The market under appreciates Tamarack Valley's reserves

Debt drives fear - management should take notice

Tamarack Valley’s aggressive expansion in the Clearwater play through the acquisition of Deltastream saw the stock fall out of favour despite the robust economics of the Clearwater play. Investors saw the company’s debt soar to the current CND$1.2 billion and went to the sidelines for fear the debt would imperil the solvency of the company and it would follow companies like Pengrowth, Lightstream, Bonavista and Bellatrix down the rabbit trap of solid assets financed with too much debt and investors would take a bath.

So far, that fear has seen investors lose trading value with TVE.TO stock falling from the CDN$5.00 level to the CND$3.00 level. For some absurd reason, Tamarack management still pays a dividend and touts stock buybacks as its strategy to create a better result for shareholders.

But that strategy of playing chicken with debt levels has seen the demise of many good Canadian energy companies, the persistence of oil prices above CDN$70 a share has seen progress made on reducing debt levels and free cash flows emerge from operations. Fear of a commodity price collapse is always a sensible fear in oil names, but Tamarack Valley’s 242 million Boe of oil & gas assets is nonetheless a solid foundation for value absent a prolonged slumpt in oil prices triggering a solvency problem.

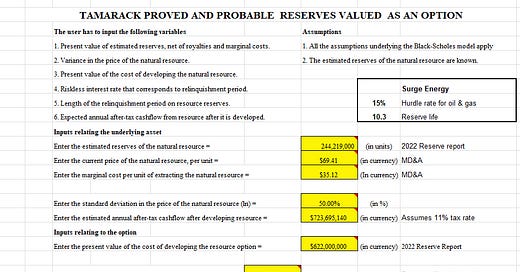

I valued the Tamarack Valley reserves (the 2022 Reserves Report) using a modified Black Scholes methodology and came up with an intrinsic value per share north of CDN$6.50 while the shares languish in the CDN$3.00 range.

At this point in the energy cycle, Tamarack seems undervalued and I categorize the stock as a high risk, high potential return speculation. If the company abandoned the dividend and buybacks and focused on getting the debt to well below 1 x EBITDA, the share might re-rate and trade at double current levels. Management does not seem inclined to do that, prefering to roll the dice, so I have avoided the shares.

Mr. Blair thank you for another valuable calculation.

IMHO TVE fears to be bought over by some competitor and thus tries to increase the stock price by paying out dividend and doing share buyback.