The art and science of valuation

Different approaches lead to different outcomes

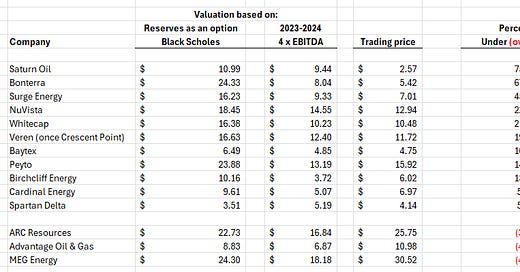

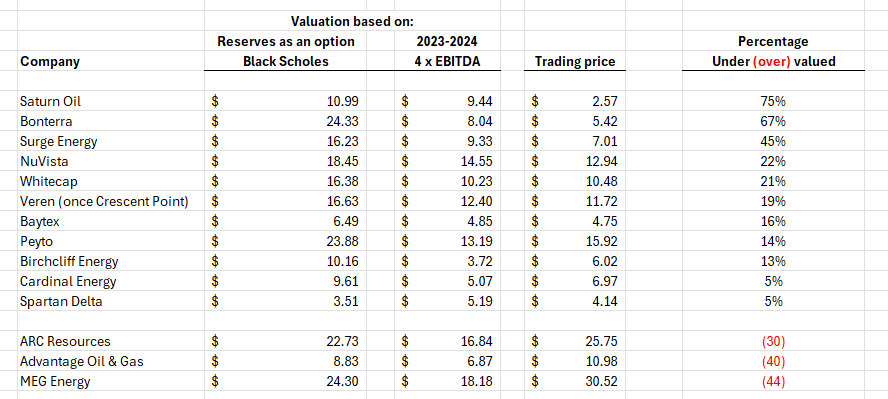

Valuation is as much an art as a science. Sell-side analysts use simple valuation models, typically valuing a stock based on a multiple of EBITDA either current or forecast for the next period, adjusted for debt and cash. The typical valuation of an oil & gas company is about 4 x EBITDA. Rarely do you see multiples less than 3 x or higher than 5 x.

A 4 x EBITDA multiple carries some implicit assumptions - it assumes more or less constant EBITDA and assumes a long lived asset giving rise to the EBITDA. And it assumes investors are content with a pre-tax 25% return on capital employed by the particular company. The implied assumption of the persistence of the EBITDA is in essence a prediction of future commodity prices. Since the multiple of EBITDA gives no consideration to the possible collapse in commodity prices, it tends to overvalue the shares of oil & gas companies except in periods of rising prices. It is an unreliable approach but valuable to sell-side analysts and their companies since it is simple, well-understood, and tends to encourage trading which is where their brokers and firms make their money.

The multiple approach is nonetheless useful in comparing companies, since its implicit errors are in common and do not materially impact the comparison in most cases.

Valuation of oil & gas reserves as a long term option on commodity prices avoids the inherent forecast error by implying that commodity prices are log normally distributed around a mean of the current price. Since Black Scholes valuation considers both the prospect of higher prices and the risk of lower prices, it is more reliable than a multiple of EBITDA, but it does suffer other limitations. The most important of these is that the reserves of the commodity being exploited won’t rise from their originating value and will be exhausted over time. All oil & gas companies with a recycle ratio greater than one can build reserves, making the Black Scholes valuation lead to undervaluation.

These two approaches lead to widely differing outcomes much of the time. Here is a table of the two approaches applied to popular Canadian oil & gas firms, and by averaging the two approaches and comparing them to today’s trading prices, getting some insight into whether the market is undervaluing or overvaluing a given name.

Some companies can add reserves quite quickly and have high recycle ratios. Both Black Scholes used to value reserves as an option, and EBITDA multiples, undervalue these companies. On this list, Peyto, Birchcliff Energy, Spartan Delta and ARC Resources are in that category.

It is easy to find fault with any analysis, but I think the exercise is valuable nonetheless. In my opinion, the data make it clear that Saturn Oil, Bonterra and Surge Energy are undervalued, and that Advantage Oil & Gas and MEG Energy are likely overvalued.

Advantage will do well if natural gas prices rise, but higher natural gas prices will impair the SAGD economics of MEG.

MEG will do well if Access Western Blend (AWB) prices rise , but will suffer if Western Canadian Select prices fall bringing down AWB with it. That seems unlikely with TMX up and running and the WCS discount narrowing. Investors like MEG and that helps explain why it trades above intrinsic value.

I cannot explain why Advantage is so popular.

You can rationalize investments in these companies by adding a “belief” that future commodity prices will make your holdings more valuable, and there is no doubt that will happen now and then, but if you can really predict oil & gas prices you are wasting your time in the stock market since there is a lot more money to be made on the Chicago commodity market and with a lot more leverage available.

Good one Michael Blair and a healthy reminder for all of us just how fraught analysis can be.