Rubellite's growth is ignored in the market

But it will eventually be recognized

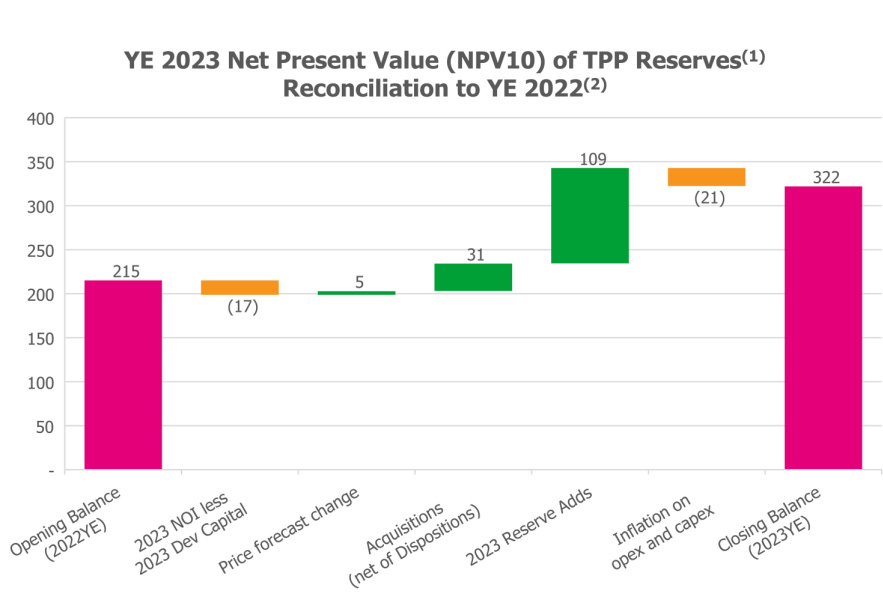

Rubellite Energy (RBY.TO) has only been in existence since the summer of 2021, but in the short three years of its existence the company’s production of heavy oil has grown from 350 barrels a day to over 4,000 barrels a day. Production growth is great but the real value the company is adding is not production but the value of its reserves. In 2023, the company added over $100 million of reserves as valued by its independent reserve valuator and published in its NI 53-101 annual reserve report

Rubellite at CDN$2.80 a share has a market capitalization of about CDN$175 million, and the addition of reserves worth $100 million comprises a return of almost 50%. With a robust balance sheet and an active drilling program, it seems likely the company will keep growing at a brisk pace.

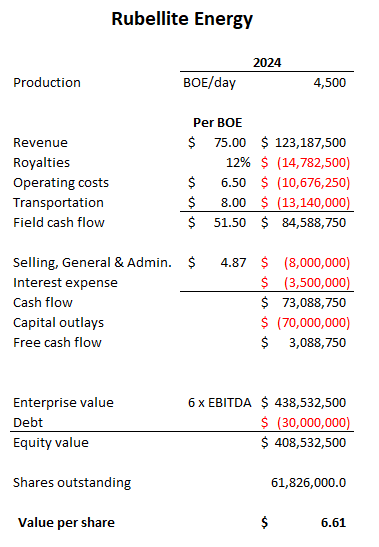

In December 2023, the company announced it had raised $8 million by selling a gross overriding royalty on certain properties (the buyer was Source Rock Royalties, a tiny streaming company which is itself an undervalued company) and will use these funds in addition to cash flows from operations to fund its 2024 capital program set at CDN$70 - $75 million and expected to bring average 2024 production to the 4,600 to 4,900 barrel per day range, compared to an average output of 3,300 barrels a day. This rapid growth should take place without adding debt.

I see that growth continuing into 2025 and expect to see output approach 6,000 barrels a day by year end 2025. Heavy oil prices have been firm and the opening of the Transmountain Pipeline expansion May 1 should see the discount on Western Canadian Select (WCS) narrow and produce higher prices for Rubellite. In parallel, the Canadian dollar (suffering from the Trudeau government’s incompetent fiscal management and reckless spending and debt) is falling relative to the U.S. adding to the Canadian oil price relative to its U.S. counterpart.

Using a conservative 4,500 barrels a day for 2024 production and an equally conservative realized price of CDN$75 per barrel, I see Rubellite shares trading north of CDN$6.00 by year end 2024.

One can quibble about the assumptions but there is not much to quibble about the result - at their trading price of ~CDN$2.90, Rubellite shares are undervalued. I hold 90,000 shares and expect to add to that position on any sell-off.

Mr. Blair, I can appreciate Rubellite´s growth, but can you do a comparison to Lucero Energy please. It has less debt, more cash, better margins (lower EV/EBITDA), yet it´s trading at the same price to book and cash flow ratios as RBY.