The case for Western Copper and Gold

And the risks that copper prices may be too high

Western Copper and Gold (WRN.TO) holds a development stage copper mine called the Casino project which has a massive deposit of copper and gold, two metals that mining bulls have fallen in love with in the recent past. Both gold and copper prices are at or near an all-time high, and the risks of a rise in inflation, and economic downturn arising from excess sovereign debt (particularly in U.S. and Canada), and a so-called “flight to safety” are pushing the gold narrative. Not a day goes by when my friend and top-notch financial advisor Jaime Carrasco doesn’t pitch gold on X or Linkedin, and he has made his clients a lot of money in the gold trade.

Copper demand is high at this point and the “transition” narrative where people abandon their internal combustion engine (ICE) vehicles and everyone drives an electric vehicle (EV) while utilities race to upgrade their power grids to get ahead of rising demand for electricity have seen mining companies, sell-side analysts and mining investors racing to their trading screens to plug copper mines or speculate on copper prices on the Chicago Mercantile Exchange.

What could go wrong? I will deal with that a bit later.

With current copper prices north of US$5.00 a pound, a lot of copper miners are making a lot of money and new projects are sporting attractive looking economics if these prices persist (or as many forecast, rise further or even double). Western Copper’s Casino project merits some attention in this environment.

The Casino project contains a whopping 10.7 billion pounds of copper and 21.1 million ounces of gold based on drilling to date and including inferred resources. Located in the Yukon, the geopolitical risk is low. Major shareholders include Rio Tinto and Mitsubishi Metals, so there is plenty of mining major support.

Ignoring the rhetoric about copper prices doubling and assuming this project can get needed permits, it would enter production in three or four years and have a mine life of about 27 years based on current data. I value development stage mining deposits as a “real option” on future commodity prices. For Western Copper, the intrinsic value I come up with is about US$38 a share versus a current trading price in the US$1.55 range. Western Copper has both a U.S. and a Canadian listing. US$38 is about CDN$50 and WRN.TO is trading in the CDN$2.00 range.

I have based that analysis on a starting price of US$4.50 for copper and US$2,125 for gold

The market ignores the obvious value, possibly because the market fears the US$4.3 billion needed to construct the mine will see Wester Copper shares diluted to smithereens or the company taken over by Rio Tinto or Mitsubishi at a fraction of its value. Both are real risks, but with a good board of directors and a world class deposit, a takeover bid might trigger a bidding war between mining majors and any takeover could easily see the shares ten or twenty times today’s prices.

But is the bullish sentiment driving copper and gold prices to record levels a bit misplaced? Maybe.

I am a big fan of commodity guru Javier Blas who writes for Bloomberg and the title of his recent article might prompt some critical thinking.

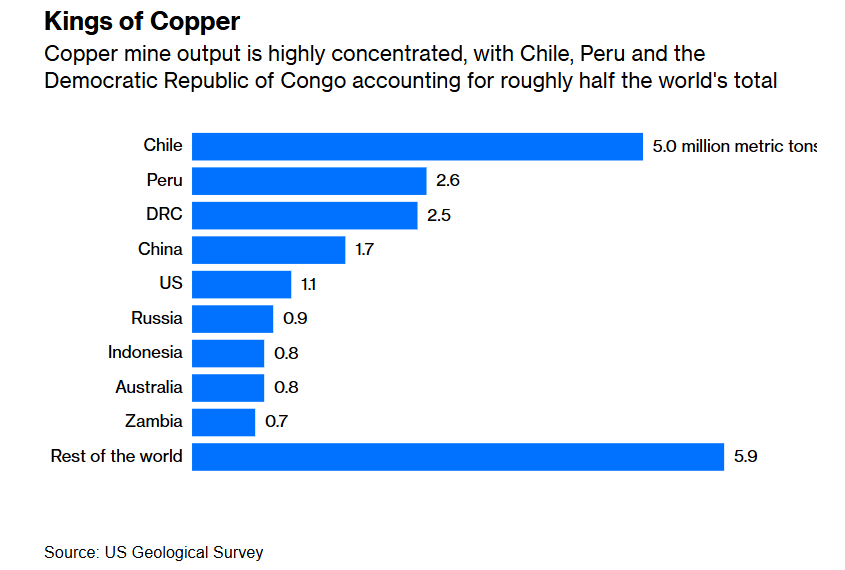

Blas makes the case that flagging demand in China and the potential for rapid supply responses from copper producing jurisdictions not stifled by silly environmental laws that overstate environmental risks and pander to activists may bring the copper market back into balance more quickly than copper bulls imagine. Chile, Peru, the Democratic Republic of the Congo and Russia and Zambia have major copper output and are not handcuffed by progressive leaders who dream they can save the planet by destroying its economy.

Nothwithstanding, there will always be markets for copper and gold and the economics of Casino are robust at prices a fraction of those of today. In my opinion, a small position in Western Copper is a call option on both copper and gold and likely to pay off handsomely if the bulls are right and not punish one too badly for taking the risk if the bulls are wrong. I own 25,000 shares.

Michael. Have you ever taken a look at Prairie Sky Royalty? They own 18.5 million acres mineral interest fee simple and GORR in Western Canada, pay a 3.8% dividend and should be debt free in a couple of years. I would be interested in your thoughts.

What are your thoughts about the permit approval process and timeline?