Saturn Oil is rapidly fixing its balance sheet

Saturn shares appear deeply undervalued, at least to me

Saturn Oil (SOIL.TO) bought Ridgeback Resources using a high interest loan from a “family office” - think of that as a private equity investment since the family office, known as GMT Capital, is also a major Saturn shareholder holding over 43 million Saturn shares of the total issued and outstanding of about 161 million shares.

The Ridgeback acquisition brought significant production of light oil with netbacks as high as $80 per barrel. Saturn followed the acquisition with a $50 million bought deal equity issue and the sale of some non-core assets for $27 million. These actions together with high free cash flow from operations have taken a large bit out of the initial debt position. As at December 31, 2023, Saturn debt level was about $450 million and I estimate as at May 31, 2024 debt will have fallen to somewhere in the $313 million range with the equity issue and asset sale augmented by approximately $50 million of free cash flow from operations. By year end 2024, debt should be in the range of $240 million and by January 2026 the company should be debt free.

Here are my estimates (admittedly pretty rough).

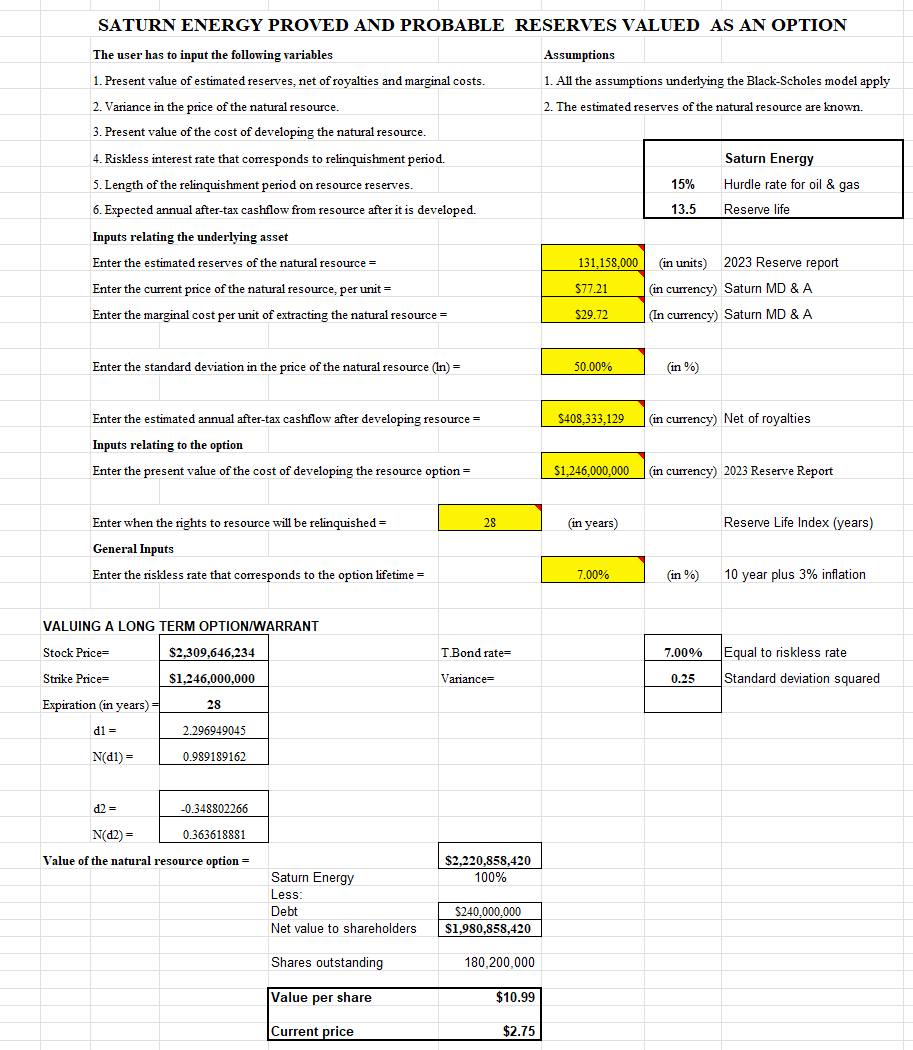

Readers can create their own models. Mine is one thing I consider when buying Saturn shares for my energy portfolio. I cross check my simple model with a more formal Black Scholes valuation of Saturn’s reserves as an option on future oil prices, and that valuation confirms a value somewhere around $10 a share.

When my analysis suggest a stock is worth close to $10 a share and I see it trading at less than $3.00 a share, I buy aggressively. In Saturn’s case I hold 75,000 shares.