Will EV sales meet expectations?

And will it cause a tight copper market?

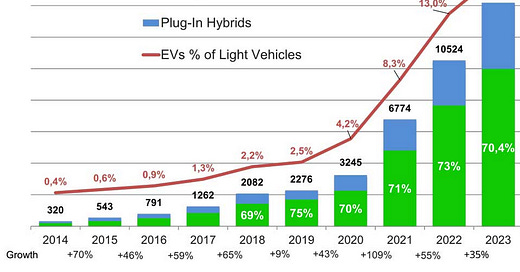

The buzz around EV sales centered around Tesla for a few years, and now most automobile assemblers are planning some form of EV offering. Sales growth has been brisk worldwide, with about 14 million EV units (including battery electric vehicles, plug in hybrids) in 2023 or about 16% of global vehicle sales.

But year to date July in 2024, EV sales comprised 16.2% of light vehicle sales, so the rate of growth in EV adoption has flattened. Some major assemblers have cut back in EV plans - Ford has cancelled some models, Volkswagen has slowed down and even contemplates closing some plants, Mercedes has cut back its EV planned production levels, and consumers aren’t as excited about EV’s as they were initially when an EV purchase received a large government subsidy. Most of those subsidies are gone now, and EV’s have to compete on both price and performance. There is no doubt that EV’s can match or beat ICE vehicles on performance but price has been a problem.

Many EV buyers are suffering buyers’ remorse and an active resale market is developing, resulting in softer demand for new EV models. Most markets saw robust EV demand in 2023 but China was the standout with 8.4 million units sold compared to 1.6 million units in North America and 3.1 million units in Europe.

The failure of many governments to match subsidies with upgrades to the grid and installation of charging stations has left many consumers disappointed. In the U.S. the Biden-Harris administration approved $5 billion for installation of charging stations and to date has installed only 7 charging stations. Private companies have built almost 200,000 of these necessary stations in some ~50,000 locations (each location having an average of four charging outlets), but that compares to 200,000 gas stations with on average three gas pumps per station, often more. It remains far easier to refill a gas tank than recharge an EV when not at home.

Not only are there insufficient charging stations, the load on the grid from EV charging as it is can cause brown outs in peak periods. Even in California, where EV adoption is almost a craze, the state government asked EV owners not to charge their vehicles during peak periods in the summer heat wave. Being stuck in a traffic jam on a hot California day with an EV battery close to running out of charge is not my idea of progress.

I think EV’s will become mainstream not only in China but worldwide over time, but ICE vehicles will remain the main consumer choice for many years since they are reliable, less expensive, and known technology. Battery technology has a ways to go, and the tendency of EV batteries to burst into flames now and then is a barrier to many considering the EV option. Technical problems get solved over time, but the over 100 year lead in perfecting ICE vehicle technology isn’t going to evaporate quickly in my opinion.

As a result, I think the projections of significant shortages of copper (each EV uses about 3 times as much copper as an ICE vehicle) in the near term are baseless. Copper can be recycled and recently Telus started a program to capture $1 billion of cash by recycling copper from its lines as it converted to fiber optics to the home. Over the long term, copper demand is likely to outstrip supply given the very long lead times (in Canada as long as 20 years) from discovery of a copper deposit to eventual permitting and production and the need not only to supply copper to EV assemblers but also to find enough copper to expand the grid to support EV use. Long term I like copper mines like Teck, Hudson Bay, Capstone and Taseko but avoid copper mines in countries with high sovereign risk. First Quantum’s bad experience in Panama won’t be an isolated incident as I see it.

Adding well-run and profitable copper names today and exercising patience should pay off for investors while traders trying to time the cycles of supply and demand will likely find that more challenging and on balance lose money. Copper is a sensible play if you exercise common sense and patience.

I would add ERO - ERO Copper in Brazil - to your favored copper company names. And, for the outsized dividends, worth considering is ARG - Amerigo Resources - which is processing the tailings from Codelco mines in Chile. I have small positions in both companies

Well said Michael.