Toyota Motors has the right strategy

Emphasis on hybrids and battery technology will pay off

Toyota Motors (TM on NYSE) is arguably the world’s largest car assembler and despite being an early entrant into electric vehicles (EV’s) with its Prius hybrid has been slow and deliberate in not rushing to build out a large volumes of pure electric EV’s. The recent introduction of the Toyota Crown model to North America is a good example of the execution - an ICE vehicle with an electric motor boost on the rear axle provides 420 horsepower with a mileage of 30 mpg. all in a good looking package all for less than CAD$50,000.

Time will tell whether the Crown will be popular with consumers but it is a nice looking sedan and the clever use of both ICE and electric powertrain (often called a “mild hybrid”) improves both performance and fuel economy without the long waits for recharging at some stations.

Many have criticized the company for its lack of a large EV offering while Toyota has been content to emphasize hybrids and internal combustion engine (ICE) vehicles leaving the EV space largely to Tesla (TSLA) and Chinese manufacturers like BYD and NIO.

I think both Tesla and Toyota will emerge as the long term winners in this crowded space and legacy assemblers like GM, Ford and Stellantis will suffer in the coming competition. Why?

Toyota has recognized there is a global shortage of battery metals and the electrical grid is incapable of supporting the volume of EV’s many governments seem committed to hosting. There is a growing and serious shortage of copper, nickel, cobalt, graphite, and even iron ore and while lithium is prolific there is a short term shortage of supply. The public is confused by the term “lithium ion” believing an EV battery is largely made of lithium while in reality lithium makes up a tiny percentage of an EV battery by weight. The percentage lithium content varies by battery type and is less than 3% in the case of the Lithium Iron Phosphate chemistry. All chemistry’s are called “lithium-ion” which confuses many.

The real shortages that limit growth of EV’s are copper, nickel, and cobalt, at least as I see it. I expect more money will be made owning well-managed miners with clean balance sheets and large deposits of these key metals with relatively high grades. Names like First Quantum (FM), Freeport McMoran (FCX), Capstone Mining (CS) and Southern Company (SO) come to mind for copper and there are limited choices for nickel and cobalt. I like Nickel28 (NKL), a small capitalization streaming company with a 1.75% Net Smelter Royalty on the large and fully-permitted Dupont deposit in Quebec (not yet in production or even under construction) and an 8.36% carried interest in a large nickel-cobalt mine in Papua New Guinea called the Ramu Mine, as well as a handful of streaming contracts with development stage battery metal mines. I also like Western Copper and Gold (WRN) which has a very large deposit in the Canadian Yukon called the Casino deposit and has attracted strategic investors including Rio Tinto who holds about 7% of WRN shares. These smaller capitalization companies are very high risk and not for the faint of heart and like fine wines, should be enjoyed in small sips.

Toyota has not rushed into the EV space but has worked on improving battery technology, with some serious success, demonstrating a solid-state battery that has the potential to provide a range of over 900 kilometers and a recharge rate of less than 10 minutes according to a report in Bloomberg. Tesla, Quantumscape (QS) and Plug Power are among the companies racing to demonstrate commercially sucessful solid-state batteries with Volkwagen partnering with Quantumscape in this race. My money is on Tesla and Toyota as likely winners.

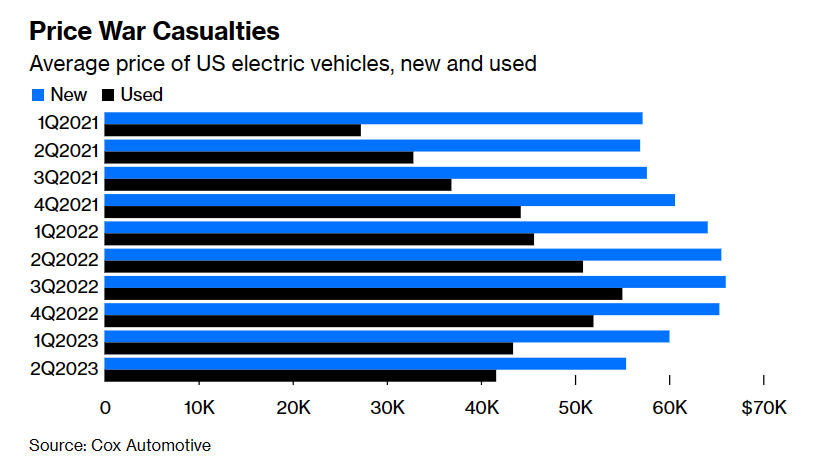

EV early adopters have found the resale value of their EV’s fall sharply. 2021 EV’s now only 2 years old trade for about half their sticker price.

Ford and GM pushed hard to create an EV offering and today ship losses of about $20,000 to $30,000 on each EV they sell hoping to make it up on “volume” by increasing market share. Consumers are fickle and demanding, so even minor quality glitches have a high cost as buyers abandon brands that have problems. GM is experiencing a lot of complaints about electrical problems in its Silverado and Sierra ICE pickups and the annoyance spills over into their emerging EV offering.

Toyota has emerged as a world leader in car assembly by using traditional approaches - like selling cars at a profit and not thinking “market share” is a sensible goal in isolation. Hardly anyone talks about Toyota’s mid-sized pickup truck, the Tundra, but it has a meaningful market share in the mid-sized pickup market (despite a 2% share in the full-size pickup area) where its competitors are limited largely to the Ford Maverick, GMC Canyon and its sister Chevrolet Colorado, and the Hyundai Santa Cruz. That is a rapidly growing market since many consumers like pickups but don’t want or need a Ford F-150 for $80,000 when a Toyota Tundra mid-size pickup can be purchased for about $25,000 less but still has plenty of power to pull a boat-trailer. Smart competitors pick their fights and don’t squander resources for bragging rights about market share.

Tesla is winning in EV’s because they have superior technology, work to reduce costs (for example, by using high pressure die casting to reduce the number of parts in each vehicle), and keep advancing the software in their EV’s towards the goal of autonomous driving. Tesla keeps lowering prices while turning in profits while its direct competitors in North America can’t make a dime on their EV’s as yet.

Toyota has a market capitalization of $215 billion, a 3% dividend and trades at 13 times net income. Tesla has a market capitalization of $850 billion, no dividend and trades at 80 times net income. Both are likely to continue to succeed as car suppliers in my opinion, but Toyota is a better bet if your goal is long term profitable investing. In my view, TSLA stock is good value at $150 a share versus its current price of about $270 a share while Toyota stock comprises reasonable value at about $200 a share versus its current price of around $160. I don’t own either today, but if I had to own a car company I would prefer Toyota to Tesla.

My preferred investment for EV adoption is metal miners, particularly copper and nickel. I hold WRN and NKL in relatively large positions and have smaller holdings in Solaris (SLS) and Arizona (AMC) who are working towards production in sizeable deposits with high grades and potentially strong economics.

I quite enjoy your writing, thanks! I have been building an EV minerals portfolio with some miners and some direct holding of the commodities like Uranium through entities such as Sprott. For Nickel and copper I have gone with RIO at the large corp end and a gold miner Osisko Developments, more for the copper potential in one of their US operations, discovered but scope not yet verified with drilling. Your advice about juniors and a strong stomach is right on. I have similar strategies to you in energy and nat gas in particular, in Canada the US and Europe. I trade the gas directly as well based on weather analysis along with some ag commodities, with the analysis geared to treating the climate alarmists as contrary to my trading. I have thought about trading copper directly but the LME melt down took that off the table. Anyway - have a great day!