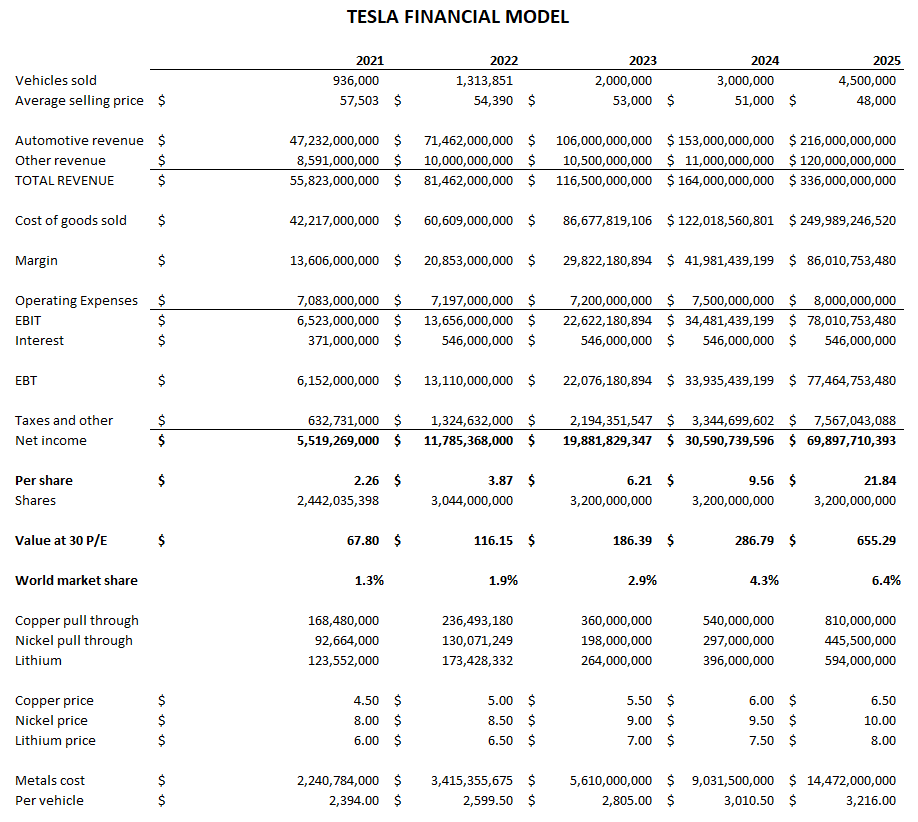

Elon Musk is putting in place enough capacity to build 5 million Tesla’s and plans for 50% annual growth. Given his track record, the quality and performance of the vehicles, and the size of the world market, he has a decent chance of success.

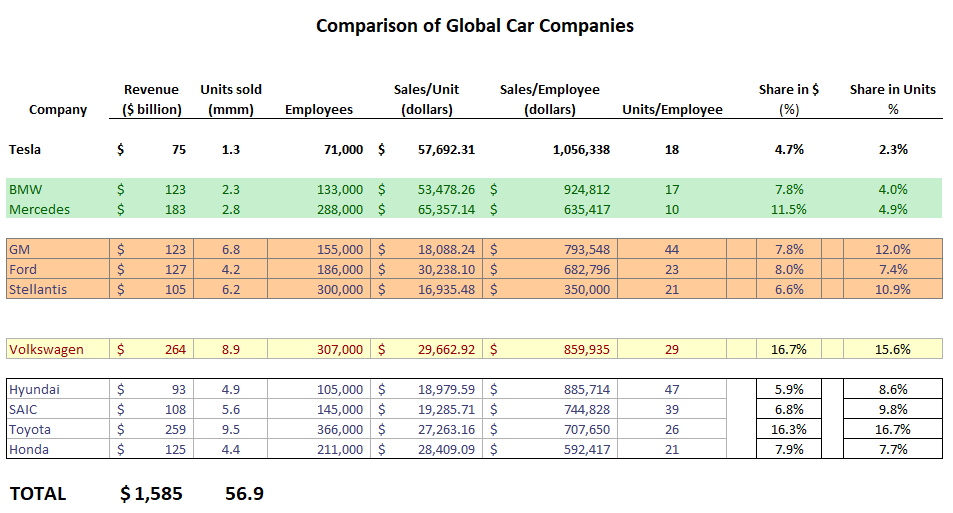

The global market for light vehicles is about $1.6 trillion (major brands, I have ignored minor brands and brands sold only in local markets) comprising almost 57 million vehicles per year. I estimate Tesla already has a 1.9% market share of this segment in terms of units and a 4.7% share in terms of revenue.

Despite rapid growth in competing models from other companies, Tesla remains the top-of-mind brand for electric vehicles (EV’s) and Tesla’s outperform their rivals on pretty well every metric. Musk’s market share ambitions are bold but his track record is solid. Tesla reduces vehicle prices regularly as the company achieves efficiencies of scale and component costs with its in-house battery production. I have assumed Tesla keeps reducing vehicles prices despite the inflationary environment (with the company absorbing the increased costs of administration and metals used in the vehicles). At prices below $50,000 a Tesla is competitive with Mercedes, BMW, Lexus, Audi, Jaguar and most luxury brands.

I value Tesla stock in 2023 at ~$185 a share based on a price to earnings multiple of thirty times (typical of a company growing at 30% per year and low for the planned 50% growth rate). If the growth persists as projected, Tesla stock should keep rising and potentially exceed $500 a share by 2025. Trading at about $180 a share today, TSLA has risen sharply from testing a low just over $100 a share a few weeks ago. The rhetoric that the company will suffer owing to Musk’s Twitter acquisition seems unfounded. The market is betting Tesla will meet its targets and the stock is undervalued if it keeps meeting them for the next two or three years.

I have included no revenue for the Cyber pickup truck or the Tesla semi. If these are successes, the case for Tesla is strong.

Michael, how can TSLA achieve 28% gross margin in 2023 (vs. 25.5% in 2022) when their car prices will have been reduced 12% on average? I have gross margin coming in about half of what you do.

Me too, I had approx 150 people who I had followed over the years on twitter deplatformed, no diversity of opinion was tolerated. For investing advice I find twitter great, I set up various lists eg Oil@Gas and put well informed and connected posters in the list for ease of access..