Torex Gold is a good bet if gold prices remain firm

John Zechner called this one out on BNN and I think he was right

Torex Gold (TXG.TO) is a Canadian gold miner with operations in Mexico. I listened to John Zechner on BNN a couple of days ago and he saw Torex as a “Top Pick”. I have always admired Zechner’s ability to see fundamental value and his common sense approach to money management.

Torex’s current production is about to rise as its Media Luna deposit starts to be mined, and construction work to bring that deposit into production is nearing completion. The total Morelos deposits including the producing ELG complex and Media Luna have an estimated twelve year mine life, and the deposits are estimated to contain 3,294,000 ounces of gold; 155,875,000 ounces of silver; and, 409 million pounds of copper.

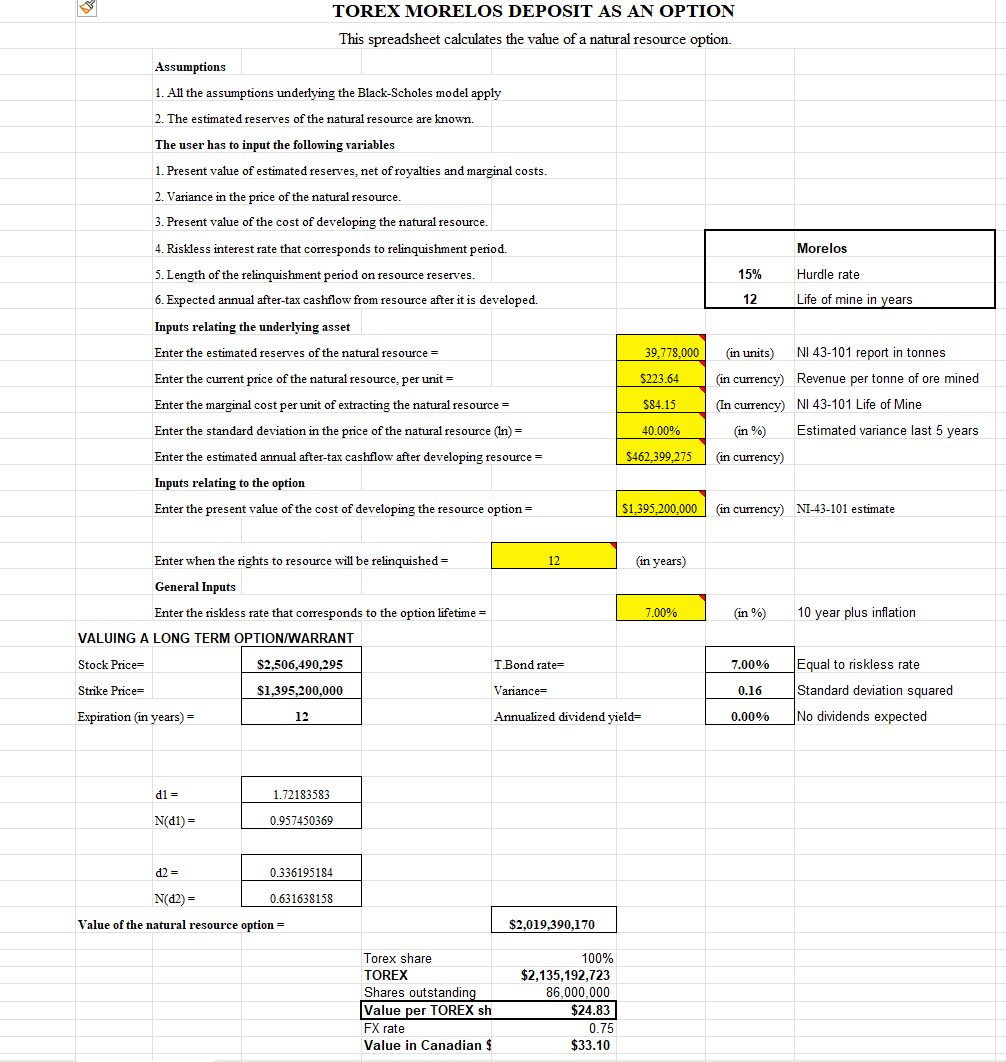

Commodity prices are reasonably firm today and I have used a US$2,000 per ounce price for Gold; a $30 per ounce price for silver; and, a US$4.50 price for copper in estimating the value of deposit as a “real option” on future commodity prices for these metals. When I say I am using the foregoing metal prices, I mean I am assumign they are the mean of a log-normal distribution of the respective prices for the duration of the mine’s life. I value mines using a modified Black Scholes model.

Capital costs including sustaining costs and asset recovery costs over the life of the mine are an estimate $1,395,200,000.

Based on that input, I calculate the value of Torex’s 86 million outstanding shares at CDN$33 per share. Today they trade at about CDN$21 per share.

Based on that analysis, Torex shares seem undervalued.