The collapse of Lithium America was predictable

Bandwagons are dangerous rides

Lithium is the 25th most abundant mineral on Earth. Some would call that “relatively rare” but it is massive if compared to carbon dioxide which is barely a trace element in atmosphere at 420 parts per million by volume. Climate nutters think CO2 is ever present in alarming quantities and lithium is a rare earth which must be valuable given the fact that electric vehicles (and many other devices) are powered by “lithium” ion batteries.

People that rely on headlines to guide election or investment decisions learn hard lessons. CO2 is harmless and lithium is hardly the next gold rush.

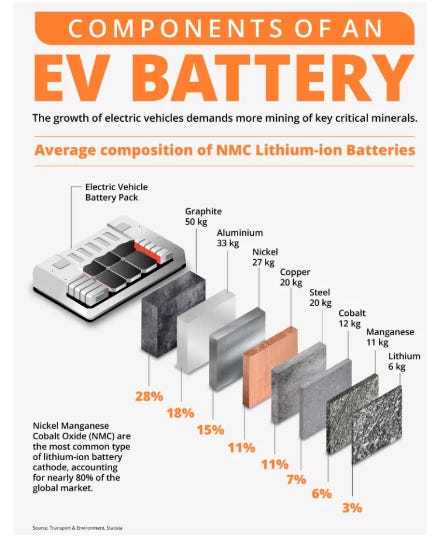

As I wrote about over a year ago, lithium may be in the typical description of an EV battery but comprises about 3% of the batteries weight. Graphite, aluminum, nickel, copper, steel and cobalt are all multiples of lithium in terms of their content in batteries by weight. The rush into lithium stocks (often propelled by bullish reports by “sell-side” analysts) has cost many dearly, somewhat akin to the silly rush into cannabis stocks after the Trudeau Liberals thought it appropriate to encourage our youth to take drugs by making pot legal for sale for “recreational” use. Years ago, our government of the time promoted sports and fitness with a program called “Participaction” which fizzled out since it involved actual effort rather than simply toking up and taking a trip into fantasy land, where most Liberals seem to live.

Typical headlines encouraging investors to buy into lithium were (and are) like this one.

This clip from an article on Invezz tells the sad tale. After running up dramatically after its public appearance and peaking at about US$25 a share, Lithium America ($LAC) stock has plummeted to about US$4 a share taking with it hundreds of millions of gullible investors monies.

The message in this tale isn’t complex. Do your homework, dig in below the headlines, don’t think the conventional wisdom is really “wisdom” and stay off “bandwagons”.