Birchcliff, Advantage and Peyto have long reserve lives which distinguish them from peers

Ultimately, reserve life determines value

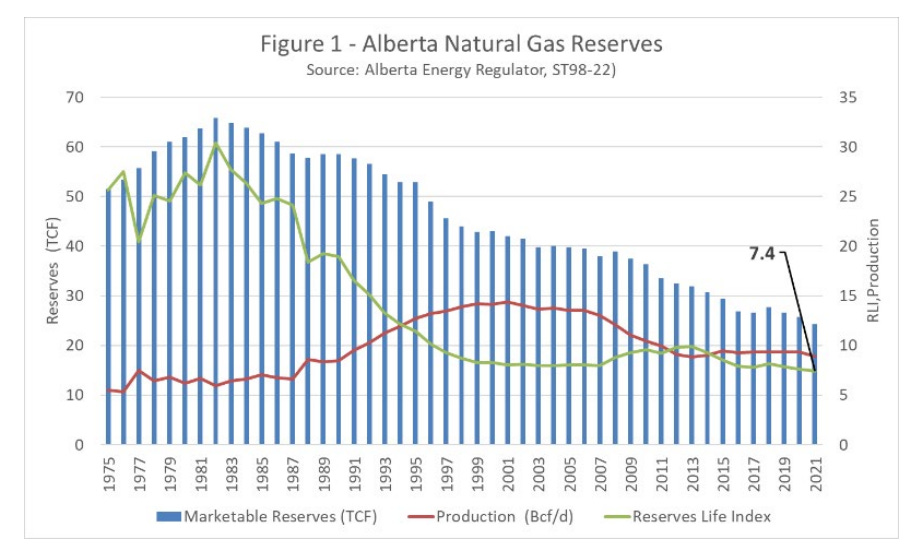

Peyto’s monthly report points out the declining natural gas reserves in Alberta. This is going to create a shortage as demand expands and Canada begins to export LNG, but it won’t be an issue for Peyto who has long lived reserves of gas.

Some Canadian oil and gas producers have high flying share prices but are short on reserves, a virtual treadmill as high capital expenses are compelled to sustain output as decline rates punish reserve lives. Nu Vista (NVA.TO) has long enough reserves but a high decline rate, an issue I will discuss a bit later.

Equity in commodity producers can be seen as a call option on future commodity prices and the duration of the call is limited to the duration of the reserve life. Value is the net present value (NPV) of the after tax cash flows (net of capital expenses, of course) over the life of the existing and potentially developable reserves existing within the acreage of the producers’ land holdings. It is obvious that shorter reserve lives = lower value notwithstanding the penchant of sell-side analysts and retail investors to capitalize current cash flows as if they were perpetual in nature. Conventional “multiple of EBITDA” valuation of natural gas producers can produce poverty for investors as quickly as the producers exhaust their reserves.

This chart of 2020 reserve life index (RLI) for Canadian exploration and production companies is based on data provided by InCorrys.

Reported reserve life is useful but not the whole story. Some producers have extensive undrilled acreage which is highly prospective for oil & gas but not included in “reserves” since it is yet to be drilled. Unbooked drilling locations is another indicator. With a 7% decline rate and 108 undeveloped locations, tiny Pine Cliff Energy (PNE) needs to drill or recomplete only about 10 wells a year to sustain production and has a realistic 11 year reserve life rather than the 6.4 calculated in its reserve report. Tourmaline (TOU) reports that it has 9,700 drilling locations in inventory.

NuVista (NVA) is not seriously short of reserves but has a very high decline rate in the 38-40% range. With annual production of 68,000 Boe/day in 2022, NuVista needs to replace about 26,000 Boe/day of production to maintain that level of output and with a capital efficiency of approximately CAD$14,000 per Boe/day (my estimate) NuVista will need to spend CAD$365 million in 2023 just to sustain its output at current levels. That is about 80% of its 2023 CAD$450 million capital budget. With natural gas prices now in the CAD$2.75 range (71% of NuVista output is exposed to floating prices with only 29% hedged) I don’t see any surplus cash flow from operations (my estimate of cash flow for 2023 based on average production of 74,000 Boe/day and a natural gas price of CAD$3.50 per Mcf with Condensate at CAD$72 per barrel is around CAD$500 million) so the prospect of debt reduction, buybacks or a dividend seems quite limited to me.

I expect a recession to further depress natural gas and condensate prices this year and my most optimistic projection for NuVista has the company treading water. By comparison, I see Peyto Exploration (PEY) having a strong year owing to its industry leading low costs. Rather than sell my Peyto holdings in anticipation of a recession, I have hedge those holdings by opening a short position on NuVista.

The expected recession will come and go, little added production is likely across the industry and the Kitimat LNG project should get into production next year so there are longer term tailwinds for gas producers. My preferences are Birchcliff (BIR), Peyto, and Canadian Natural Resources (CNQ) and small cap Pine Cliff (PNE). Advantage Energy (AAV) has great resources but I am avoiding the name since I think its foray into “carbon capture and storage” will turn into a stranded asset when the world finally admits CO2 is harmless and high cost efforts to mitigate emissions are a waste of time and money.

Thanks I appreciate the articles you publish

Regarding the recession, when do you expect it to be announced? End of Q2?