Talking heads on BNN - How good are they?

Review of January 2022 "Top Picks" for some prominent advisors

A regular part of BNN Bloomberg daily market analysis is the popular interviews with professional money managers including their “top picks” for the coming year. I had some fun reviewing the January 2022 “top picks” from some of Canada’s money managers. Full disclosure, some of them are personal friends.

Andrew Moffs

On January 31, 2022, Andrew Moffs chose Boardwalk REIT, Storage Vault and Dream Industrial REIT as his “top picks”. Boardwalk dropped from $54.42 on January 3, 2022 to $49.43 on December 26, 2022. Storage Vault opened the year at $6.91 and ended at $6.02 and Dream Industrial REIT began 2022 at $16.47 and ended at $11.69. On average, these “top picks” lost 16% in the year. Presumably his second tier picks did worse.

Ryan Bushell

On January 26, 2022 Ryan Bushell tagged Brookfield Renewable Partners (BEP-UN), Aecon (ARE.TO) and Freehold Royalties (FRU.TO) as his “top picks”. Brookfield opened 2022 at $43.13 and closed at $34.28; Aecon opened at $16.98 and closed at $9.11; and, Freehold opened at $12.20 and ended at $15.83. Despite the 30% gain in Freehold Royalties, Bushell’s “top picks” lost an average of 12% in 2022.

Greg Newman

Greg Newman’s January 13, 2022 “top picks” were TFI International, Bank of Montreal and Finning Tractor (FTT.TO). TFI and Bank of Montreal rose about 4% during 2022 while Bank of Montreal fell 14%. On average, a small loss.

Barry Schwartz

On January 4, 2022 Barry Schwartz picked Costar (CGSP), Watsco (WCS) and CoPart (CPRS) as his top picks for 2022. Costar gained 8% in the year; Watsco lost 16% and CoPart lost 11%.

John O’Connell

On January 7, 2022, John O’Connell chose Amazon, Citigroup and Disney as “top picks”. Amazon share price fell 48% in 2022; Citigroup fell 31%; and, Disney fell 45% in the year. I am pretty sure Mr. O’Connell was still paid a fee by his clients for managing their money.

These money managers are all good money managers, not reckless nor foolish. They were just wrong. Calling the stock market is a mug’s game unless those calls are based on formal valuation analysis and strong foundation in macroeconomics. It takes a certain amount of courage to appear on national television and tout your favorite stocks as a way to generate clients for your advisory firm and I am sure that is what motivated these appearances.

But they demonstrate an important lesson for investors - professional money managers may be no better at managing your money than you would be. In 2021 and 2022, the macroeconomic forces driven by a global energy shortage (itself an outcome of ill-considered climate policies that pretend CO2 causes adverse climate change) made the energy sector the place to be. Managers embracing ESG as a positive force simply lost their clients a lot of money.

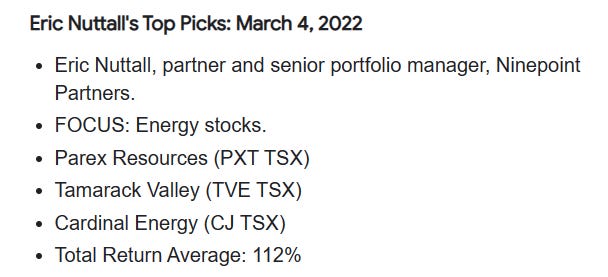

One money manager who got it right was Eric Nuttall of Ninepoint Partners. Eric correctly saw the macroeconomic forces and global energy shortage as it materialized and took large positions in Canadian energy names. Nuttall’s performance as a fund manager in 2021 and 2022 was exceptional.

If you lack the knowledge or competence to manage your own money, it is important to pick an advisor with a demonstrated record who exhibits knowledge and competence. There are many good choices beyond Eric Nuttall (who is exclusively focused on energy) - John Zechner, David Burrows, Jaime Carrasco, Margo Naudie, and recently retired Norman Levine is a short list of some of the best I know and admire .

I have always managed my own money. My 2021 return was 188% and my 2022 return was 73%. If I had to turn my money over to anyone to manage owing to incapacity or infirmity, I would choose my friend John Zechner for his integrity and common sense.