The debt ceiling debate is persuasive evidence of the rot in Washington

It is a bizarre stand off in every respect

Joe Biden is on national television railing on about the Republican bill that adds $1.5 trillion to the debt ceiling but requests some cost reductions. Biden says the cuts will harm veterans, law enforcement, border security and a host of other “programs” he calls necessary. Baldersdash.

U.S. national debt when Biden took office was $26 trillion. Biden added $2.1 trillion his first year in office and the debt is now approaching $32 trillion. Speaker McCarthy offered to increase the ceiling to $33.5 trillion, about $250,000 for every American household. Sooner or later, someone has to repay that debt.

The U.S. government will collect about $4.7 trillion in revenue this year.

If spending were kept to $4.7 trillion, the debt limit debate would be academic. Impossible? Hardly. U.S. government expenditures in 2018 amounted to $4.1 trillion. Most households could get by on their 2018 budget, and so could United States it the will was present.

Imagine having to manage within a budget of $4.6 trillion when expenditures at the 2018 level were merely $4.1 trillion? The Biden budget for fiscal 2023 is $5.8 trillion and includes $1.6 trillion of so-called “discretionary” expenses. McCarthy’s proposal raises the debt ceiling by enough that this budget is fully funded. All Biden needs to do is start the process of reducing discretionary expenses to a level consistent with government revenue - you know, plan to balance the budget and make debt ceilings an artifact of history.

But he won’t. He is running for re-election and wants “pork” to buy votes. That is what is going on behind the stand-off. Biden would prefer to risk debt default than compromise his ability to buy votes in 2024.

Democrats like to spend. Republicans like to spend. Only when in opposition does either party think fiscal prudence is a worthwhile goal. But eventually, America will run out of any ability to borrow as so-called “entitlements” keep rising to where they can no longer be met even with massive borrowing.

By 2050, some economists project that entitlements will consume 15.5% of GDP and as much as 90% of federal government revenue. Not all entitlements in that figure, just Social Security, Medicare and Medicaid. Interest on the government debt, spending on defense and infrastructure, and spending on the popular but unnecessary “climate change” programs will have to fit into the remaning 10%. That will be quite a chore since interest charges alone are likely to exceed that 10% and national defense runs at 12% of government revenue. Biden’s spending dreams are unsustainable and the risk of default is a minor risk compared to the risk of economic collapse inherent in continuing to spend, spend, spend.

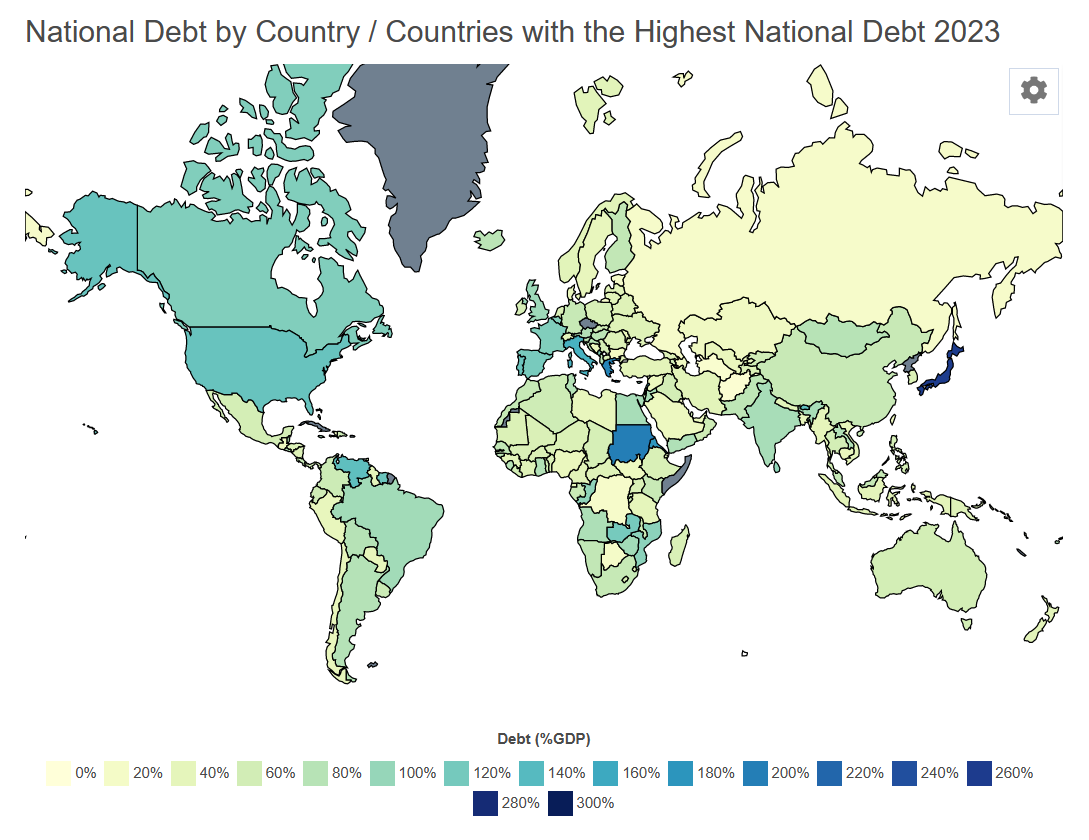

United States is fast approaching the debt levels I used to associate with poorly run third world countries like Mexico, Argentina, Venezuela and Turkey. This chart says it all.

Only Venezuela, Sudan, the Czech Republic, Greenland, Japan and North Korea have debt to GDP ratios higher than United States under Joe Biden, although Canada under Trudeau is trying to pass on the inside lane. The collapse of Argentina in the 1980’s had its roots in excess debt leading to hyperinflation. Similar stories exist for Mexico in the so-called “Peso Crisis” of 1994 saw a rapid devaluation of the Mexican currency as lenders fled risks of default and capital headed for the exit door, causing contagion in other Latin American countries. Only a $50 billion bailout organized by Bill Clinton and adminstered by the IMF stopped the crisis from escalating to complete economic collapse.

The lessons of history are with us. An evangelical belief that “it can’t happen here” and that America is immune from such crises is hope replacing common sense. Money shows no mercy. Biden demonstrates a total lack of awareness of the damage he chooses to inflict on United States, always with a “do-gooder” theme like his nonsensical claims about climate change. CO2 is harmless. Biden is not.

When forced to pay “reparations” after World War I the German Weimar Republic suffered hyperinflation and German debt levels that took 92 years to repay. Germany’s recovery rested on lend-lease and the Marshall Plan backed by United States, without which Germany may never have seen daylight and many of its neighbours would have endured decades of weak economic outcomes. Who is there in the wings able to bail out the U.S. if its economy falters and lenders stop lending to the U.S. treasury? Think China will come to the aid of America?

Set aside which party is in power - the issue would be the same if the parties were reversed. With an election only 18 months away, the party in power wants to spend to curry favor with voters and the opposing party gets religion and cries for fiscal prudence. But this charade has run its course and like it or lump it the Republican party is on the right side of this debate and should not be discouraged by the prospect of default. Better to face the music now that have a worse outcome later.

Good points . 2 more …

1. I’d blame the voter who has agreed to be bought … there are words for that

2. The problem with letting it default is we are also in a Cold War with Red China who are aggressively trying to replace the US Dollar as the reserve currency . Default would speed that process up and all hell could break loose .

What to do ? Both parties have to reach a point where they want to deal with it . RFKjr has his flaws but is the only sane person in sight to lead the Democrats. I’m starting to hope he can somehow win and then with Kevin McCarthy start to …. dare I say it ? ….. MAGA

Weird how this might work eh ?

Michael, Haven't you heard? It's different this time. MMT will take care of everything. The people who run the country now are not only much younger than in the past, they are much smarter than those old fogies. Capitalism is passe as money now grows on trees. Cheers