TD Wealth Vice President Kim Parlee is the host of Money Talks on Business News Network (BNN). She is paid to deliver condescending homilies to Canadians on a regular basis.

Kim has a great educational background with an undergraduate degree in Economics and Finance from Guelph University and an MBA from York University’s Schulich School of Business. For the past decade she has been the host of Money Talks. I met her at a conference called the Ontario Economic Summit in Niagara Falls quite a few years ago, and she is presentable, bright, and a good speaker. With all that talent I would expect to see her with a serious career in Finance.

But no, what I see is Kim telling people to create virtual jam jars and manage their money about the same way our grandparents might have when they were struggling through the depression - One jar for groceries, one for utilities, etc. and a bit of money set aside for emergencies. I am not sure what course at the Schulich School covers the “jam jar” theory of economics, but I am certain it wasn’t raised at Western Business School (now called the Ivey School of Business) where I received my MBA in 1976, when Kim was about five years old. Maybe this theoretical breakthrough is more recent? I suspect it falls short of Nobel prize material.

Not everyone thought Kim’s “jam jar” advice was all that impressive. This tweet captured my own reaction.

Kim has obviously studied finance since she mentions behavioural finance now and then in her episodes. Behavioural finance has been made mainstream by Nobel laureate Richard Thaler, Nobel laureate Bob Shiller and psychologist Daniel Kahnemann. Kim’s conversations about behavioural finance border on trivial. What Thaler observed was that investors over react to bad news and under-appreciate favorable trends. I had trouble finding that insight described clearly on Money Talk.

I listened to fifteen minutes of Kim speaking with Brad Simpson who holds the title Chief Wealth Strategist at TD Wealth which purported to advise listeners on how to navigate the market in volatile times. I didn’t get anything useful out of the conversation other than it reminded me that “wealth management” is a very profitable stream of income for TD even if it is not for their clients.

You can find dozens of “money talk minutes” on the Internet and listen to Kim Parlee interview other members of TD Wealth management encouraging you (for example) to rely on an advisor, change your will when moving to another province or on divorce, or set up a “rainy day” fund. Think this advice is free? Think again - you pay for it in higher commissions and fees and TD Wealth management is the beneficiary.

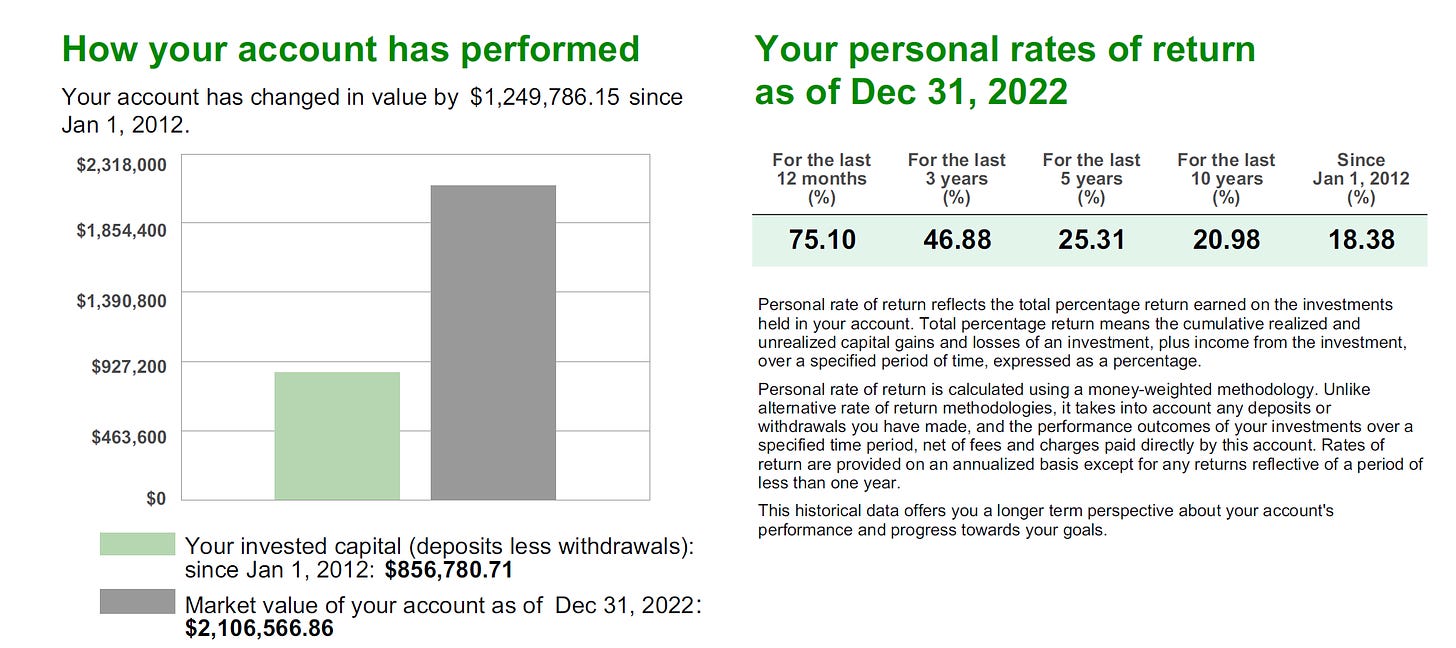

I have a small margin account at TD which I have managed without Kim’s advice (or anyone else’s) for the past decade or so. Here is my returns.

I used to think BNN was a professionally run network bringing together investors and money managers to discuss investment strategies, macroeconomics, geopolitics and markets so that viewers would be better informed and make wiser investment decisions. What I have learned is that BNN has little added value and its hosts combine a set of naive assumptions that lead viewers to make worse investment decisions. They are:

Flawed assumption that investors benefit from higher stock prices. They don’t. Lower stock prices benefit investors and higher prices have value only for traders and wealth managers who charge fees. Buying an interest at a lower price for the same stream of future income compels higher returns, and paying a higher price results in lower returns. BNN seems to exist to “churn” commissions and trading fees.

Flawed climate change rhetoric. I have heard so many BNN anchors pay lip service to the theory that CO2 causes climate change that I gag. It is nonsense, violates laws of physics, and fosters fear where no fear is warranted.

Flawed support for ESG based investing. ESG is a “feel good” scam that gives financial advisors ammunition to sell investors poor investments and avoid good ones. Imposing ideological social goals on corporations comes at the expense of investor returns and punishes not only their direct savings held in shares but also the money invested on their behalf by those who manage their pensions. Famed market guru Aswath Damodaran has the right take on ESG which he makes public in articles such as this one entitled: “ESG, the Goodness Gravy Train Rolls On”.

Flawed claims that stock prices follow seasonal patterns, a sure way promote trading but devoid of any empirical support.

TD Wealth pays Parlee and Simpson very well to promote their “wealth management” business. Their concern is their wealth, not yours.

Spot on, again! Thanks

Michael, you cover a lot of bases, cant say I disagree with any of it, as far as jars, yes it may have worked when people actually did canning, had the jars and mostly a physical money economy. I recall back then as a kid my grandmother darning my socks, because socks really did cost a lot of money, and certainly growing up I had no money except the 2 cents I could get for finding bottles to return :)