Suncor stock is cheap at today's prices

Investors seem too lazy to look below the WTI headline price for oil

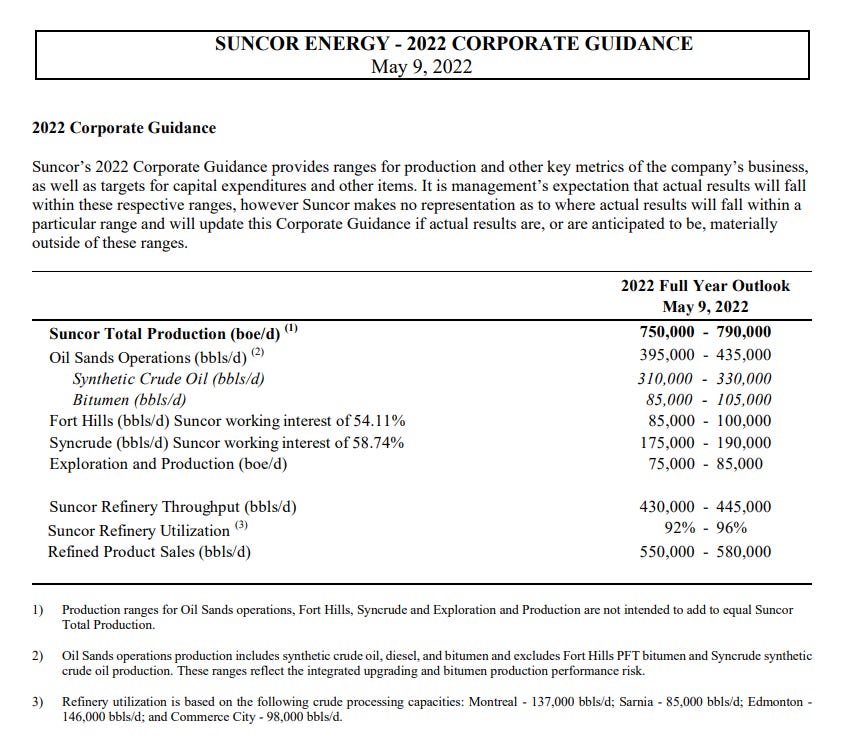

Suncor (SU.TO) is one of the Canadian heavyweight oil producers with its Syncrude facility producing ~400,000 barrels a day of bitumen much of which is upgraded to Synthetic Crude Oil (SCO).

The price for upgraded bitumen (Edmonton Sweet Synthetic Crude) is currently US$156 per barrel (close to CAD$200 a barrel). That price has been on a secular rise for several months despite volatility in West Texas Intermediate pricing.

Of Suncor’s 750,000 to 790,000 barrels per day of production, about 330,000 Barrels per day is SCO, 58.74% of which is to Suncor’s account and for which Suncor is receiving the US$156 price. The SCO price in Q2 is sharply higher than the CAD$114 SCO price received in Q1 2022. Suncor releases Q2 results August 4, 2022 and those results should be very strong.

Suncor’s realized price for SCO is not the only tailwind. Suncor’s refining operations are benefitting from a robust crack spread, something all North American refineries are receiving owing to a severe shortage of refining capacity.

At a current price of CAD$42.50 a share Suncor’s annual dividend of CAD$1.98 (paid quarterly) provides a yield of 4% and the stock trades at approximately 7 times forward earnings. In addition to its dividend, Suncor has been buying back stock. In Q1 2022 Suncor spent CAD$1.3 billion to repurchase and cancel about 33 million shares.

These are volatile times in the energy market and share volatility sees daily changes as high as 9% to 10% for individual stocks, so the space is not for the faint of heart. But on any metric, Suncor stock seems cheap to me. A likely recession may take the bloom off the rose for a few months but will do nothing to increase North American refining capacity or increase oil & gas supply, so any softness will correct itself when the recession ends, typically in a few quarters.

Suncor has been a core holding in my portfolio for years now - boring & at times not very rewarding, though that is beginning to change now.

At times, I've added in order to average down, but feel I have enough exposure now.

Therefore, given the recent moves down (and limited cash resources), I decided to increase my holdings in CNQ from beer money - to small.

Then this.....Suncor Energy Announces CEO Transition

https://www.newsfilecorp.com/release/130430