I watched an interesting interview by Steve Paikin on The Agenda last week where he hosted Professor Allison Christians whose latest book “Tax Cooperation in an Unjust World” advocates among other things a global minimum corporate tax to preclude venue shopping by corporations. It seems to have escaped Professor Christians attention that corporations don’t pay taxes, they collect them. All taxes paid by corporations are just another cost passed on to their customers including you.

Tax systems worldwide are primarily mechanisms of income redistribution and in Western democracies tend to be “progressive” so that higher income taxpayers pay taxes at higher rates and less fortunate people pay lower taxes or none at all. Revenue from the wealthier taxpayers - whose taxes pay the majority of all taxes collected in Canada or the United States - funds health care, public education, common infrastructure, retirement pensions and welfare systems among other “entitlements” as they are called by Americans. It makes no sense to tax corporations pushing the cost of the benefits enjoyed by the recipients of income redistribution back on to those recipients.

In 2019, OECD data show Canadian governments collected about $96 billion in taxes from corporations. Canadian consumer spending for 2019 was approximately $1 trillion. Household spending was $93,724 per household in 2019 but of that $68,980 was spent on goods and services. All corporate revenue ultimately comes from households either directly (for example, you shop at Loblaws or Costco) or indirectly (Loblaws and Costco suppliers’ revenues comes from Loblaws or Costco who pass the costs on to you). Imports and exports cloud the picture somewhat. The bulk of Canadian exports are resources and resource companies pay significant royalties but little taxes. Corporations import goods and sell them to other corporations or to you (ignoring government purchases from corporations which you already pay for through your taxes either currently or when the amounts governments borrow must be repaid ).

The point is that most of the $96 billion Canadian governments collected in corporate taxes in 2019 was passed on to households who purchased their goods and services in large part from those corporations. It is a reasonable inference that at least one third of household purchases of goods and service arise from the lower 50% of households, if not more. That implies that at least $32 billion of the corporate taxes collected by Canadian governments is ultimately paid by the poorest 50% of Canadian households.

Canada reports that the bottom 50% of taxpayer s pay only 14.6% of all taxes collected while the top 20% of taxpayers pay 56% of all taxes paid. That is the expected outcome of a progressive tax code, something Canadian politicians tout with pride. Total income taxes collected in Canada in 2018 amounted to about $250 billion with Provincial taxes making up about $97 billion of that total.

If you add the estimated $32 billion corporate taxes indirectly paid by the poorest Canadians to the 14.6% reported taxes collected from this group, their share of total taxes collected rises to $68 billion or 27% of the total. The Canadian tax code is not as “progressive” as Liberals and New Democrats claim. Yet Jagmeet Singh keeps ranting about “corporate greed” and “greedy corporations” and wants to dramatically increase corporate taxes, promising to “crack down on corporate loopholes”.

Singh’s proposal is to raise corporate tax rates from 15% to 18%, which would increase corporate tax payments from $96 billion to $115 billion and increase the flow-through taxes paid by the poorest Canadians by $6 billion. I can’t think of a more blatant case of hypocrisy - a left wing leader who pretends to stand up for working Canadians wanting to increase corporate taxes of which working Canadians not only pay a large share but pay a share out of proportion to their limited incomes.

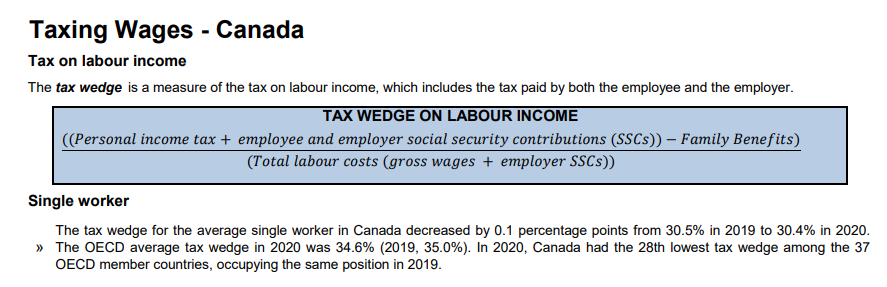

The average household income of the bottom 50% of Canadian households is $40,000 annually and this cohort comprises 5 million households. $68 billion in effective taxes across 5 million households is $13,600 per household for an average tax rate of 34%. That is more or less equal to the average tax “wedge” for all Canadians which OECD estimates at 30.5%. So much for a “progressive” tax system.

Our leaders need to face facts. Corporate taxes are not paid by corporation but by their customers and ultimately by consumers. Corporate taxes add to inflation and militate against the “progressive” intent of Canada’s tax code. Corporate taxes have no place in a sensibly run democracy.