Why Saturn Oil should produce high returns even with lower oil prices

A misunderstood and undervalued company

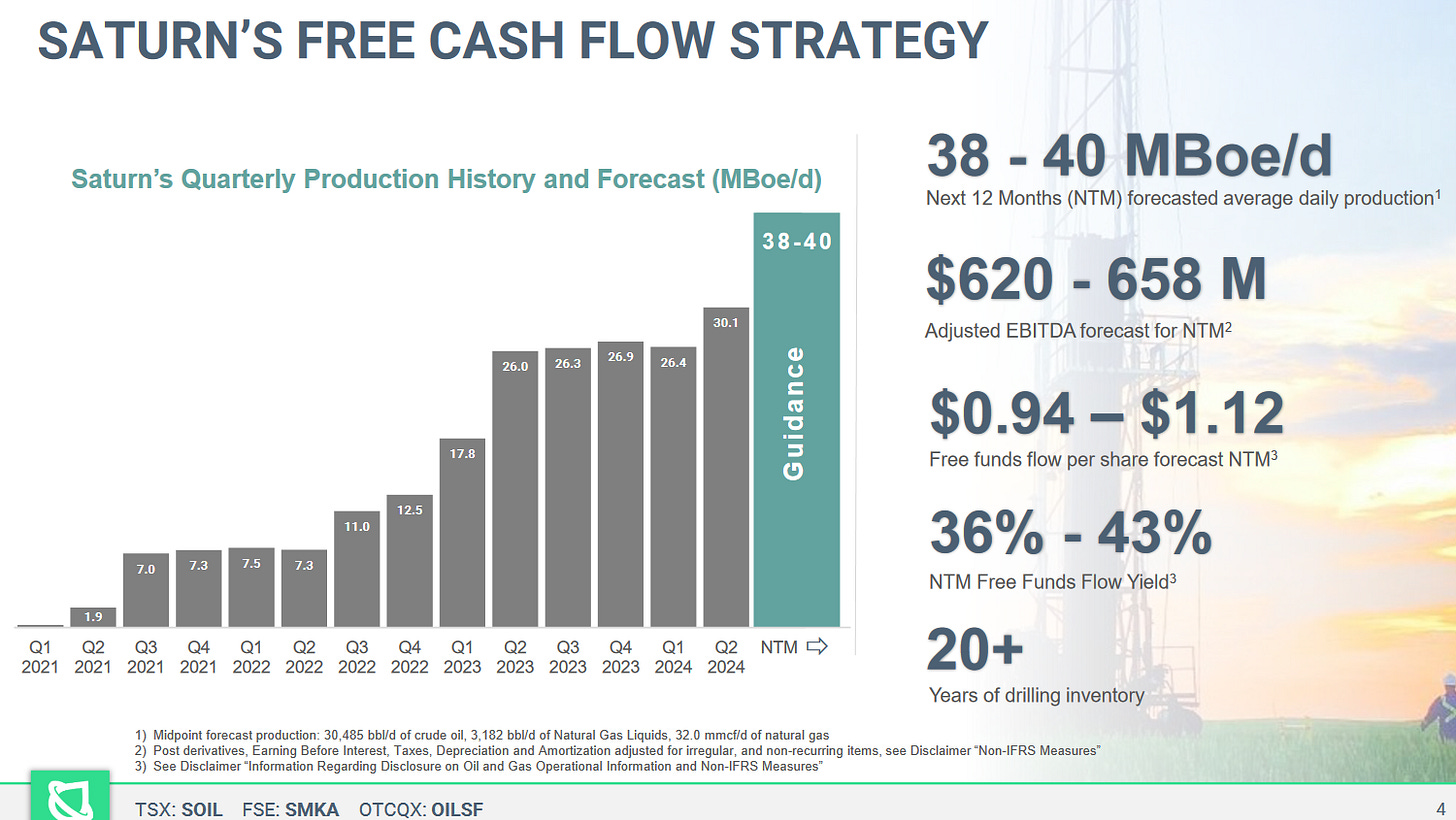

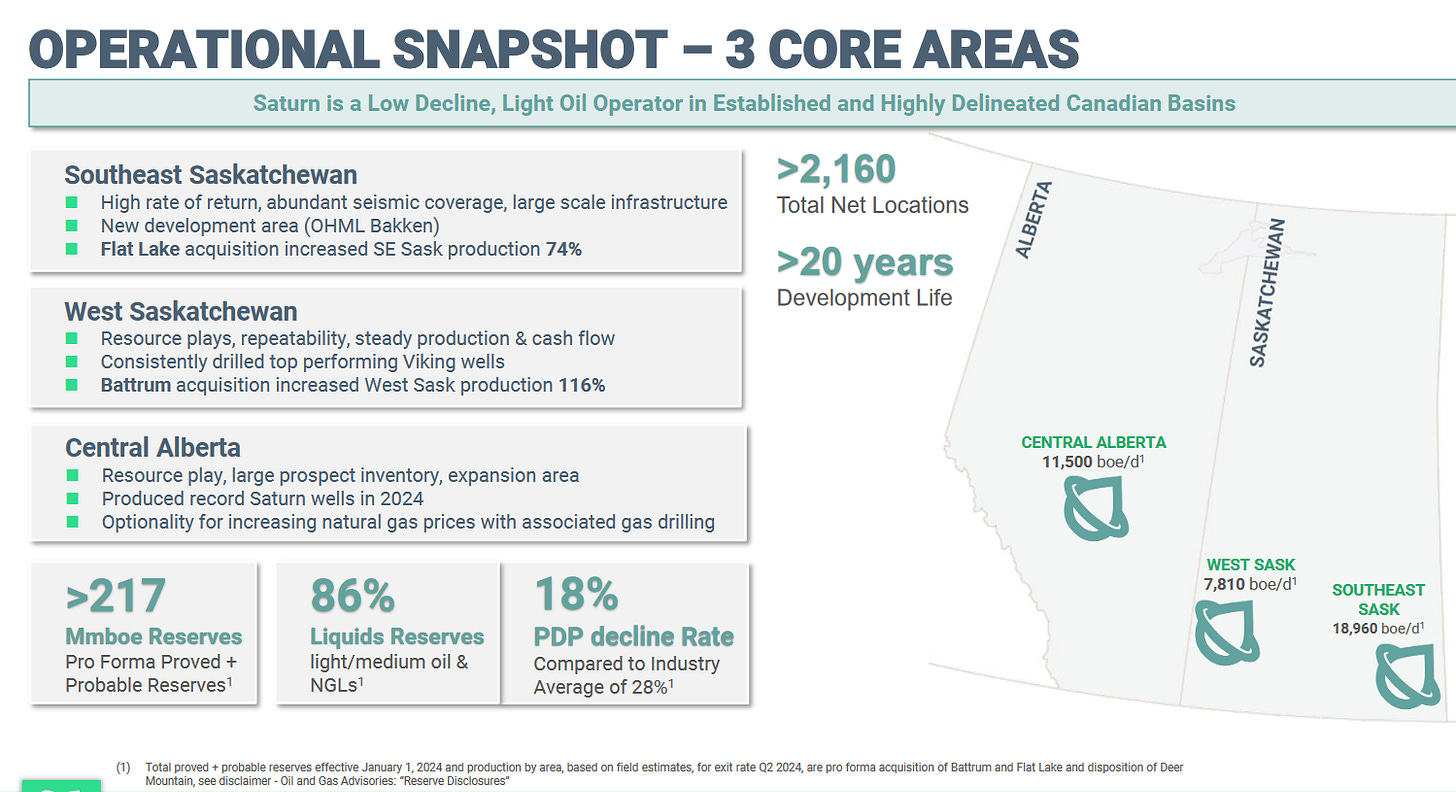

Saturn Oil & Gas (SOIL.TO) is an odd company. It has grown through timely acquisitions of oil & gas assets at somewhat depressed prices using (believe it or not) debt instruments at a time when energy investors rail against the use of debt. Over the next twelve months, the company projects EBITDA of well over $600 million on production at ~40,000 barrels of oil equivalent a day, most of that liquids (the output includes just over 5,200 boe/day of natural gas).

Given the aversion of Canadian banks to leveraged oil & gas companies, how did they pull it off?

The funding for the growth of Saturn came initially from Michael Dell’s family office and through a timely refinancing by Goldman Sachs resulting in a US$650 million 9.625% term loan. Cobbled together with a CDN$150 million reserve based loan and a CDN$100 million equity financing Saturn created a balance sheet which, while leveraged, has manageable debt with much of the scheduled repayments hedged through forward sales of oil production and staged to fall well within free cash flow.

Saturn now has 217 million barrels of reserves which at 40,000 boe/day will last 15 years without further reserve growth. With a decline rate of only 18% and a capital efficiency of somewhere in the neighborhood of CDN$25,000 per flowing barrel, maintenance capital outlays come in somewhere around CDN$180,000 per year, leaving well over CDN$400 million per year to service debt and reduce debt balances

Operating costs including transportation run about CDN$22 a barrel and royalties are at a rate of ~12%, so Saturn’s netbacks are relatively high at today’s oil prices. Light oil in Canada currently sells for CDN$90 a barrel, NGL’s about CDN$35 a barrel, and natural gas at today’s depressed price goes for CDN$0.80 per gigajoule more or less, and if you apply those prices to Saturn’s mix of output you come up with gross revenue per boe of CDN$75 and a netback of ~CDN$43 a barrel ($75 x .88 (adjusting for royalties) = $65 less operating costs including transportation of $22 = $43.00)

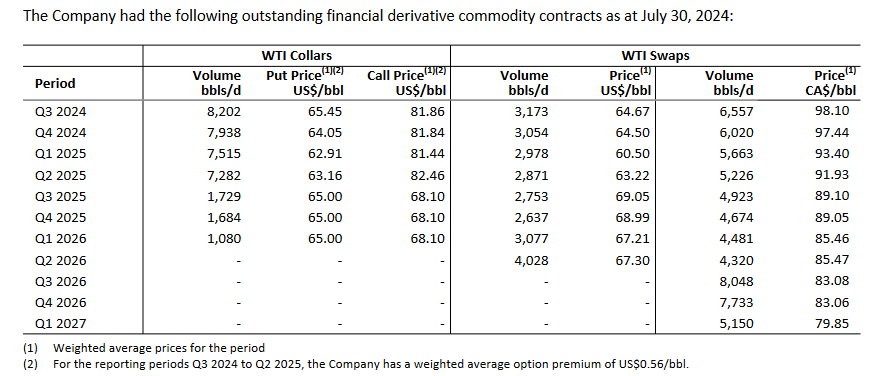

I expect to see softer oil prices over the winter and firmer natural gas prices as a likely trend. I am no Nostradamus, so don’t put too much stock in my views of price. As at June 30, 2024 Saturn had a fairly robust hedge book (below) and states its debt deal will be supported by hedges on 50% of its PDP production, so I have little doubt they have added and will continue to add hedges while they pay down debt.

The 2025 hedges in place as at June 30, 2024 total over 13,000 barrels of oil in Q1 2025; almost 13,000 barrels a day in Q2; and over 6,000 barrels a day in the second half, all at prices that ensure a realized price on the hedged output of at least CDN$90 a barrel. We will learn what new hedges were put on after the most recent acquisition in the Q3 2024 report.

What I get out of all of this somewhat hectic activity as management expands through acquisition is a relatively low risk and deeply undervalued company trading at a tiny fraction of its intrinsic value. I own 60,000 shares and options on another 60,000 that expire next April and have a strike price of CDN$4.00 per share. The options provide insurance that if the market wakes up to the value I won’t miss out, and since they only cost ~$0.25 per optioned share, I can let them expire and just add to my common share holding next April if the stock is trading then at less than CDN$4.00 a share.

Oddly, I am somewhat bearish on oil prices and have most of my energy investments focused on natural gas where current prices are severely depressed. But Saturn is an outlier in my view and I expect it to be a significant contributor to my 2025 investment income.