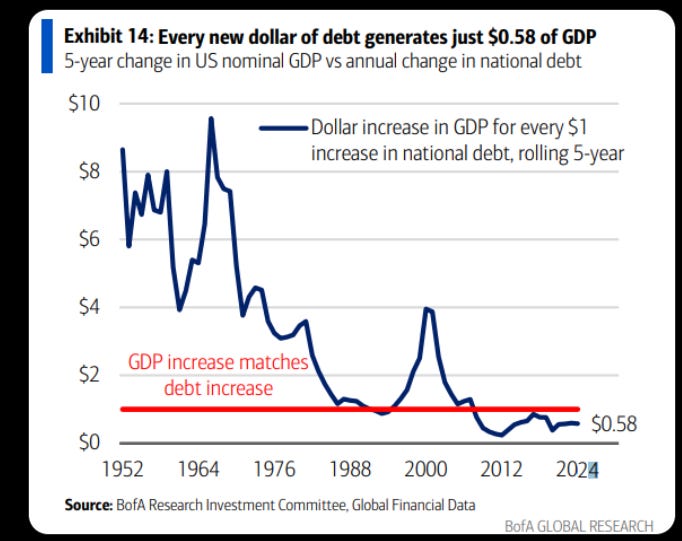

Canada’s sovereign debt has reached $1.2 trillion and the Liberal budget anticipates a deficit of about $40 billion this year. Deficits are often considered stimulative by economists, but they become a drag on growth in Gross Domestic Product (GDP) after a certain point. This chart from Bank of America on the U.S. situation shows that United States has reached that point.

U.S. national debt is a staggering 125% of U.S. GDP today but has been greater than GDP since 1988, and despite some year to year volatility owing to other macroeconomic factors, higher U.S. debt in relation to GDP will tend to curb rather than stimulate GDP growth.

Canada’s debt to GDP ratio was never a problem until Trudeau came to office in 2015. Since that time, our national debt has risen dramatically and now stands at about 70% of GDP. Deficits in the $40 billion range will see that ratio keep rising by about 2% per year barring a recession. In a recession, deficits will balloon while GDP will fall and the ratio will blow up quite quickly.

Are we heading towards a recession? In my opinion, that is likely. Canada is closely tied to the U.S. economy and unless that country’s economy keeps growing, Canada’s will roll over. Canada’s ability to avoid recession during the current period of higher interest rates to curb inflation is largely the result of higher profits in the energy industry, without which tax revenues would have fallen and deficits ballooned.

Economist David Rosenberg sees a recession as likely. Canada’s economic problem remains unaffordable housing and “theatre” policy announcement from Ottawa are unlikely to ease that problem. Crippled by high rents and high mortgage payments, Canadian households are struggling to make ends meet and Ottawa’s response is to keep pretending it is more important to “fight climate change” by raising the carbon tax than to deal with actual problems Canadians face.

Trudeau’s plans are to “tax the rich” to reduce deficits. The “rich” already pay most of the taxes levied in Canada and that well has run dry for a long time. The bottom 40% of Canadian income earners already get a virtual free ride in tax terms, and they don’t need more government support - they need a better economy with opportunities to earn higher income.

The way for Canada to “right the ship” is as plain as day. Build our energy industry, eliminate the carbon tax, and cut the size of the bureaucracy in Ottawa.

Trudeau has added over 100,000 civil servants to an already bloated government, at an annual cost of about $10 billion which adds to the deficit and produces nothing. Poilievre promises to “axe the tax” repealing carbon tax legislation and cut the size of government. These are important steps.

But the real money is the taxes and royalties from energy industry output. Since 2001 the energy industry has ponied up $755 billion in taxes and royalties and contributes about $26 billion a year today. Canada is host to 165 billion barrels of oil and massive amounts of natural gas, all of which are in demand globally. Our annual production of these key materials under the thumb of Liberal policies has been a bit less than 5 million barrels a day or 1.9 billion barrels a year. Increase that through construction of pipelines and deep water ports and at 5 billion barrels a year revenues to government at current tax and royalty rates would swell to about $70 billion a year, the Canadian dollar would like rise relative to the U.S. currency putting downward pressure on inflation, and Canadian deficits would soon disappear.

Killing the carbon tax, cutting the size of the civil service, building pipelines and enouraging growth of the energy industry are key policies embraced by Pierre Poilievre. He is on the right track and his election will mark the turning point in Canada’s economic outlook.