Touch wood on Touchstone Energy

The company is entering a period of rapid growth

Touchstone (TXP.TO) is the residue of once high-flying Petrobank Energy and Resources (and subsidiary Petrobakken, itself renamed Lightstream and which ultimately entered CCAA in 2016 owing to excess debt, a failure to issue shares when the stock was flying high. Before its failure, Lightstream paid a CAD$0.96 dividend ($0.08 monthly) As late as the fall of 2013 Lightstream had a market capitalization of over CAD$2 billion and an enterprise value of over CAD$3 billion. John Wright was CEO at the time of the company’s failure. Petrobank was renamed Touchstone Exploration in May 2014, before the CCAA filing by Lightstream. Mr. Wright today serves as Chairman of the Board of Touchstone.

The Lightstream story is a classic tale of a management team’s overoptimistic view of commodity prices, fear of share dilution and excess use of debt, a problem which plagued many in the Canadian oil patch at that time and led to the failure or near-failure of Pengrowth, Bellatrix, Bonavista, and Penn West Petroleum (since renamed Obsidian Energy). Rather than issue equity today while commodity prices are high, may Canadian Exploration and Production companies are using surplus cash flows to buy back stock while debt remains outstanding. MEG Energy under CEO Derek Evans, who was CEO of Pengrowth until its failure, seems to be repeating the error, although MEG is strong enough it will likely barrel through and prosper.

It seems Mr. Wright has been more conservative in leading the board of Touchstone which has wisely gone to market several times in the past few years to raise equity capital to fund its exploration program and continues to maintain a pristine balance sheet. Like a Phoenix rising from the ashes, Touchstone has had recent success in that exploration program in Trinidad and Tobago.

Touchstone has a market capitalization today of about CAD$300 million. The company’s most recent natural gas discovery is just beginning production at 8.4 mmcf/day of natural gas all of which is sold to the Trinidad natural gas utility at a contract price of ~US$2.50 per gigajoule, subject to adjustment every few years. The Coho facility has the capacity to scale up to 24 mmcf/day (equivalent to about 3,950 boe/day).

It is too early to get a firm handle on the economics of this gas but revenue should begin at a rate of 8,400 x US$2.50 x 1.34 exchange or ~CAN$28,000 per day (CAD$10 million at annual rate) and profit margins in natural gas are typically around 25%. CAD$2.5 million a year of cash flow won’t move the needle on a company with a market capitalization of CAD$300 million (but it is a beginning of what should be rapid growth and is additive to the current oil revenue of about CAD$33 million) and Touchstone’s data suggest Coho natural gas revenue should rise to the CAD$30 million range as well.

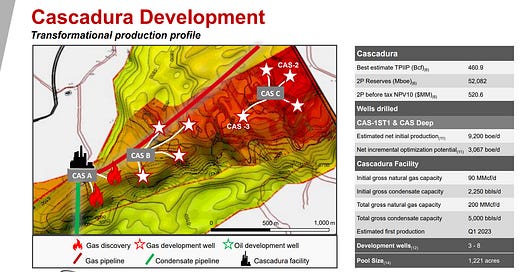

Cascadura may be the growth engine for the next few years if it lives up to its promise.

I see TXP.TO growing in steps:

Scale up of Coho natural gas production to around 3,000 boe/day of gas.

Development of the larger Cascadura find which is expected to add about 9,200 boe/day of natural gas in early 2023 and can be scaled to over 30,000 boe/day, the capacity of the processing facility.

In addition to the Cascadura natural gas, the processing facility has the capacity to extract about 5,000 boe/day of condensate. We have no information yet on how condensate rich the gas find is but the fact that the facility was designed to accomodate condensate extraction suggests it is expected to be present.

Exploration of the company’s Royston acreage.

If Touchstone does in fact reach 33,000 boe/day of natural gas, natural gas revenue in the CAD$250 million range is in the cards, and cash flows of somewhere around CAD$60 million or more. With the current market value of the company at CAD$300 million, the market is discounting this expansion. The potential for investors is if the momentum can continue and, when the current pricing agreement comes up for renewal, the possibility of higher prices.

I see Touchstone shares as fully valued today, but hold 30,000 shares anyway since I believe the company will continue to grow rapidly for several years, will be able to negotiate natural gas prices in the context of the much higher prices present in North American and Europe, and will continue to produce oil and condensate. The possible 5,000 boe/day of condensate from Cascadura at CAD$75 a barrel will add CAD$130 million of revenue and perhaps as much as CAD$60 to CAD$70 million of cash flow. I like the odds and am willing to take the risk I am dead wrong.

Touch wood.

The author has Petrobank and Petrobakken confused. Petrobakken became Lightstream and went bankrupt. Petrobank's heavy oil recovery experiment never turned out so they sold their assets and put the money into touchstone. Wright was involved in both companies..... Cheers....