Will U.S. treasuries run into a buyers' strike in 2024?

Likely, if Biden win's re-election, as I see it.

United States needs to raise $6.3 trillion in 2024. The U.S. Treasury will have about $4.8 trillion of debt maturing in 2024, made of $2.4 trillion of T-bills, $1.6 trillion of notes, $0.6 trillion of bonds and $200 billion TIPS. Biden’s projected deficit adds another $1.5 trillion that needs to be funded.

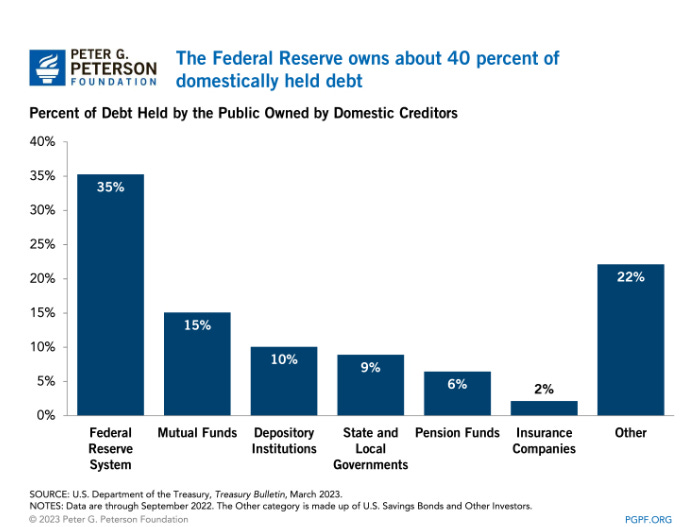

For several years, the government was able to raise substantial amounts of debt by selling bonds that were purchased directly or indirectly by the Federal Reserve System (the “FED”) which by 2022 held 40% of the government’s outstanding debt, most of it purchased during a bond buying spree called “Quantitative Easing” or QE.

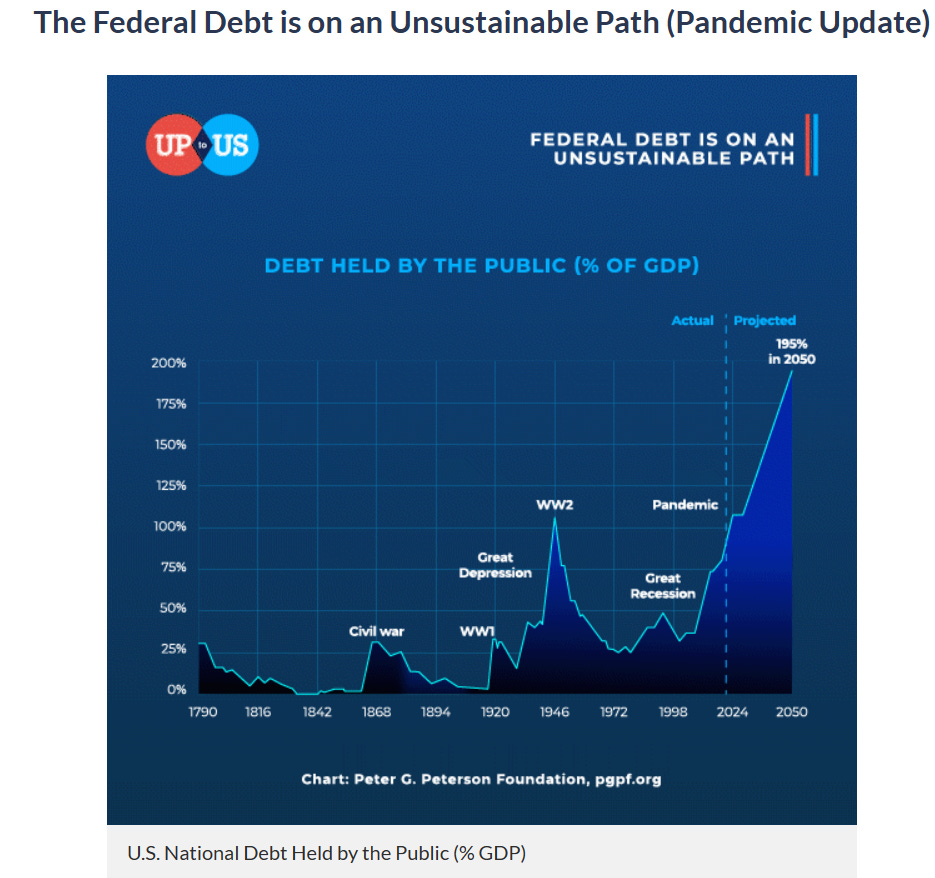

QE has ended and a period of Quantitative Tightening (QT) is underway. That means the FED will compete with the treasury in finding other buyers for its massive holdings of U.S. debt which total approximately $6.1 trillion. The Fed’s current rate of deleveraging is a monthly sale capped at $60 billion of bonds and $35 billion of mortgage backed securities, in total a rate of about $1.1 trillion a year. Add that to the $6.3 trillion needed to keep the government coffers full enough to pay its bills. That may be quite a chore as bond investors keep taking it on the chin since rates began their recent rises in an effort to curb inflation. Some pundits (I among them) think the U.S. debt has reached a level which is “unsustainable”.

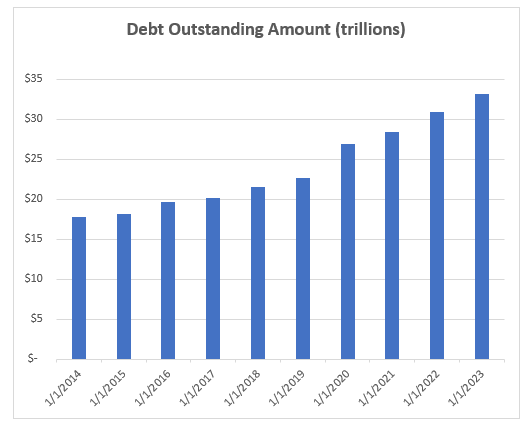

In absolute dollars, the U.S. debt just keeps growing and now exceeds $33 trillion.

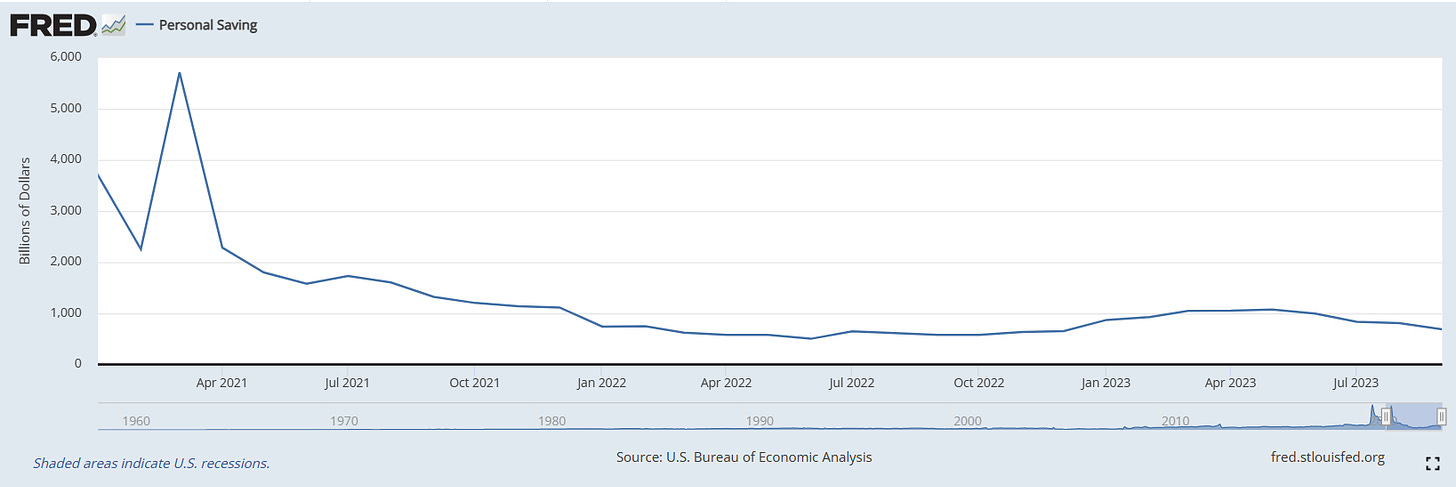

Personal savings were a good source of government borrowing for many years but have been falling sharply since 2020 and now comprise little more than a rounding error in the U.S. treasury’s needs.

That leaves corporate treasuries, pensions funds and institutional buyers as the last refuge of domestic credit availability for the government, and it is likely that will not provide the $7 trillion or so that will be needed to fund the government and aborb the FED’s QT sales of treasuries. Foreign buyers may be the only way to balance the books or a U.S. default will not be caused by failure to approve an increase in the debt limit but rather buy a failed bond auction. The largest foreign holder of U.S. debt is China and the current Biden administrations’ relationship with China is tenuous at best. China holds some $1 trillion of U.S. debt and if that country decides not only to eschew new purchases but also to divest its current holdings, the U.S. will face a catastrophic financial crisis.

I think this problem is serious and getting worse. Biden seems incapable of understanding the depth of the financial problems the U.S. is heading into and prefers to keep spending taxpayer money like a drunken sailor to buy votes. If he is successful and wins re-election, I think that event will trigger the buyers’ strike I see down the road. I wouldn’t buy a used car from Biden let alone invest a dime in any credit instrument that relied on the “full faith and credit” of a Democrat led America.