Rubellite versus Headwater

Timing is everything, or almost everything

In Q1 of 2021, only three years ago last March, Headwater Exploration (HWX.TO) reported production of 4,805 boe/day and quarterly cash flow of $14.5 million. At that time, Headwater shares traded at $4.49 a share and there were 196 million shares of the company outstanding, while the company had positive working capital of $80 million. Headwater was growing quickly, profitable, debt free and investors loved the story. The result was an Enterprise Value of ~$800 million.

Headwater was and is a great investment. The company’s Q1 2021 guidance added to the appeal back then calling for average annual production of 6,500 to 7,000 boe/day and year end output in the 8,000 boe/day range with capital expenditures of $90 million and an expected year end positive working capital balance of $80 million. There was not much not to like.

Rubellite barely existed in early 2021, only becoming a traded company after a spin-off from Perpetual Energy a few months later in 2021.

What about Rubellite today?

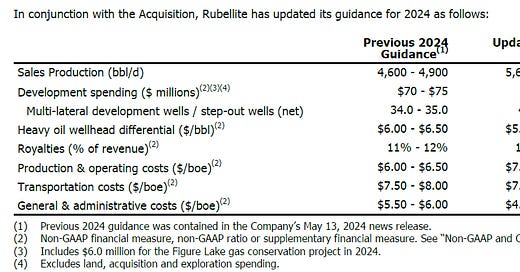

Today, in its Q2 2024 report, Rubellite reported production of 4,500 boe/day (remarkably similar to the Q1 2021 Headwater report) and, giving affect to an acquisition agreed after the end of the quarter, gave guidance that it will end 2024 with production of almost 8,000 boe/day (once again, remarkably similar to the Headwater guidance given after Q1 2021).

Of course, Rubellite had $30 million of debt at June 30, 2024 and took on another $86 million debt to fund the acquisition, but has only some 68 million shares outstanding including 5 million used as part of the funding for the acquisition. Trading at $2.68 a share today, Rubellite has an Enterprise Value of a bit more than $300 million.

Give that a moment’s thought. Both Headwater and Rubellite are players in the Clearwater play where their future really lies but at the same point in its history in terms of production and expected growth, Headwater had an Enterprise Value of $800 million and Rubellite has an Enterprise Value of $300 million.

One of these things is not like the other, as they say in kindergarten.

It seems clear to me that Rubellite is deeply undervalued. I think Headwater remains undervalued as well. But for my money, the outlook for outsized returns in Rubellite shares is materially brighter than for Headwater shares, so I am out of Headwater (at a nice profit, I add) and hold 80,000 Rubellite.

I am an old man and an old fashioned investor, who still believes that buying value is the only way to accumulate wealth, that trading is a mug’s game, and that a switch between two companies whose future is tied to the same oil & gas play with similar economics makes sense when one of them is valued at half the value of the other adjusting for size and stage of development. Of course, Headwater kept growing profitably as expected, has a market capitalization of $1.6 billion today, and in my opinion will continue to grow profitably unless heavy oil prices tank (always a risk), but for me at least, Rubellite makes more sense for a long term gain.

Michael I live in the UK. I read almost all your stock write ups. I really appreciate them and enjoy them. Please keep them coming, they are fantastic and educational. They also help to fatten the wallet.