Trudeau promised to put “a price on pollution” during his 2015 election campaign and defined CO2 as “pollution”. Ignore the fact that CO2 is essential to life or that the oxygen we breathe arises from the photosynthesis of CO2 by plants. We can be thankful the Liberal Party government didn’t define oxygen as a “pollutant”.

Carbon pricing became law with the enactment of the Greenhouse Gas Pollution Pricing Act, SC 2018, c 12, s 186. The new law was attacked as federal government overreach and unconstitutional by several provinces but held valid by the Supreme Court of Canada in a split decision. It is tragic that Canada has a Constitution written with such a lack of clarity that even Supreme Court judges cannot agree on its terms. It leaves little doubt that Canadian citizens cannot rely on a Constitution that even our highest Court cannot comprehend.

There is no doubt that the “carbon tax” as it is commonly called will increase the price of products that contain “carbon” in some form or other, largely products derived from fossil fuels and in particular gasoline, home heating oil and natural gas. The carbon tax as enacted is proposed to increase annually with a dramatic rise of 350% by 2030. Many world leading economists including Nobel prize winners such as Paul Romer argue that a carbon tax is the best way to reduce CO2 emissions. Those economists accept without question that CO2 is responsible for the feared “global warming” it is blamed for, and make no contribution to advance or rebut that theory. All they do is say that higher prices will result in lower usage. That seems to be no advance over the thinking of Adam Smith in his classic book “Wealth of Nations” published in 1776.

Of course, neither Adam Smith nor the current crop of economists even pay lip service to the inelastic nature of energy demand. I am reminded of the old saw - “if you put two economists in a room to solve a problem, they will emerge with three opinions”.

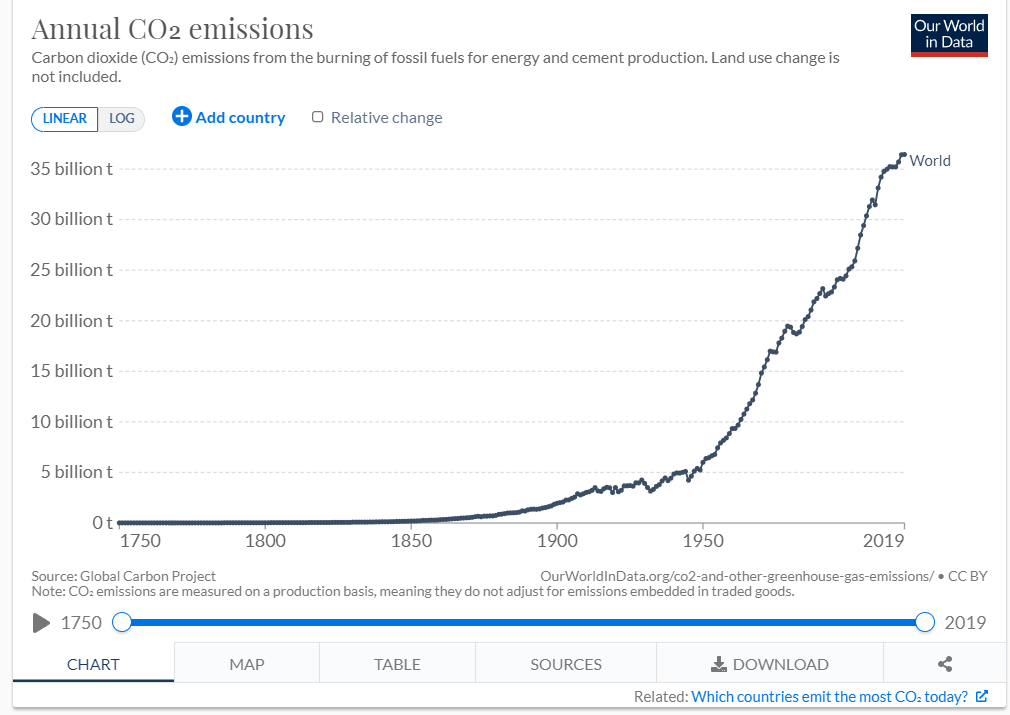

The current thesis that carbon taxes will reduce emissions ignores reality demonstrated by empirical data. The price of oil has risen dramatically since 1990 . . .

. . . but global emissions have been unaffected, monotonically rising each year regardless of the price of oil.

CO2 emissions from complete combustion of a barrel of oil comprise 433Kg. A planned $170 per tonne carbon tax amounts to 433/1000 x $170 = $73.61 a barrel. Trudeau seems to believe that adding $73.61 to the current oil price of about

$CAD90.00 per barrel will result in dramatically less use of oil.

That claim is nonsense. Canadian oil prices have been that high in 2008 without any effect on Canadian emissions whatsoever, and the volatile price fluctuations have not seen a blip on emissions in any year.

Oil prices since 2001 in U.S. funds

But carbon taxes are not without consequences. The convoluted efforts by the Liberal government to protect some consumers from their effects through “refunds” is a bizarre approach that defies the reality that the carbon tax is not directly paid by consumers except for its impact on utility invoices where it is a separate line. Rather, carbon taxes are paid indirectly in the price consumers pay for energy intensive materials contained in products they purchase and in transportation costs passed on in fruit, vegetables, and all goods shipped by truck. Costs of steel, plastic, aluminum, copper, zinc, nickel and cobalt will all rise and drive prices higher. Canadians will see those costs add directly to the inflation the Trudeau’s government’s profligate spending has already seen rise to alarming levels with no signs of easing.

The lack of common sense in Canadian governments is not isolated to one party but seems endemic in the Liberal party under Trudeau. Eighty percent of the world’s energy is derived from fossil fuels and there is no viable alternative to that source for decades to come. The pitiful progress of “renewables” reflects their high costs and unreliability so that after a couple of decades and trillions of dollars of investment they still comprise a tiny portion of global energy.

Rather than reducing emissions, the Trudeau carbon tax is just ensuring Canadians share in the pain of the energy crisis caused by ill-conceived attempts by governments to alter the course of nature based on a flawed belief that CO2 is harmful. Lost in a sea of cult like devotion to his Liberal cause, Trudeau has joined world leaders in jetting to COP26 where they were treated to diatribes from innocent and uninformed Greta Thunberg and senile, nonsensical Richard Attenborough (who still believes the polar bear population is threatened and the Antarctic ice cap is melting while both are surging). They will return home to countries desperately begging oil rich countries to produce more oil to avoid the energy catastrophe of their own making.

Until Canadians wake up, abandon their love affair with Sunny Ways and elect a government capable of applying reason and common sense to policy, we are in for a rough ride. What makes it worse is that the alternatives to the Liberal government under their current leadership are no better.