Rubellite Energy is a steal below $3.00 a share

A pure play on Clearwater worth owning

Rubellite was recently spun out of Perpetual Energy at $2.00 a share. Debt free with enough cash from its concurrent financing, Rubellite has enough firepower to drill a dozen or more new wells in the profitable Clearwater play that has created so much excitement for Headwater (HWX.TO) and even for much larger Baytex (BTE.TO). With only 46 million shares outstanding the company has a market capitalization of about $100 million.

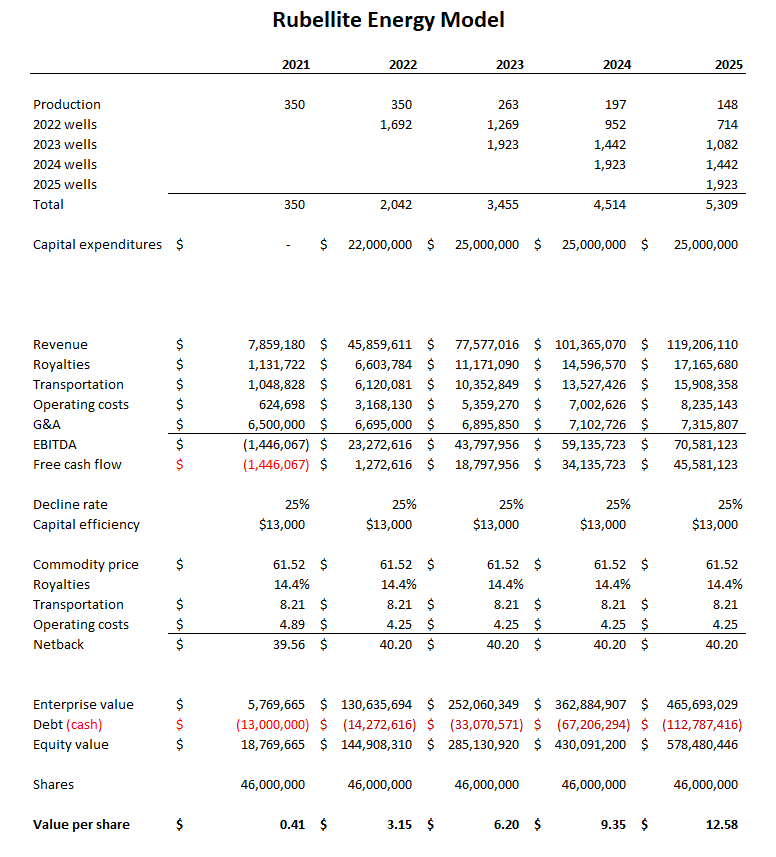

Wells in the Clearwater formation cost less than $1.5 million to drill and complete and typically produce 250 to 500 Boe/day with a netback north of $40 per barrel at today’s prices. Rubellite says it currently produces only a few hundred barrels a day but expects to break 2,000 barrels a day in 2022. At that rate operating cash flow at a $40 per barrel netback is ~$23 million. That puts an EV/EBITDA multiple on 2022 results somewhere around 5 times allowing for corporate costs which is high compared to many producers. So why is it a steal?

Two reasons. First it is debt free and with $23 million cash flow from operations next year can fund another ~20 wells adding about 1,500 barrels of oil a day if those wells come in at rates similar to other Clearwater wells and the original wells have a decline rate in the 25% range. By 2025 I foresee production of about 5,000 barrels a day and cash flow around $70 million. A couple more years of rapid growth and Rubellite turns into a good sized junior.

Making a few wild ass guesses as to costs (by taking reported data from Headwater and assuming Rubellite will experience similar outcomes) I have built a model of the company’s growth, shown below.

If I am any where close RBY.TO shares could trade in the $12 range in 3 years, or almost 5 times the current price of $2.60 a share. Sure, there is plenty of risk and commodity prices can fall as well as rise, but I like the company’s debt free profile and potential growth so I bought 30,000 shares. We will see how that works out.

I hate I didn't find your substack in 2020 or 2021?