Short term trading my be exciting but it won't make you rich

Buy well and hold accumulates wealth. Compare Athabasca Energy and Peyto.

I see many sour faces on Twitter (now X) since energy investments lagged market indices, and plenty of comments providing accolades for those holding shares in Athabasca Oil ($ATH) or Canadian Natural Resources ($CNQ) whose shares bucked the trend.

Athabasca shareholders gloat about the exhilirating rise in the share price over the past five years.

A longer-term picture shows Athabasca shareholders have seen a different outcome. Those who acquired their shares in 2010 have seen the trading value of their shares fall almost 70% and have yet to receive a dividend.

Athabasca does not pay a dividend and prefers to buy back stock. But Athabasca shareholders as a group have seen a significant loss in trading value and only those wise enough to sell into a buyback or to another shareholders actually realized a benefit and any gains by one were offset by losses to another.

Canadian Natural Resources (CNQ) shareholders have enjoyed solid returns for the past five years, but lagged ATHs over that period.

But CNQ shareholders not only enjoyed rising share prices but also meaningful dividends, and can smile about returns approaching 6,000 percent in 25 years and have received literally billions in dividends over that period.

Stock markets are an efficient mechanism for transferring wealth to the patient from the impatient, to paraphrase Warren Buffett or the late Charlie Munger. A short term focus leads to disappointment much of the time.

I like the outlook for Peyto Exploration and Development ($PEY). This well-run company is a low cost producer with a high return on capital employed and historically has paid out its net income as dividends, or at least most of it. Here’a five year look backwards. The 5-year term is arbitrary and the rise in stock price lags that of Athabasca but excludes the dividends Peyto pays - currently $1.32 per share per year.

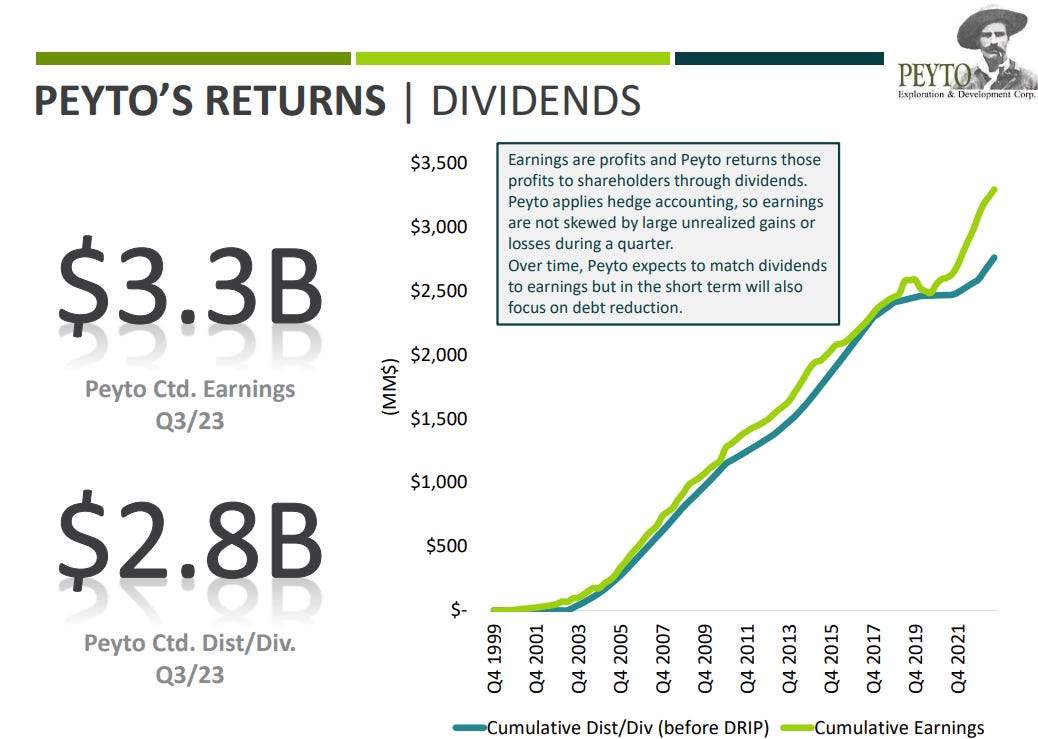

Shareholders who purchased Peyto shares in its initial listing have enjoyed returns of over 10,000 percent in the company’s 25-year history as a public entity.

There are two approaches to investing for those who wish to accumulate wealth. You can trade shares of companies like Athabasca and claim membership in the subset of owners of those shares who have seen the value of their shares rise and brag about the “gain” at cocktail parties but ignore that you have to sell to advantage to actually get any money from your investment. Or you can buy a well-run company and hold your shares for decades receiving more or less regular dividends and ignoring the trading price of the shares as irrelevant to anything but banter at cocktail parties.

Since going public Peyto has paid its shareholders CDN$2.8 billion in dividends. Athabasca has paid its shareholders nothing (except former shareholders from whom the company repurchased shares).

If you are serious about accumulating wealth, buy shares in companies like Canadian Natural Resources and Peyto and avoid shares in those like Athabasca. Sure, you will give up bragging rights at cocktail parties but you can actually spend your dividends on things that interest you. I buy art, fine cars and real estate and I prefer to own stocks rather than trade them.

I agree with the premise and logic of your article. I wonder if Athabasca is the right benchmark measure though because as I recall it IPO'd at an inflated value in 2010 right before the peak of the oil/commodity bull market.

I would say ATH might even be a good long term buy now, no debt and billions in tax credits. They seem to have their oil sands doing well too. The price of oil and a 2 year delay on TMP might impact them BUT they can't control that. PEY with low NGas price is not great. Likely better that CR or BIR, but still.. they all do great with $90 oil and $4 ngas