The Shopify Ponzi scheme marches on

The "business" has lost billions since incorporation while insiders have made billions selling stock

Shopify (SHOP) is a Canadian stock market darling, having soared in trading price since its initial public offering in May 2015. The company offers merchants an alternative to Amazon (AMZN) where they can set up online “stores” and payment options and get help with fulfilment without having to put up with the (some say) onerous terms and conditions imposed by Amazon on its merchant “partners”. Now barely 8 years old, Shopify has “made” millions for early investors - largely insiders - since the gains made by public investors in secondary markets have come at the expense of people who have either lost an equivalent amount or continue to hold their shares and brag about the wisdom of their investments at cocktail parties.

I set up a Shopify store a while back, and the process was easy but at every step offered “add on” options that increased the cost of doing business through Shopify to the point where I gave up and shut it down. I was hoping to sell some of my artworks which most people would not pay much for, but as P.T. Barnum reportedly quipped “you will never go broke by underestimating the taste of the American public” or something along those lines.

Here is a piece of my art. It is not to everyone’s taste, it seems, since I gave it to one of my sons as a birthday gift and he was so unimpressed he left it in my house where it sits today. I rather like it.

So what precisely is Shopify’s “business”? I say it is issuing stock to gullible investors, issuing options to insiders, and promptly selling the stock and coining millions while the unwashed masses who bet the company will become the goose that lays the golden eggs wait patiently. A simple analysis of Shopify’s financial statements shows they may have to wait a bit.

Since going public, Shopify has raised almost US$7 billion by issuing stock. In that 8-year period the company has lost about US$500 million from “operations” and in its “best” year made just over US$300 million from its actual business activities.

Losses haven’t discouraged insiders from their relentless selling of shares although CEO Toby Lutke, now a billionaire many times over, did buy $13.6 million in shares early in 2023.

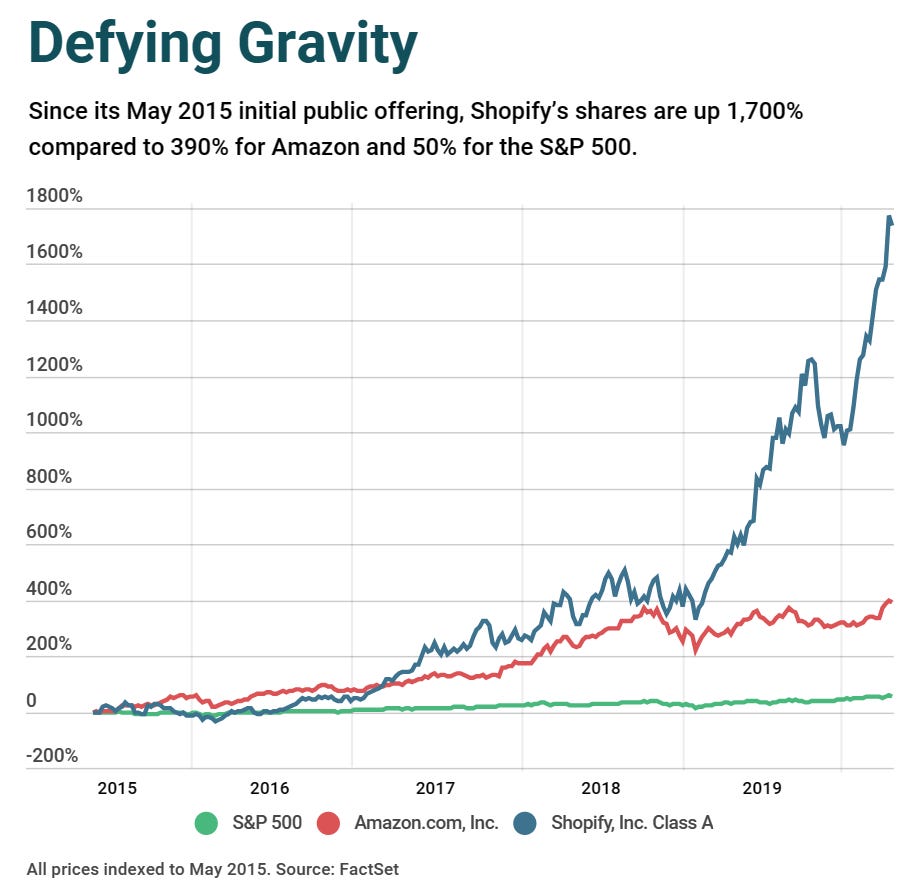

Shopify has made quite a few people very wealthy, but few of them public investors. But the “Street” loves charts like this one from Forbes showing the dramatic rise in the trading value of SHOP shares since its IPO.

The chart title “Defying Gravity” was well-chosen. The laws of gravity seem intact with SHOP shares now down about 65% from their peak about two years ago.

Ultimately, Shopify will have to become a profitable company before any sensible public investor risks their retirement on its shares. Founders and insiders have made millions and had the common sense to realize a lot of that in cash by exercising options and selling their shares to less fortunate investors who they have persuaded will benefit long term from a Shopify investment. Maybe they will. The jury is still out on the company’s fortunes and everyone loves a good story, particularly a Canadian success story like Shopify. But for me, I will pass. I just don’t buy the story - I am an old-fashioned investor who prefers profit to propaganda.

Today, Shopify has a market capitalization of about US$65 billion. At some point, Shopify growth will taper off to match global economic growth and at that point the market value of the company will reflect a market multiple of ~15 times earnings (a typical multiple for a profitable company growing in line with the world economy). To justify a US$65 billion valuation the company will have to earn about US$4.3 billion.

Shopify has revenue today of US$5.6 billion and exhibits growth of ~40% for the time being. Competitor Amazon is a more mature company and enjoys net income to sales on the order of about 2.5%. Assuming Shopify economics are somewhat similar, a US$4.3 billion net income implies annual revenue of US$170 billion which at even a 40% compound annual rate of growth will take over a decade to materialize. Investors in SHOP at today’s price are already paying for over a decade’s growth at a 40% annual rate, more if the rate of growth tapers off. SHOP investors are betting that the company will keep growing at high rates for more than another decade and at least parallel the profitability of Amazon.

That is a risky bet. In my opinion, the shares are overvalued and will continue to benefit insiders at the expense of public shareholders.

I like your painting. As of SHOP, I run a small E-commerce business (not on SHOP) and believe their business is good to very good. Does not apply to its market price.

Nice piece of art!