LNG markets are becoming important to energy trade with Asia by far the largest importer. These data from 2018 show the market at that time.

The main LNG exporters comprise Australia, Qatar, the United States, Malaysia, and Algeria with Canada joining the fray with the start up of the first Canadian LNG facility in Kitimat expected next year. LNG imports to Europe are increasing since the curtailment of some natural gas delivered by pipeline from Russia following the Ukraine war outbreak and the foolish commitment of Germany and the United Kingdom to wind and solar which have proved incapable of providing enough energy to keep the lights on and homes heated.

Monthly U.S. LNG exports are expected to comprise 16 Bcf/day by 2025, about equal to the total Canadian natural gas production and about 16% of U.S. output which is running close to 102 Bcf/day at present. ARC Resources has committed almost 20% of its natural gas output to LNG through its partner Cheniere Energy, based on the press release from ARC published today.

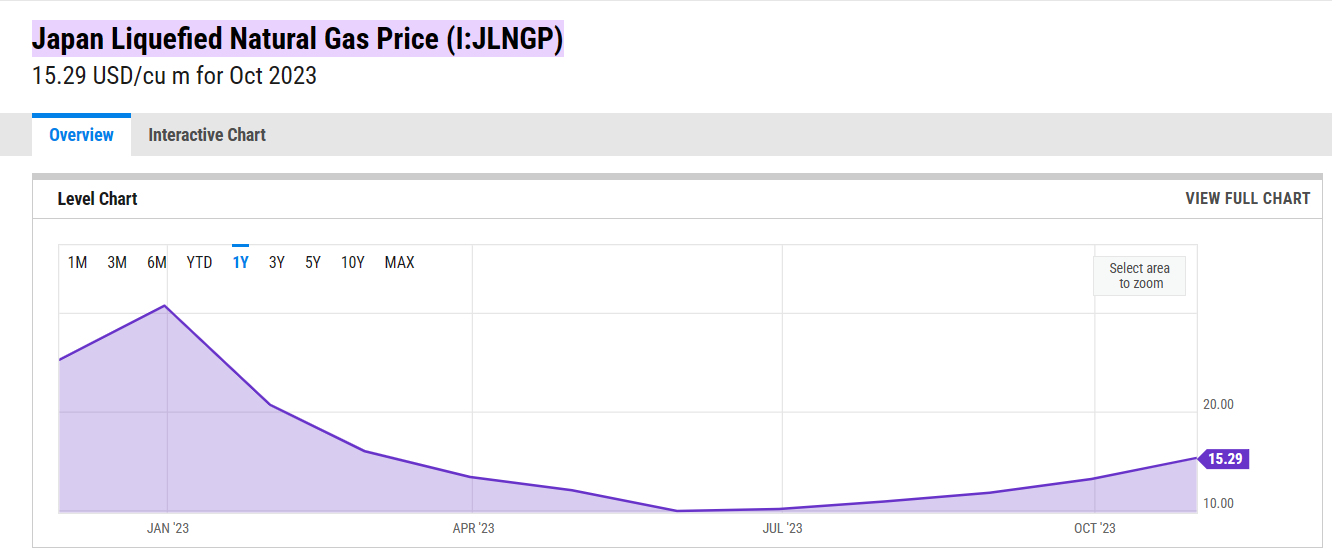

Cheniere sells most of its LNG to Japan, the largest importer of LNG, and will receive a price based on the Japanese price less transportation and Cheniere’s operating charges. Japan prices for LNG have dropped by half in the past year but remain well above North American prices, so the netbacks for ARC seem robust based on current pricing.

Source: Y Charts

The risk to the Japanese LNG market is the restart of idled Japanese nuclear power plants, which were shut down following the Fukushima disaster.

CBC reports that Japan plans a nuclear renaissance and will expand nuclear energy over the coming years, about tripling the share nuclear has of total energy in Japan from 6% in 2021 to over 20%. LNG currently provides about 30% of Japan’s energy needs, and nuclear will likely cut that almost by half.

Large price spikes in Japan’s electricity costs are highly correlated with LNG prices. Natural gas fired generators need about 7.4 cubic feet of natural gas per Kwh of electric output, so the cost to create power from LNG at $15 per thousand cubic feet is $15 x .0074 = $0.11 for the natural gas fuel and likely double that for the delivery of that power to consumers. [For comparison, Albertans pay about 2 cents per Kwh for for natural gas -this includes the cost of the commodity, carbon tax, franchise fees, GST, transmission and distribution charges. Alberta utilities charge about $0.10 per Kwh for electricity making it clear that gas is more economical than electric power in Alberta.]

Since nuclear in Japan costs consumers about 24 yen per KwH (equivalent to about $0.22 Canadian) it is likely (but not certain) that LNG based electrical power will remain competitive in Japan at current prices and while the market may shrink, the netbacks to ARC Resources should remain economical and the Cheniere contract profitable. There seems to be low risk that ARX will not benefit from the market diversification.