensions and perhaps even the dealer network..

Good article, we know not to bet against Musk, and Im sure you are aware but he is also working on turning twitter into some sort of online banking. He has the exposure and contacts to make it happen through X and Paypal so time will tell. He certainly has well recognized brand names in Musk, Elon and Tesla, even a few more.... lucky he wasnt born with John Brown...

Nice to see African Americans do well, too bad he didnt stay in Canada...