Rubellite is emerging stronger

Growth potential now proven, economics still uncertain

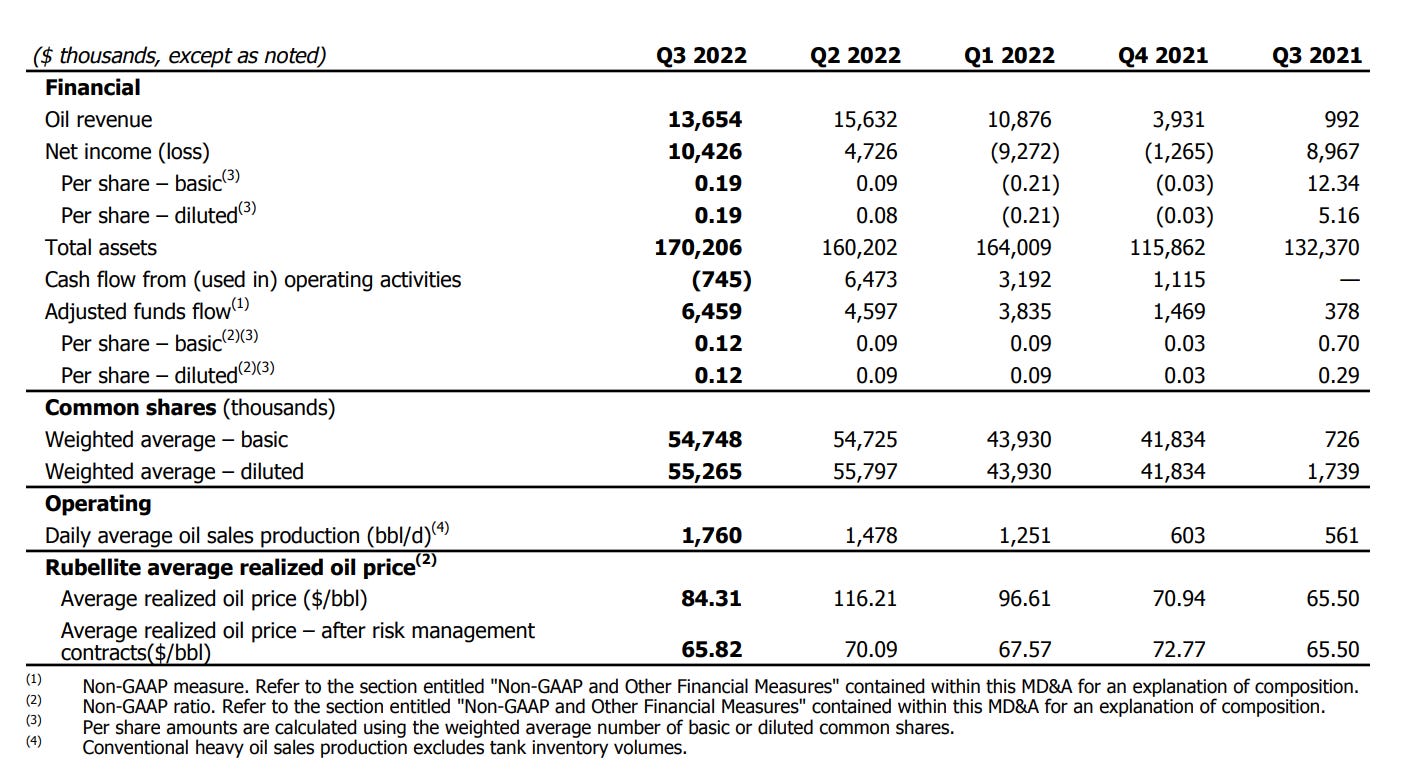

Rubellite Energy (RBY.TO) disclosed year end production numbers that impress. Q4 2022 production averaged over 2,000 barrels of oil a day (boe/day) and year end production rate was 2,700 boe/day. While Rubellite is exclusively operating in the prolific Clearwater play, the company has yet to demonstrate the highly profitable economics associated with others in Clearwater like Headwater (HWX.TO), Tamarack Valley (TVE.TO) or Baytex (BTE.TO). It is not that Rubellite has had poor economics, it has just not have enough time to build a convincing track record of high netbacks, and its performance in Q3 2022 was confounded by hedging. Nonetheless, for what is really a start up company, early results are encouraging.

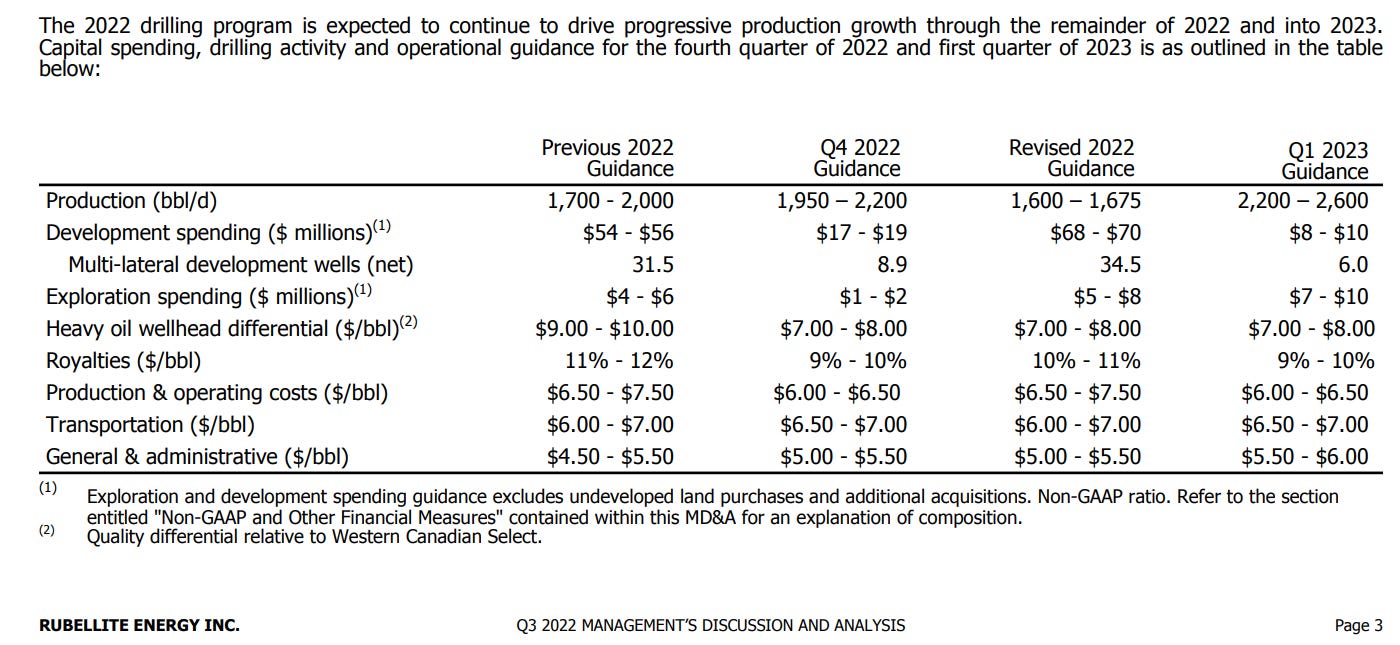

The company seesm to be on track to meet its Q4 2022 and Q1 2023 guidance released with the Q3 2022 results. I like to see reports that demonstrate that guidance was reasonable.

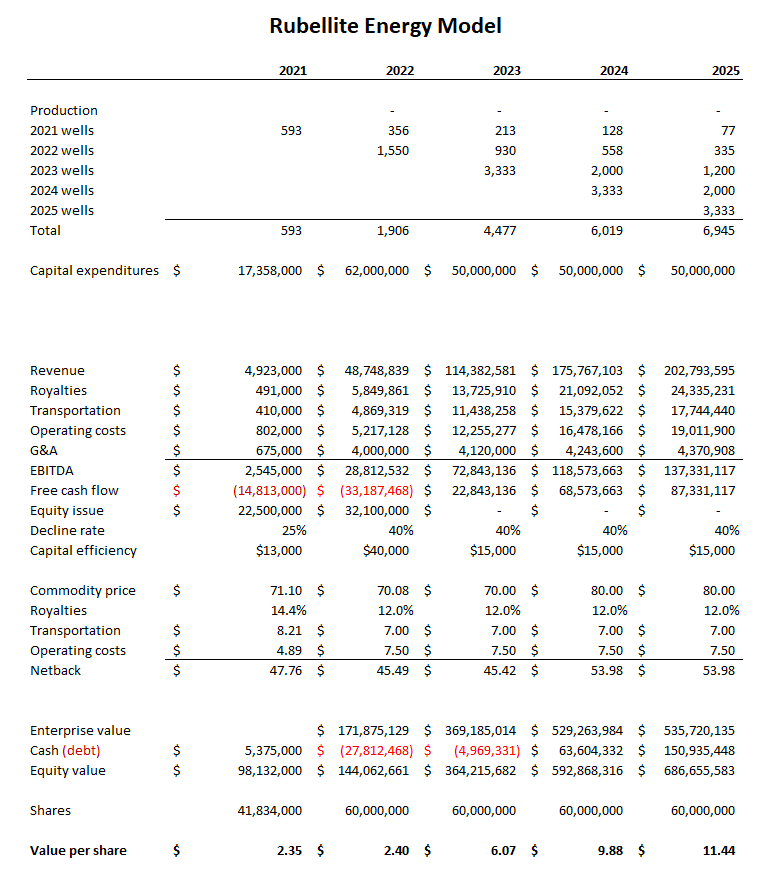

I model Rubellite’s growth based on assumptions of CAD$15,000 capital efficiency, a 40% decline rate, and oil prices of CAD$70 in 2023 and CAD$80 in 2024 and 2025. Based on that model, I value RBY.TO shares at CAD$6.00 in 2023 and CAD$10.00 in 2024 if commodity prices remain firm. Lots of assumptions and no shortage of risk, I admit, but I like the risk on this one.

If these estimates are anywhere in the ballpark, Rubellite can grow rapidly from internally generated cash flows (as Headwater has done in Clearwater) and build a cash balance while more than tripling production from 2022 levels by year end 2025.

In my opinion, subject to all the caveats inherent in assumptions that are little more than guesses and the risks to oil prices posed by an expected recession, I consider the shares undervalued and hold 50,000 shares at an average cost of just over CAD$2.00 per share. Risking a loss of CAD$100,000 for a reasonable shot at a gain of CAD$450,000 is a bet I am willing to make. If Rubellite does demonstrate the same kind of growth we see in other Clearwater operators, I am likely in the shares for the long run.

Capex flat for three straight years yet production increasing by 15%? Sounds like Tesla assumptions and accounting shenanigans there

No dividend OR buybacks? Why would anyone invest in such a company?!