As a student of history, I like to pore through antique books and records to see how the U.S. economy performed throughout its existence, how governments operated, and whether the results benefited citizens generally. There are hard lessons in the history books, many of which today’s American leaders either haven’t learned or choose not to learn.

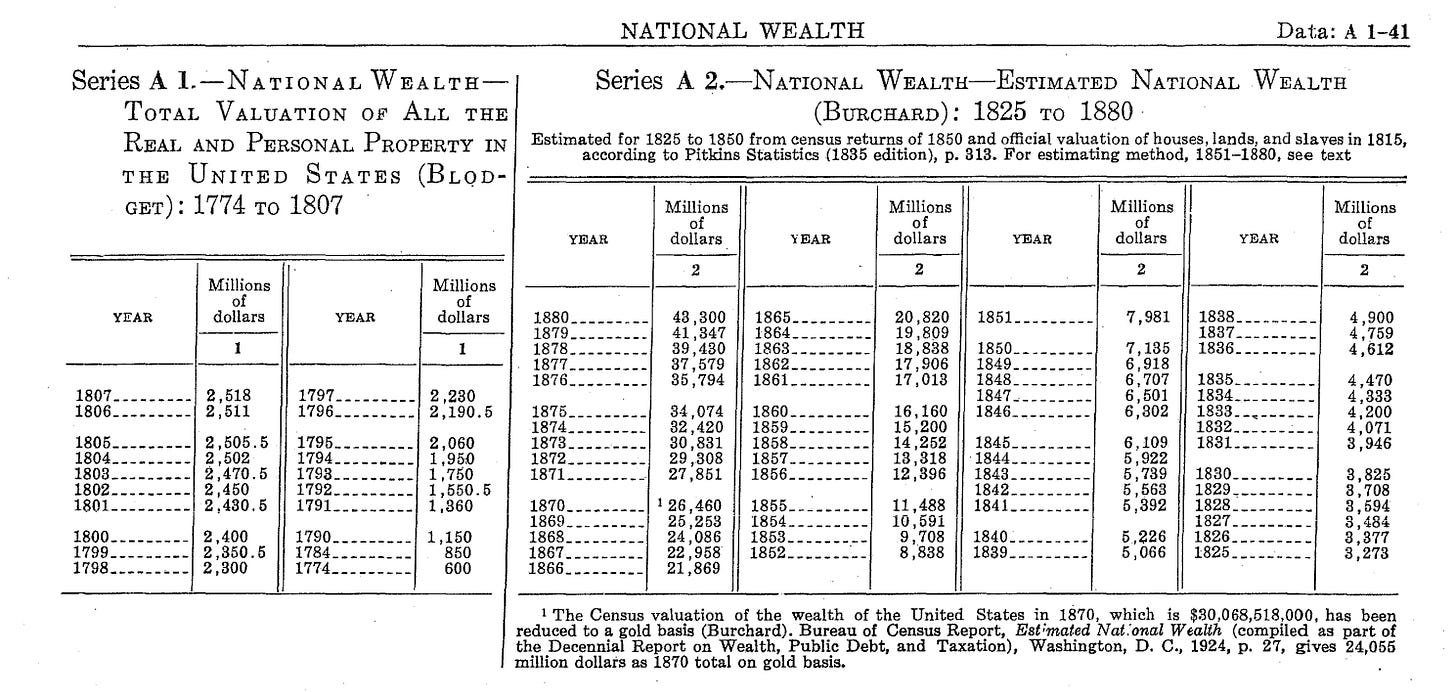

A good starting point is the century or so following the declaration of independence as the newly created country started to installing systems of government and providing services to its population. Until 1914, United States had no income tax and government revenues came from tariffs imposed on importers to the growing market and small amounts of borrowing. The concept of Gross Domestic Product (GDP) didn’t exist until it was coined by Simon Kuznet in 1937, but government officials made efforts to measure the success of the economy nonetheless. Here is a clip from an old U.S Census Bureau record setting out what was then called “National Wealth”, which, at the time of the report, comprises an estimate of the total valuation of all real and personal property in the United States. In many ways, despite its focus on the value of assets (houses, lands and even slaves) it was a reasonable proxy for GDP today.

From 1825 to 1880, the value of the nation’s assets (expressed in terms of a gold equivalency) had risen from $8.3 billion in 1825 to $48.3 billion in 1880, an annual rate of increase of 3%. Since inflation throughout that period (and in fact from 1789 through 1914) averaged one tenth of one percent, that 3% figure was “real growth”.

It was only after the introduction of income taxes in 2014 (a temporary measure to pay for the U.S. involvement in WW1, but which became permanent by default) that the United States government started to run “deficits” and rely on borrowed money. Economist Stephanie Kerton (“The Deficit Myth”) would argue that deficits are not “borrowed money” since the government creates the money, and further that when the state is in deficit there must be a corresponding “surplus” in the hands of society at large. She says that governments can spend as much as they want as long as they have their own currency as long as they are alert to the risk of inflation, which in her version of economic theory is the only constraint on government spending and that taxes, absent from United States until 2014, are a mechanism to pull money out of the hands of the public to mitigate inflation risk. Note that for 125 years, the U.S. grew at 3% in real terms without taxes and without inflation of any consequence.

While Kerton claims to be a Modern Monetary Theory (MMT) economist, her explanation of how the economy works sounds quite similar to John Maynard Keynes who says governments should run deficits when the economy is weak to stimulate growth but target surpluses when the economy is strong to “rebalance the books”. But Kerton sees no need to ever balance the books. Her well-written book The Deficit Myth offers no explanation as to how the United States operated without taxes and without any material deficits for 125 years (1789 to 1914) enjoying robust growth, funding the industrial revolution, and doing it with inflation levels essentially at zero.

Borrowing and “deficits” became the norm after WWI and now occupy centre stage with the creation of the Federal Reserve in 1913, pretty well concurrent with the initiation of income taxes. Charged with administering monetary policy to balance low inflation with full employment, the Fed is now headline news every time it makes a nominal change to policy rates which are its primary tool to lean against the negative outcomes arising from government fiscal policy. The concept that a central bank intervening in the economy to set interest rates is somehow an advance is outright silly. Worse, the Fed specifically targets inflation rather than price stability, setting an aribitrary 2% as a “goal” which it has rarely achieved. Through its intervention in free markets, the Fed’s policy rate denies bond investors a return commensurate with the risks they take set by an open auction. This system ensures pension funds and savings with large holdings of government bonds essentially lose money with the artifically low interest rates gobbled up by the target “inflation” and many bond investors earning nothing or even suffering losses for keeping the government afloat.

Since the Fed and the government are at cross purposes (the government wanting to spend, spend, spend to buy votes and the Fed wanting to keep inflation at bay), the Fed was established to be independent. We have reached the point in history where politicians now threaten to abolish that independence.

This chart sets out how U.S. federal budgets have looked since Independence Day.

What is obvious is that the allure of the power to spend and to borrow (or create) the money intoxicated political leaders, the term “pork barrel” entered the vernacular of American jargon meaning federal money spent on local projects to benefit an elected official’s chances of re-election, regardless of the merits of the project. Budgets in recent years are massive documents, put before Congress so soon before a vote that members are unable to reasonably read or study the document, and full of “earmarks” which are items added by individuals or parties for ideological reasons and benefits that are unrelated to the budget’s goals but benefit individual jurisdictions. Essentially, they are the “pork” in the “pork barrel”.

American lost its way somewhere between WWI and the early 1980’s when the divide between the two parties reached a chasm and the “left” or Democratic Party embraced the idea of bringing down capitalism by purposely bastardizing the budgeting process to run up cumulative deficits in the trillions of dollars, justify them by relying on nonsense like MMT, and blame everyone but themselves for the inequities they cause. I laid out how the Democrat policies benefit their donors, impoverish middle and lower class Americans, widen income and wealth inequality, and intentionally divide American in an earlier article - More holes in the MMT "Deficit Myth" theory (substack.com)

The original ideas of the Founding Fathers of America were a robust framework to build a great nation. They have been abandoned by the left wing who embrace socialism or outright Communism, seek power to bring about a silent revolution that brings down capitalism and makes everyone subservient to and dependent on the State. And they are winning. The United States is well on the way to becoming an authoritarian socialist state with its schools and universities infected with faculties that are not only left wing but often Communist, trade unions embrace socialism, and Communists like Bernie Sanders had a good shot at becoming President.

The tools of the left are visible throughout history. Divide the population by identity group, create an “enemy” (Jews, monarchists, and now “climate change”), make the citizenry dependent on government, increase the size and scope of central government regulation, censor speech, interfere in elections, enact “gun control”, and pretend your efforts are for the “greater good”. It worked in Russia, it worked in China, it worked in Vietnam, it worked in Venezuela, and it is working in America. The Democrat candidate for the November 2024 election is so far left she makes Bernie Sanders look like a capitalist.

The billionaire donors who benefit from the transfer of wealth from middle and lower classes to themselves are already piling on, coughing up hundreds of millions of “donations” to Kamala Harris campaign, and efforts to stifle any effort to limit voting to citizens of the U.S. are being frustrated by Democrats across the country and in Congress who are rejecting the move to require a voter to show ID before voting. Leftist organizations are in high gear to “harvest votes”, ensure the distribution of millions of “mail in ballots” where it will be impossible to see who (if anyone) actually voted or whether they are U.S. citizens, and the mainstream media is awash with propaganda re-writing Harris’ history to distance her from her far-left policy statements of earlier campaigns.

November 2024 will be an interesting month. Either Trump will prevail and hold off the march to socialism for another term, or Harris will triumphantly enter the White House and begin to push American one step closer to tyranny. The effectiveness of the left in advancing their socialist agenda is at such a high degree that I see good friends here in Canada speaking highly of Harris, demeaning Trump, and embracing the idea that another Democrat regime will be good for America. They could not be more wrong.

The effectiveness of the left in advancing their socialist agenda is at such a high degree that I see good friends here in Canada speaking highly of Harris, demeaning Trump, and embracing the idea that another Democrat regime will be good for America.

Yup seen the same thing, shocked at first, but the captured media is very powerful. Combined with Hollywood which makes Goebbels look like a piker, there is little chance to avoid it imo.. When Obama changed the law to allow propaganda on its own people it was game over...

It's a great point about taxes and the growth big government. I would also offer that the seeds of our eventual destruction were sown in the 60's with Johnson's Great Society program that destroyed the black family. Second to that was the redesign of the immigration program to favor people from Africa and Asia. The result is a factionalized population that has no common roots to bind it together. The world's greatest empire prior to ours-Rome, fell in part from unchecked immigration of people who had no commonality with the existing population. On its current path, America will meet the same fate. By comparison our principal foes-China, Russia, and Iran have more cohesive populations and strongly identify with the goals of their respective governments. The clock is ticking for the west.