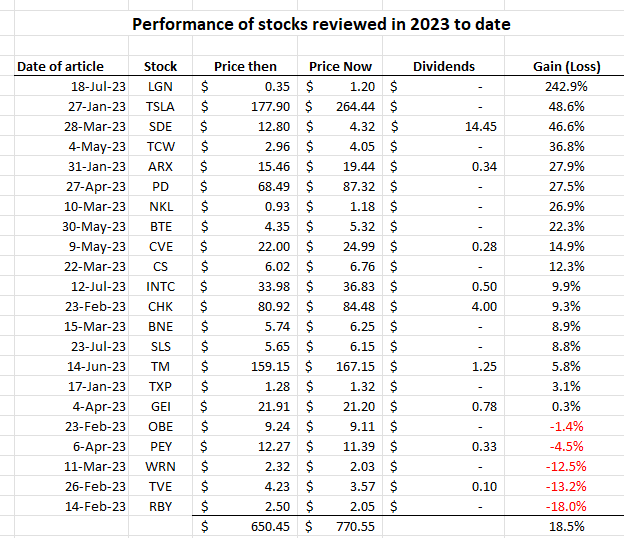

Review of stocks reviewed to date in 2023

Average return of 18.5% about matches market indices

I have written articles on 22 stocks so far this year and this chart sets out the price change since the articles were published. The average return of 18.5% compares to the S&P 500 year to date return of 18.96%. So much for my “stock picking”.

Logan Energy (LGN.TO) showed the best returns based on the spin off price of $0.35, although the spin off also included a warrant to buy an additonal share at $0.35 which, if included, would have add $0.85 to the return for those who exercised the warrants and sold the stock. That is omitted for simplicity.

The worst outcomes were Tamarack Valley (TVE.TO) which is digesting a major acquisition and remains a good investment in my opinion, providing heavy oil prices remain as firm as they are today. Rubellite (RBY.TO) is exposed to the same pricing and is an early stage, fast growing operator in the prolific Clearwater play where Tamarack is concentrated, so these shares are likely to rise or fall with the price of Western Canadian Select (WCS) oil in parallel with Tamarack.

I remain positive on the entire list. A few have yet to report Q2 2023 results and those inputs may change sentiment for some. Chesapeake (CHK) reports August 1, 2023; Capstone (CS), Obsidian (OBE) and ARC Resources (ARX) report on August 2nd; Bonterra (BNE), Peyto (PEY) and Rubellite (RBY) report August 9th; and Touchstone (TXP) reports August 17th. I anticipate no surprises although the Touchstone report might shed some light on their exploration successes and timing of commercial production of their major natural gas discoveries.

I live in UK and own a small no. of Spartan Delta.

My broker gave me one working day + weekend, to exercise the Logan warrants (through their custodian). I.E. I lost the ability to exercise them a week before the stated expiry 31July. Makes you think?

I wonder if there is anyone else from the UK reading this, as I feel I'm being fleeced on brokerage charges - particularly currency commission at 1.5%. (I'm with an execution only broker - Interactive Investor - who used to be TD Waterhouse in the UK).