It is 50 years or so since modern portfolio theory emerged from a litany of Nobel laureates who promoted the efficient market hypothesis (EMH) which guided professional money managers ever since. The theory that a well-diversified portfolio would produce the highest return for a given level of risk became popular and even de rigeur for managed money, with highly paid “experts” populating the pension committees of major companies, unions and governments. Most acted as if a portfolio comprising 60% equities and 40% bonds was the best balance, with the ratio of equities to bonds shifting plus or minus 20% to keep a 60:40 ratio one way or the other.

How has that worked out? Not well.

In an efficient market, the theory would work well and Eugene Fama, Harry Markowitz, Merton Miller, Franco Modigliani and William Sharpe could sustain their speaking tours pointing to the benefits of their Nobel prize winning work while MBA students would still spend study hours learning how to create an efficient portfolio, calculate Beta and Alpha, and prepare themselves for careers with Goldman Sachs or Morgan Stanley. But markets are a lot less efficient than the theory assumes.

The inefficiency lies at the feet of government intervention in markets. In the famous words of another Nobel laureate, Milton Friedman, “The government solution to a problem is usually as bad as the problem." Worse actually, and Friedman captured the essence of the issue with another famous quote: "Concentrated power is not rendered harmless by the good intentions of those who create it."

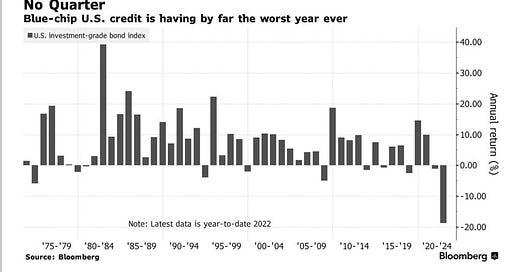

The emergence of fantasies like Modern Monetary Theory (MMT) and Quantitative Easing (QE) gave governments the dry powder to pretend they could borrow without limit and control interest rates through central bank intervention in markets, either by buying bonds to drive rates down or selling bonds to drive them up. What was missing from the analysis was not who would sell the bonds to the central bank since there was always a willing government eager to spend more money without raising taxes, but who would buy the bonds when the central bank reversed course. Not me is the answer and it seems I have company. Here is the devastation in the bond market in the recent past.

This is the tip of an iceberg that is growing faster than climate alarmists say the Greenland ice cap is melting. The most feared words on the floor of any trading market are “no bid” and we are starting to see that phenomenon as investors flee risk created by the same people who promote the climate alarm.

That risk is a global energy shortage with no signs of any Western governments recognizing that if world oil & gas production is not dramatically increased and soon, energy prices will keep rising and strangle economic growth worldwide while causing even higher inflation than the stupidity of monetary and fiscal policy under leaders like Biden and Trudeau in the past few years.

Rates will keep going up and bonds will keep falling in price. All it will take to precipitate a crisis is a failed bond auction in a major economy. We nearly had one in the U.K. narrowly missed by prompt action by the Bank of England to re-start QE buying as many bonds as it took to stabilize the market despite the inflationary effect of doing so. Look at the results - Ontario Teachers’ Pension Plan reported a 1.2% return for the first half of 2022. OMERS lost 2.7%. Canada Pension Plan (CPP) returned 3.1% for the year ended March 31, 2022. With inflation at over 6% that is a sizeable loss of real value in three of the largest pension plans in Canada. And it will get worse since the Bank of Canada will keep raising rates until inflation is tamed and the Trudeau government will keep stifling oil & gas production and spending borrowed money hamstringing the anti-inflationary efforts of the Bank of Canada with stupid fiscal and energy policies.

It is hard to imagine a worse set of policies but I am confident Trudeau will find ways to make the outlook even more dire. He is already planning to triple the carbon tax next April and is going to raise payroll taxes on EI and CPP in January.

The old and now hackneyed EMH and 60:40 rule have given way to new fads - ESG investing and mandated climate change disclosure for public companies. The costs of ESG policies and climate disclosure will be borne by investors like the three pension funds listed above, with no offsetting improvement in operating cash flows. The implication is that returns to those pension funds (and to everyone else) will fall and retirement income will be hard to come by whether from CPP, employment or personal savings.

I have escaped this malaise by investing in energy, with my return in 2021 at 188% and year to date 2022 at 45%, padding my retirement savings with a few more millions. A good thing as well, since my $960 a month CPP is my only pension income since I am too rich for Old Age Security.

The economic problems facing Canadians are home grown and arise from electing a drama teacher Prime Minister and buying into to the “climate change” propaganda spouted by Liberal leaders which lie at the root of the economic issues, exacerbated by reckless spending of borrowed money by Ottawa.

It is going to a cold winter, both in fact and metaphorically. With inflation now at over 10% in Europe and oil & gas shortages so severe that many can’t run their businesses or pay for home heating, that economy may well collapse. If it does, North America will import the same problems as its major trading partners become less capable of buying our exports and our political leaders double down on stupid policies that do not and cannot work.

Energy market and financial markets left alone by governments would have long since solved the current problems. Absent government intervention, oil & gas companies would have responded to shortages by investing in additional output. Vilified by Liberals and strangled by regulation, the industry has chosen to repay debt, increase dividends and buy back stock. Without QE, interest rates would have been set by the market and never entered negative rate territory driving home prices to where today they are unaffordable (Royal Bank estimates a new home in Toronto or Vancouver would consumer 70% to 90% of the average household’s income, the worst affordability measure on record). Without restrictive zoning and permitting issues, developers would have built more than enough homes to supply demand including demand arising from hundreds of thousands of welcome (and necessary) immigrants and home prices would still be within reach of our children.

We are witnessing a time in history where left wing intervention in free markets is demonstrating its dangers and it is not over. We need new leadership in Ottawa and Washington if we are to reverse this trend. If not, the outlook is dire.

Peter Schiff reported that public pensions in the UK leveraged up with borrowed money. Rising interest rates could put the pensions at risk. The Band of England stepped in with QE.

Kick the can one more time. Policy makers try to avoid the inevitable, pick your poison,

10% inflation robbing the pension fund of half its value in 7 years, or face the music and default on billion dollar loans. One way or another, the outcome is bad, but predictable.

One possible modification to the 60:40 portfolio is to replace some portion of bond by precious metals and other commodities.