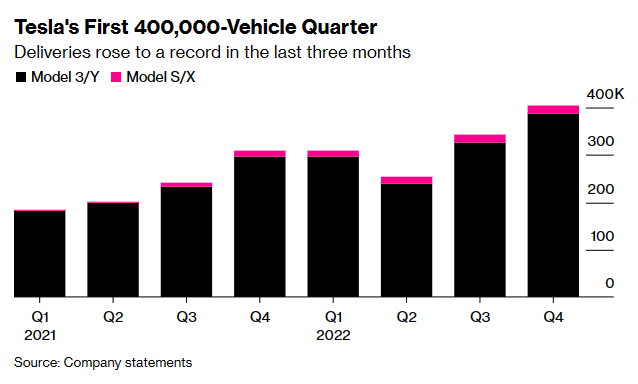

Tesla’s sizzling growth continues. Sell-side analysts dreamt of even higher number and now have to ratchet down their optimism. Tesla stock may come at a lower price as the weak sisters bail out. The recent 15% fall could be just the beginning.

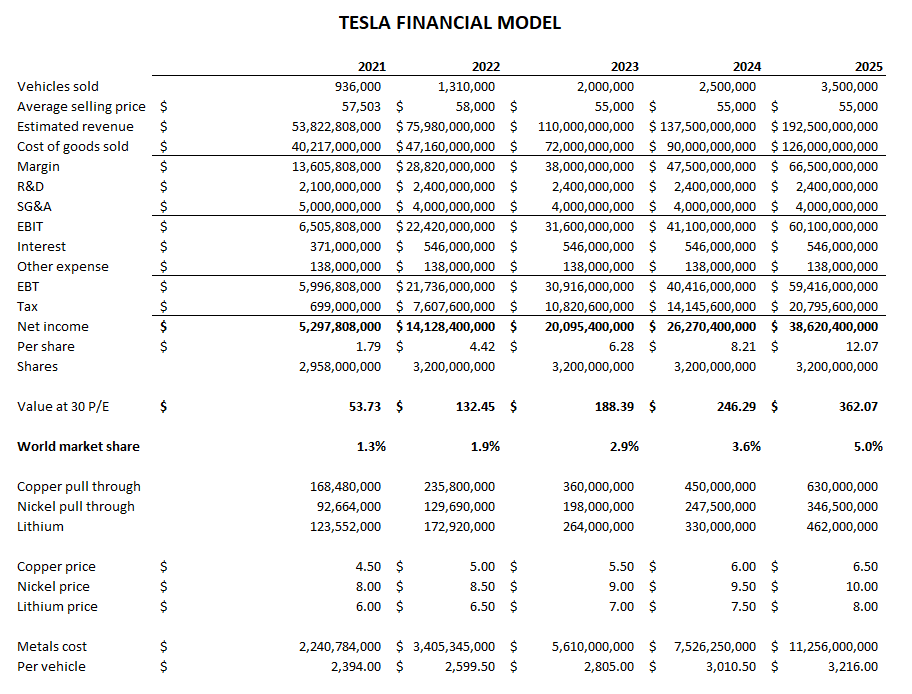

Based off sales of over 400,000 vehicles a quarter and some potential growth arising from China re-opening, it is not hard to imagine Tesla selling close to 2 million vehicles in 2023. Tesla’s profit per vehicle (I estimate) is over $9,000. Profit for 2023 of $20 billion or more is within the bounds of sensibility, and with 3.2 billion shares outstanding, suggests a per share profit of US$6.00 is in reach. At $115 a share, a price earnings multiple of ~20 times flows from those (albeit sketchy) assumptions. I think that multiple is too low for Tesla’s likely growth rate.

Tesla will keep growing in my opinion. Short term softness in China owing to the chaos created by the government’s sensible decision to abandon ZeroCOVID and a North American recession could be headwinds that stall growth for a short period and market darlings that turn in slow growth become pariahs in many funds, so I could see a further sell off as both a serious possibility and a substantial opportunity.

I drove in my son’s Tesla Model X from Whistler to Vancouver recently, and was blown away by the vehicle. Once you drive a Tesla, you begin to understand the hype. It was quiet, fast, comfortable and with the equivalent of 1,100 horsepower, had impressive acceleration and passing power. It made my Mercedes cls450 look sluggish (and the Benz is by no means sluggish).

My rudimentary financial model for Tesla is based on the assumption of a 70 million unit worldwide market for light vehicles with zero growth, and Tesla increasing its market share to 5% over the period through 2025. I have estimated the cost of key materials used in each Tesla and do not expect materials cost inflation to materially alter gross margins, and have assumed an average selling price of US$55,000 per vehicle, less than current to reflect the mix of production and some discounting. Here is that model:

Based on a price earnings multiple of 30 times (appropriate for the high growth in units and dollar sales in my opinion) I see TSLA shares reaching a value of over US$350 by the end of 2025. I have not attempted to forecast cash flows and have left interest charges flat at $546 million presuming that operating cash flows are applied to building the assembly plants and gigafactories needed to support the increased output. I think that assumption is conservative - there is not much risk Tesla will need to issue more shares or borrow more to fund its growth as I see it.

The 2 million unit sale assumption for 2023 is aggressive but not important to the growth opportunity. With production now demonstrated at over 400,000 units per quarter it is achievable from a production standpoint and despite fear of lagging demand, I see Tesla’s everywhere now and at the premium end of automotive markets there is rarely much impact on demand from a recession. For most people who buy a Tesla, the cost is a rounding error.

In the result, I see a reasonable prospect of TSLA shares tripling within 3 years from their current price of ~US$115. In my opinion, Tesla shares are both high risk and undervalued in today’s market.

Using a PE of 30 for a automobile company.....while others trade in the single digits....this is a formula for success

What is growth slows to 20% or....lower.....

unless its a bubble stock which Tesla is