Meteorology serves traders but is worthless to natural gas investors

Timing the market is a mug's game

There are plenty of investors in volatile natural gas markets who look to the NOAA for temperature forecasts to estimate whether gas demand will surge or plunge and take their positions accordingly. If only it were possible to forecast the weather with any certainty. As an old fighter pilot, I was required as part of my flight training to study the basics of meteorology, and my only insight was that on multiple choice examinations you could get a decent grade by choosing (C) or the longest answer. An RMC classmate of mine who (perhaps understandably) washed out of flying training was the first to gain this insight and passsed it around.

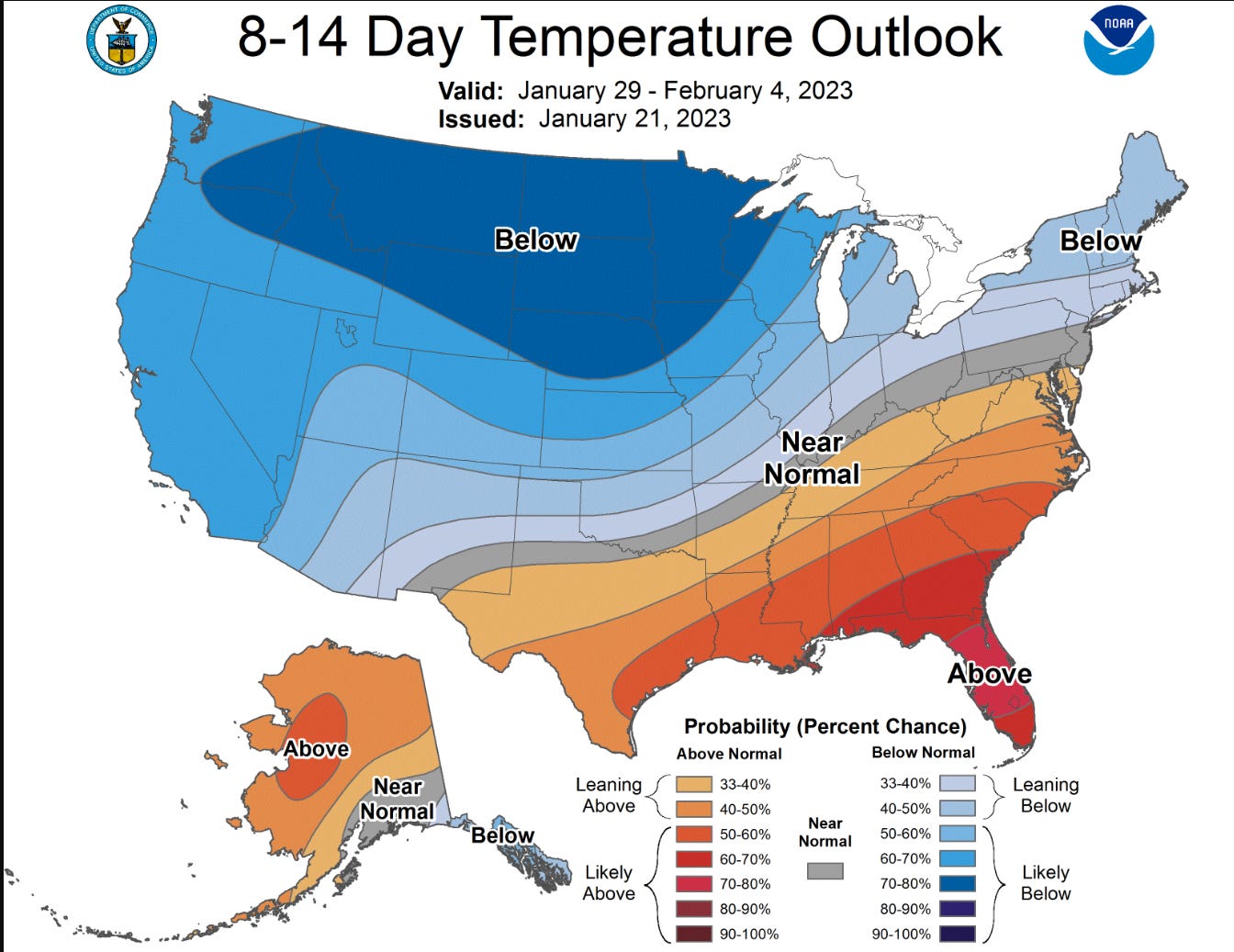

Nonetheless, everyone talks about the weather and weather is a big factor in driving demand for natural gas. The NOAA publishes 14 day forecast which many rely upon. Here is one from January 21, 2023. With much of the United States forecast to experience below average temperatures for the period January 29 to February 4, 2023 (OK, not quite an 8 to 14 day outlook, since at best it is 7 days). With half of the land mass of the United States expected to be either at normal seasonal temperatures or below normal, it looked like natural gas prices would be firm.

Oops! On February 5, 2023 the temperature outlook had been updated and the outlook for the next not quite 10 day period (actually 6 days) was for above normal temperatures across the North East and near normal everywhere else except California.

Market prices for natural gas went in only one direction since the New Year - down, following a trend that started in early December. The biggest factor affecting prices wasn’t unseasonably warm weather (although it is unseasonably warm at present and it is a major factor) but the fire at the FreePort LNG facility which took down demand by about 2 BCF a day in late summer and the market has been soft ever since. In my opinion, natural gas prices are likely to fall further and natural gas stock prices to tumble in parallel. Freeport has sought permits to restart production and that may provide a bit of relief, but don’t think it will tip the scales as we approach spring.

Markets react to sentiment as much as to supply and demand, and prices of natural gas can be particularly volatile even with small changes in the supply-demand balance. A review of weekly supply demand data illustrates the point.1 Production has been relatively flat with a range of from 91.6 Bcf/day to 98.51 Bcf/day in the 8 weeks shown, while demand (excluding exports) has ranged from 83.45 Bcf/day to 125.62 Bcf/day with periods of some oversupply and periods where draws from storage were material amounts. But Nymex natural gas prices have gone straight down. Traders relying on weather forecasts, projected degree-days, and short term estimates of the supply-demand balance have been whipsawed brutally and very likely lost money.

I look at natural gas producers based on basic analysis of profit and loss. Peyto (PEY.TO) reports an operating cost per Mcf of CAD$0.35 and Birchcliff (BIR.TO) an operating cost per Mcf of CAD$0.57 (CAD$3.50 per Boe divided by 6.1, includes cost of liquids). Both companies are quite profitable at natural gas prices in the ranges shown in the table. Birchcliff projects CAD$483 million of cash flow in 2023 at prices of $70 WTI for oil and $3.00/Mcf for natural gas.

I bought Birchcliff at $0.88 per share in 2020 and Peyto at about $1.00 per share. They pay dividends of $0.80 and $1.32 per share respectively and, sure, they will cut dividends if prices fall far enough. But my approach to energy investing is to buy at depressed prices and hold the position for decades (if I am lucky enough to live for more decades, which at my age is a riskier bet than any of the stocks I own).

My point is that the sell-off in natural gas prices and the related softness in natural gas producers’ shares is more opportunity than a problem, as I set out in more detail in a recent article.

The data in the Table come from TD Waterhouse “The Gas Line” reports and ignore imports and exports

I appreciate and look forward to these posts. Thanks for the contribution to the community.