Why do you want stock prices to rise?

Serious investors want prices to fall

It is hard to watch five minutes of Business News Network (BNN), Bloomberg, CNBC or MSNBC without a talking head giving a dozen reasons why a give stock will rise in price or why the market is poised to surge. When the indices rise a bit, the glee in the business news anchors voices is palpable. You have to ask yourself if you accidentally joined Alice in Wonderland.

A few tautologies. All publicly owned company shares are owned already. Sure there may be new issues, but the bulk of the market comprises trading in shares from one investor to another. The totality of the trading generates fees and commissions for intermediaries but does not add a dime of profit for investors as a class, and the “gains” made by one investor are offset by the losses suffered by another.

Company profits are either reinvested or paid out in dividends. The real benefit of publicly traded shares is the opportunity to buy into a growing (hopefully) stream of dividends. Reinvested profits are based on the expectation that management has investment opportunities that will produce better returns than their shareholders might find themselves. If that were not the case, shareholders would vote to wind up the company and move on.

The opportunity to buy an interest in an operating company is the real value of public markets. Would you rather buy that interest for a higher price or a lower price?

I often hear both sell-side analysts and securities regulators claim a “lower cost of capital” is the benefit of a particular change in capital structure or regulation. But a lower cost of capital is a lower return to shareholders whose return is the other side of the “cost of capital”. What is “cost” to the company is “return” to the investor.

As a group and in aggregate, traders lose money. Their losses are exacerbated by fees and commissions. Trading is a “mug’s game”. If you are betting your life savings on your belief that you have insights into the market not shared by the market as a whole, better start with a lot of savings since on balance you are likely to lose money.

For serious investors, your “three wishes” are as follows:

The company you invest in is profitable and growing

The company you invest in distributes a portion of those profits as dividends

The company you invest in earns returns on reinvested funds at least as high as its dividend yield.

That investment becomes a source of enduring value and growing income in the hands of investors without squandering more money on fees and commissions. If you build a portfolio of such companies, you become Warren Buffett or Warren Buffet-like.

I wait patiently for what are called “bear markets”. In those markets, I can add to my investment portfolio at lower prices than prevailed earlier. In bull markets, I spend my time on other hobbies and interests and ignore the stock market. I rarely sell an investment unless there is compelling evidence the underlying company has changed in a negative way.

Many investors rely on “advisors” who are stereotypically bullish and encourage their clients to buy a given stock beause it will “rise in price” based on an analysis or theory. A better reason to buy a stock is because it is unlikely to fall further in trading price, has a viable and profitable underlying business, and is run by competent and honest managers.

Few investors make a living “trading stocks” but many lose their shirts in the attempt. Investors in aggregate earn positive returns because the industries underlying the stock market are profitable, growing with the economy and payout a portion of their income as dividends.

If you are a serious investor, buy well and build a diversified portfolio of investments that provide a reasonable yield and likely to produce a steady and growing stream of dividends. Your best opportunity to do so is when prices are falling. It is not more complicated than that.

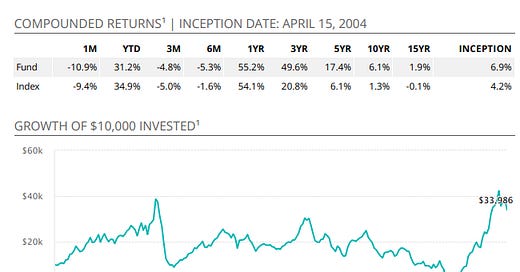

Famed Canadian Energy Fund Manager Eric Nuttall manages the top “performing” Nine Point Partners Canadian Energy Fund. The average return on this fund over the past 15 years is 1.9%. The inflation rate over the past 15 years has been 2.08%. Congratulations, you paid Eric to lose money.

Source: Nine Point Energy Fund website.

I watched Eric on BNN today touting Canadian energy names on the basis they could privatize themselves in a few years but had reserves that lasted much longer, the idea being investors today are getting the next 10 to 25 years of production “for free”. I have always been suspicious of something for nothing stories and this one is no exception.

Eric’s story today is about the same as it was six months ago when he was interviewed on BNN on June 3, 2002. His “top picks” then were MEG Energy, Enerplus and Tamarack Valley, all on his list of top holdings today. I admire his consistency. In the past six months his fund has lost 5.3% but Eric still got paid.

There is nothing wrong with Eric’s fund, his stock choices or his recent record of profitable investing. There is something wrong with being a “perma-bull” regardless of the macroeconomic environment or actual risks facing investors. Eric clearly wants higher prices for the stocks he manages since that affects his performance fee. But why do you want higher prices? This is not a trivial question.

If you are persuaded that Eric’s outlook for energy prices and energy firm profits is reasonably accurate, wouldn’t you want lower prices? I would.

In Eric’s interview today he excoriated Birchcliff Energy (BIR.TO) management for not repurchasing shares noting that Birchcliff’s stock price fell 10% after it declared a special dividend and set a dividend rate of $0.80 per share for 2023, saying “make what you will of that”.

What I make of it is that Jeff Tonken was wise to avoid letting a fund manager guide his strategic decisions. The fall in share price allowed me to add 10,000 shares at a sub-CAD$10 a share price not available since last July and increase my ongoing dividend stream by $8,000 a year. It also avoided Birchcliff buying back shares at a price higher than today’s market last June when Nuttall was last interviewed on BNN.

I will hold my Birchcliff shares for at least another fifteen years (the outside edge of my life expectancy) barring some major adverse event compelling me to realize cash for some other purpose, and during that 15 years very likely enjoy a return of at least 8 to 9% and possibly more given that Birchcliff’s cash flows more than cover its dividend and sustaining capital costs at prices as low as $2.50 a gigajoule for natural gas. If Eric’s fund performance in the next fifteen years matches the last fifteen years, my 8 to 9% return will dwarf the 1.9% of Ninepoint Energy Fund and I won’t have to pay anyone any fees.

I am hoping the expected recession comes soon and is deeper than most economists predict. That will put a coffin nail in the current rate of inflation, drive commodity prices to very low levels, and crush stock prices which will fall in parallel. I will use my cash reserve and cumulative dividends not needed to put food on the table to increase my energy holdings when they are clearly out of favour and see my long term dividend stream increase materially.

What happens if in the expected recession the oil price falls to CAD$50 barrel (WCS and Edmonton Par) and natural gas falls to CAD$2.50 a gigajoule? Birchliff will still generate enough free cash flow to cover its sustaining capital and dividend. But Ninepoint Energy Fund may see a decline in the trading prices of its assets? I keep models of all my energy holdings which overlap those of Ninepoint. Here is my estimate of how that level of decline in energy prices will effect Ninepoint unit holders.

Start with Ninepoint’s June 2022 portfolio.

Here are my estimates of the trading price at 4 x EBITDA of the Ninepoint fund holdings and the trading value of the fund’s holdings at those reduced commodity prices:

$15.45 ARC Resources or $116 million

$2.90 Athabasca Oil or $130 million

$4.60 Baytex or $124 million

$8.00 Crescent Point or $136 million

$12.00 Enerplus or $120 million

$6.00 Headwater or $132 million

$0.20 Lucero or $10 million

$8.70 MEG Energy or $78 million

$3.00 NuVista or $36 million

$50.00 Ovintiv or $113 million

$3.00 Pipestone or $27 million

$5.36 Tamarack Valley or $198 million

GRAND Total $1,220,000,000 a decline of 4% from cost and a decline of 15% from June 30, 2022 “fair value” as reported by the Fund.

I have used a 4 x EBITDA multiple since multiples typically expand in market sell-offs of energy names, even though that multiple is higher than the approximately 3.5 x EBITDA the market values these stocks at today. The lack of a material decline below cost in the Ninepoint Energy fund trading value under these assumptions is testament to Eric’s stock picking skill.

But Ninepoint Energy Fund does not pay a dividend and Birchcliff does and likely will keep doing so even at those theoretical lower prices. Call me old-fashioned (I am) but I prefer an 8 to 9% current yield to an approximate break-even on cost or a loss of 15% at market. Don’t get me wrong, Eric Nuttall is among the best of breed in managed money and if the expected recession does not take place or is a mild recession, the Ninepoint fund will keep doing very well. My point is simply that wishing for higher stock prices isn’t consistent with a sensible investment philosophy any more than wishing for higher car prices is a sensible approach to buying a new car.

I am a serious investor. Substantially all of my income is from investments in the stock market or income properties. I know which side of my bread is buttered so I prefer to see stocks fall in price.

I find it a bit amusing that in this period of high inflation consumers complain about rising prices for goods and want prices of consumer goods and services to fall but concurrently wish for higher prices for stocks and hope that central banks don’t have to trigger a recession to reign in inflation in the hope that stock prices will keep rising while hoping that prices for the goods the companies in which they are invested start to fall. The internal inconsistency in those two aspirations has an Alice in Wonderland aura.

Birchcliff stock was $6.65 a year ago; had they purchased 10% of that back then wouldn't it be very profitable for the shareholders now today at $10.15?