The sell off in copper stocks is an opportunity

Canadian and American stocks have the least political risk and the most leverage to higher copper prices

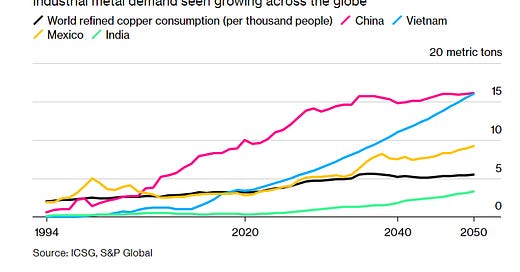

Copper demand is forecast to rise sharply over the next few years, outpacing increases in mine output.

The major force driving copper demand upwards is the growing production of electric vehicles (EV’s). The average EV uses about 150 pounds of copper according to industry estimates.

Even with a likely recession, copper watchers project demand to keep rising.

In recent months, the price of copper has fallen from about US$4.50 a pound to about US$3.50 a pound and copper stocks have taken a pounding. Relative to their recent highs, Capstone (CS.TO) has fallen 66% from CAD$7.50 range to a current price under CAD$3.00; Copper Mountain has fallen 60% from about CAD$4.00 to current CAD$1.34; First Quantum is down about 50% from the mid-$40’s to a current CAD$22; and, Freeport McMoran has fallen about 50% from about US$52 to the US$26 range today. As recession fears contribute to the bearish market sentiment, they may well fall a lot further. But it is now time to start to build meaningful positions for a 10-year horizon.

There are plenty of copper stocks to choose from. My preference is the four listed which combine relative financial strength and low costs with enough scale to meaningfully benefit from higher commodity prices down the road.

I expect to put my toe in the water over the next week or two and start with a small copper portfolio of about CAD$50,000, more or less equally spread across these names. I will bookmark this article and update progress in a year’s time. It is always dangerous to make predictions about future commodity prices and related stock prices, but when prices of established mining companies are close to or below book value, operating costs are under control, and balance sheets are sound, the risk-reward ratio is favorable in my opinion.

Thanks for your article. I like your list of 4 copper stocks. Let me hopefully add value by mentioning AMERIGO RESOURCES [ARG.TO] which at the current price of @ C$00.90 is paying over a 13% dividend. Amerigo produces copper concentrates at its 100% owned MVC operation in Chile by processing fresh and historic tailing from Codelco's El Teniente mine. The company appears to have a flawless balance sheet, appears quite undervalued, and at current copper prices the dividend is sustainable. The company has a nearly endless supply of copper tailings to process, which the company estimates will take them 100 years to process. They are currently paying C$ 00.03 quarterly dividend. FYI.

Added to my watch-lists and will follow the technicals! Cheers!