Why managed money won't outperform

Even Eric Nuttall's Ninepoint Energy Fund underperforms the S&P over the long term

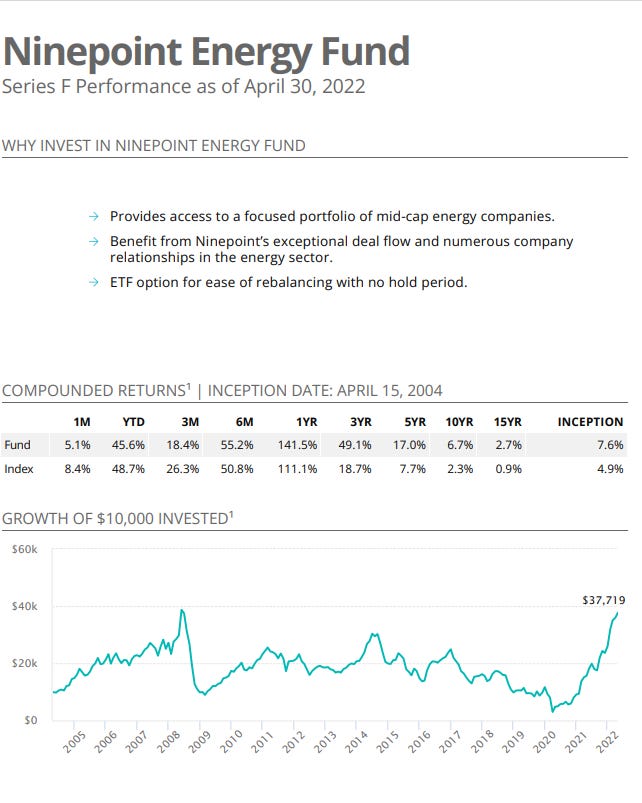

Ninepoint Partners fund manager Eric Nuttall gets a lot of ink for his sterling performance managing an energy fund with spectacular returns in the past year or two. Ten thousand dollars invested in his NinePoint Energy Fund in 2004 has grown to CAD$37,719 today. That is a continuously compounded rate of return of 7.4% (for any math geeks, the continuously compounded rate of return is the natural log of the ending value divided by the beginning value with the quotient divided by the number of periods. ln(37719/10000)/18 = 7.4%). The fund says it average return is 7.6% and I will excuse that difference since like many funds they may be using an arithmetic or geometric average rather than a continuously compounded return and my approach omits dividends (and no doubt there were some).

Note that the fund has underperformed by Index Eric chooses to compare return to by 3.3% in the past month, 3.1% year to date and 8.1% for the past 3 months. Does that suggest the bloom is off the rose?

Not really. As managed money goes, Eric’s fund is about as good as it gets. The fund reports a management expense ratio (MER) of 3.93%. The 7.4% return since 2004 is presentable but not spectacular. The average return on the S&P index over the same period (i.e. since April 2004) is 9.47%.

The gap between Nuttall’s fund performance and the S&P is a factor of two circumstances - first, Eric’s fund is solely an energy fund and secondly, it carries the burden of the Managment Expense Ratio (MER). The investment choices have been good, since the fund would have outperformed the S&P by ~180 basis points but for the MER burden.

This is why many investors now choose index funds rather than active managers. Index funds typically have MER’s of less than 50 basis points.

I think the energy cycle is a tailwind and Eric’s fund will do very well in the coming months, likely outperforming the S&P by a wide margin even if it lags the index the fund compares itself with. It is a good time to be in energy and I am up to my neck in it.

But the time will come to switch, probably sooner than most think. At the point where a deep recession is declared it may already be too late so look for the cracks as they appear. If there is a major selloff (say over 10% on one day) smart money sells everything and goes to cash. After a few weeks of volatility with pundits on both sides calling a bottom or a deeper market rout, some semblance of stability will return and at that time, I am moving into a broad index fund for at least a few months while I pore through the rubble of a market crash to find the real value hidden underneath. I will do a deep dive into energy firm valuations at that time since history has shown me that energy stocks fall far further than warranted in the down cycle and the chance to build positions at bargain basement prices should be seized.

A good example is in March 2021 when investors stampeded for the exit doors and companies like Peyto (PEY.TO) Birchcliff (BIR.TO) Whitecap (WCP.TO) Bonterra (BNE.TO) and Canadian Natural Resources (CNQ.TO) traded for pennies on the dollar of real value and I loaded up on them, now enjoying tenfold gains or more on some holdings.

I don’t think the coming collapse is imminent and I believe the energy trade has a ways to go so I am standing pat for now.

The point of this article is to encourage investors to do their homework and consider managing their own money rather than paying someone else over 3 or 4 percentage points to do it for them. It is hard (if not impossible) to beat the averages long term after giving up 3% to an advisor.

Within the last 2-3 months I have bought most of Eric's Top 10 picks. In a recent twitter post Eric [somewhat tongue-in-cheek] refers to himself sitting on his hands, not buying or selling. I see the commodity super cycle lasting AT LEAST another 8-10 years [as historically commodity cycles last 10-12 years]. I bought Eric's picks as minimum 3-5 year holds as each company (1) buys back shares (2) uses the FCF to pay increasingly large dividends and (3) as the per share free cash flow multiple re-rates share prices higher, from 2 or 3 to 6 or 8. If we assume a recession is hitting world economies in the next 6-12 months, my limited view of things tells me that (1) to (3) will continue but at a slower pace. I see a $150 price for WTI as a given sometime this year, which will drive O & G picks and prices per share even higher. Would the author like to comment on these remarks? Am I missing anything and if so what? and what do I need to look at more closely to fill in the gaps in my understanding? I just don't see a recession derailing my thinking ... or the super cycle. I do see a recession lengthening the time period for (1) to (3) to drive price per share of energy companies higher. Thoughts and other points of view would be appreciated

Micheal, you forgot to exponentiate the final number. So the return is 7.65%