Solving the looming fiscal crisis in America

A buyers' strike for U.S. treasuries could trigger an economic collapse

Biden keeps running deficits, with the current year deficit likely to exceed $2 trillion. U.S. taxes need to rise or expenditures need to fall or the relentless parade of bond auctions will sooner or later fail and a worldwide financial crisis follow.

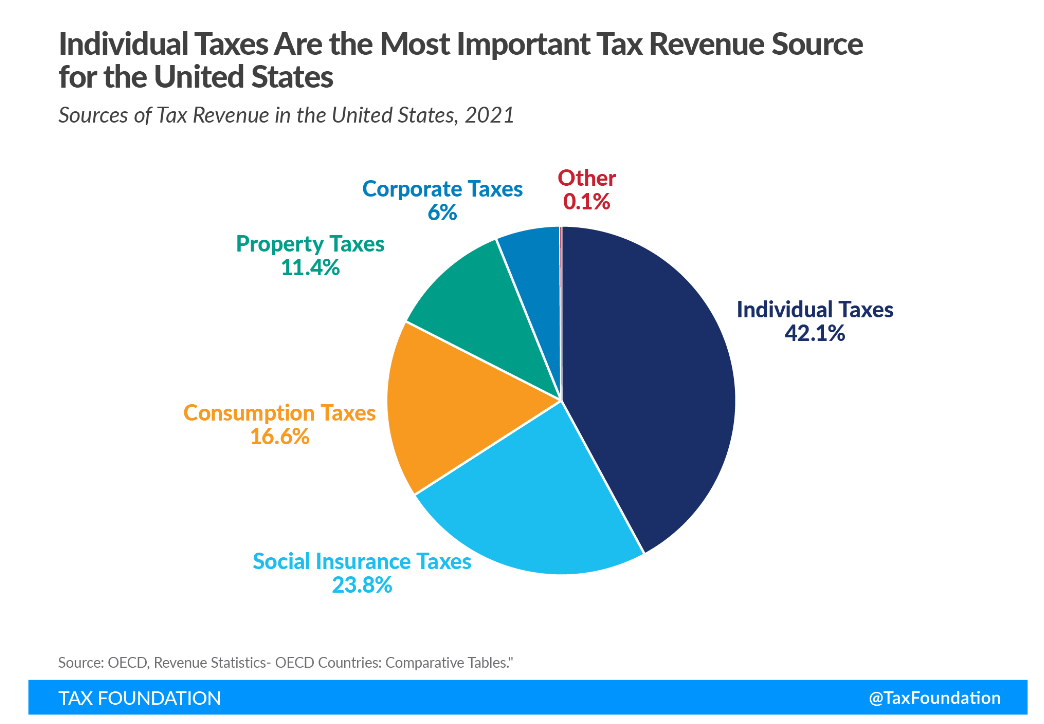

Where does the U.S. get is revenue? Largely from personal taxes. I look at taxes at all levels of government to avoid mistakes in analysis of how much tax society can tolerate.

Corporate taxes comprise 6% of taxes collected but in reality are a tax on the poorest members of society since corporations don’t pay taxes, they collect them and pass them on in price. To stay in business, they must, since competition keeps prices in check.

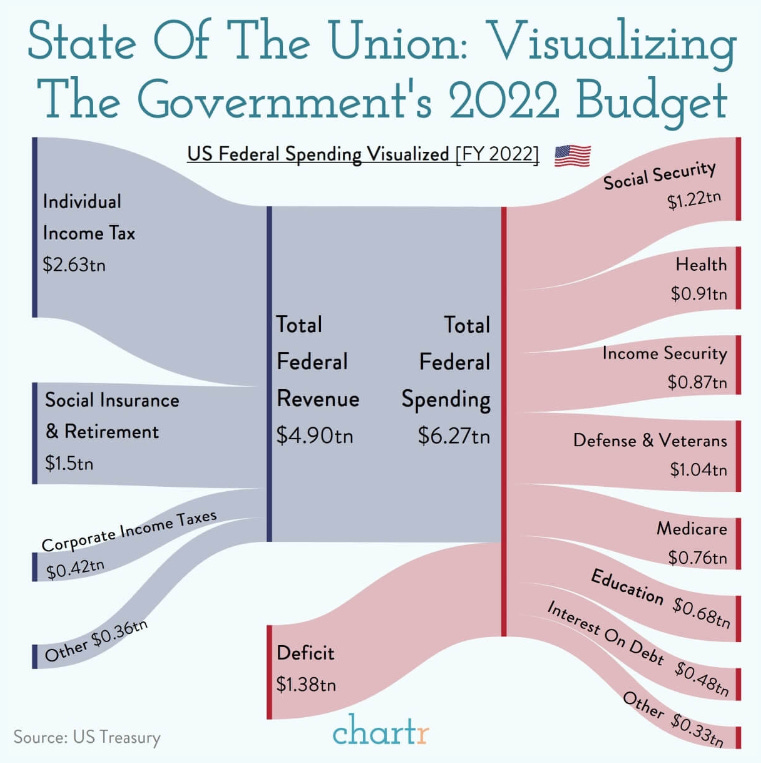

The 2022 U.S. federal budget didn’t seem alarming at the time. A deficit of $1.4 trillion was manageable with interest rates relatively low, and interest on debt was less than $500 billion. Total revenue of $4.9 trillion amounted to ~20% of the $25 trillion GDP, which is on the high side but not excruciatingly so.

Rates are higher now by a few hundred basis points, total debt is now $34 trillion, and since the duration of the debt is less than five years, higher rates are sure to eat up a lot more than $480 billion in interest costs in the next few years. Expect interest on the national debt to total over $2 trillion in a year or two. So-called “entitlements” are the major expenditures and are politically sacrosanct. So how does the U.S. avoid the rubber hitting the road and the economy collapsing?

Make no mistake - higher revenues are the only solution other than massive changes to “entitlements” and the trillion dollar defense outlays. American are already having trouble making ends meet so higher taxes will not be popular and will hasten the end of the Biden years, make Bidenomics into late night TV comedy, and see a sea of red swamp the Blue states.

But unlike Europe or Canada, the U.S. has no “value added” tax like HST. Elimination of corporate taxes in their entirety would tend to promote more economic activity, deregulation of the energy industry and abandonment of the “climate change” charade could fuel a major expansion of oil & gas output with higher royalties adding to state and federal coffers, and an 8% value added tax would contribute about $2.1 trillion to revenue, offset by a refund to the 40% of Americans with incomes below a $100,000 annual threshold which would probably cost about $350 billion.

The revised fiscal picture would have revenue of $5.8 trillion:

$2.6 trillion Personal income taxes

$1.7 trillion 8% value added tax

$1.5 trillion social insurance and retirement contributions

$0.0 corporate taxes

$5.8 trillion

On the expense side, elimination of the Department of Education saves amost $700 billion. This department contributes nothing but “woke” ideology and is unnecessary.

Increasing the retirement age by one year would reduce “entitlements” by at least $100 billion in my estimation.

Cutting the bloated national defense budget by $100 billion seems long overdue.

Total expenses would fall to $4.8 trillion excluding interest on the national debt which I expect to rise to $2 trillion and eat up the benefit but reduce the ongoing deficit to about $1 trillion which is manageable if the absence of corporate taxes and deregulation of oil & gas results in economic growth and the growth should result in higher revenues. Greater domestic energy supply and lower corporate taxes will manifest themselves in lower inflation and interest rates will stabilize or even fall as inflation abates.

The added revenue from economic expansion should reduce or even eliminate the projected deficit almost immediately. Within a year or two, Americans would once again enjoy a balanced budget, be on a path to energy independence, and be rid of the expensive but otherwise useless “progressive” policies that choke the economy. To get there, all they need to do is dump Joe Biden and the toxic Democrats, reduce the bureaucracy strangling enterprise, and take a holiday from the spiteful divisive policies the left has inflicted on the country.

A good analysis but to execute would require an informed voter who would give the mandate .

For example to cut corporate taxes to grow the economy would require economic literacy . It ain’t there .

Thomas Sowell says there aren’t solutions only trade offs . Weak inept political leaders have avoided hard choices for decades . Israel/Palestine is an example of that . It can’t be solved . There has to be a winner and a loser .

Same with social security. Harper added a couple of years . Then Trudeau cut it back to 65 . Harper added audits to First Nations social programs then Trudeau eliminated them . Voters elected Trudeau 3 times .

We need a competent media to create an informed voter

PP is riding high in the polls because heretofore economically illiterate millennials are hurting and they think he can fix their kitchen table economics . He can . But it will take a decade . Are they patient ?