Spartan Delta momentum continues

This may be the most undervalued stock on the TMX

Spartan Delta (SDE.TO) reported a terrific third quarter after close yesterday, and surprised investors with a CAD$0.50 special dividend. That amounts to CAD$43,000 for my 86,000 shares which will come in handy when paid on January 15, 2023 when I start to estimate my taxes for 2022.

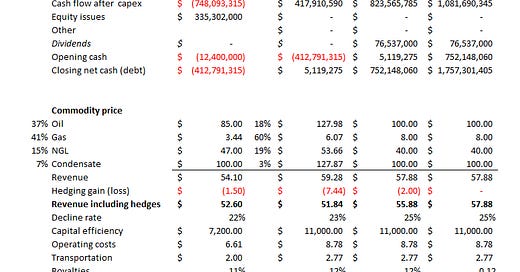

Spartan Delta is now almost debt free and I expect the company to generate over CAD$1 billion in cash flow in 2023 based on an assumed $400 million capital budget and commodity prices close to today’s levels (lower for oil, higher for natural gas).

Commodity prices will determine the outcome but the clean balance sheet and relatively low operating and transportation costs make this company lower risk than many of its peers. I have used a natural gas price of CAD$8.00 a gigajoule which is a wild ass guess and could be materially wrong, but the expected expansion of the pipeline to the Northwestern United States under construction, the completion of the TransMountain Pipeline and the start up of the Kitimat LNG project are all within the forecast period and should be tailwinds for SDE.

If I am anywhere in the ballpark (and there are no guarantees that I am) with respect to the economic model I have created, there is a decent chance SDE shares can rise to the CAD$50 range within a couple of years.

I like the odds, accept the risks, and expect my 86,000 shares to increase in value well beyond the price in the low teens the shares trade at today.

Thanks for your insight. Should be a very interesting year ahead for SDE.