Reckless spending threatens democracy

Biden doesn't care, he wants to make U.S. a socialist autocracy

I listened to Nobel laureate Paul Krugman on Wall Street Week this morning. Krugman argues the growing American debt pile is no threat to the country’s economy or world economic stability, saying the historic record is replete with examples of countries whose debt grew even larger than U.S. debt expressed as a percentage of GDP, and in that he is correct. Krugman says he is terrified at the prospect of a U.S. debt default but unconcerned about credit rating downgrades of U.S. treasuries. At least he admits a debt default would be a problem. His comments on lessons from history are accurate but incomplete.

History also teaches us that GDP can fall as well as rise but debt will only fall or become less burdensome if GDP keeps growing faster than debt keeps rising. In the four years from 1930 to 1933 American GDP fell a cumulative 29%. In that era, it was austerity, not spending, that exacerbated the collapse of world economies. Many world economies have experienced serious economic consequences of too much debt including Venezuela, Mexico, Argentina, Zimbabwe, Turkey and (of course) the legendary collapse of the Weimar Republic. Krugman’s argument that the economic theories that apply to the U.S. are different than the economic theories that applied to those countries whose economies collapsed under the weight of too much debt is more an argument for repeal of his Nobel prize than an argument that debt is not a threat to the United States.

Sure the U.S. economy is enormous and capable of supporting a massive amount of debt and arguably nowhere close to collapse today despite the squabbling in Congress over the debt ceiling. That is no reason to ignore the reality that there is a limit, and the pace of debt-fueled spending under the Democrats will accelerate the race towards that limit if left unchecked.

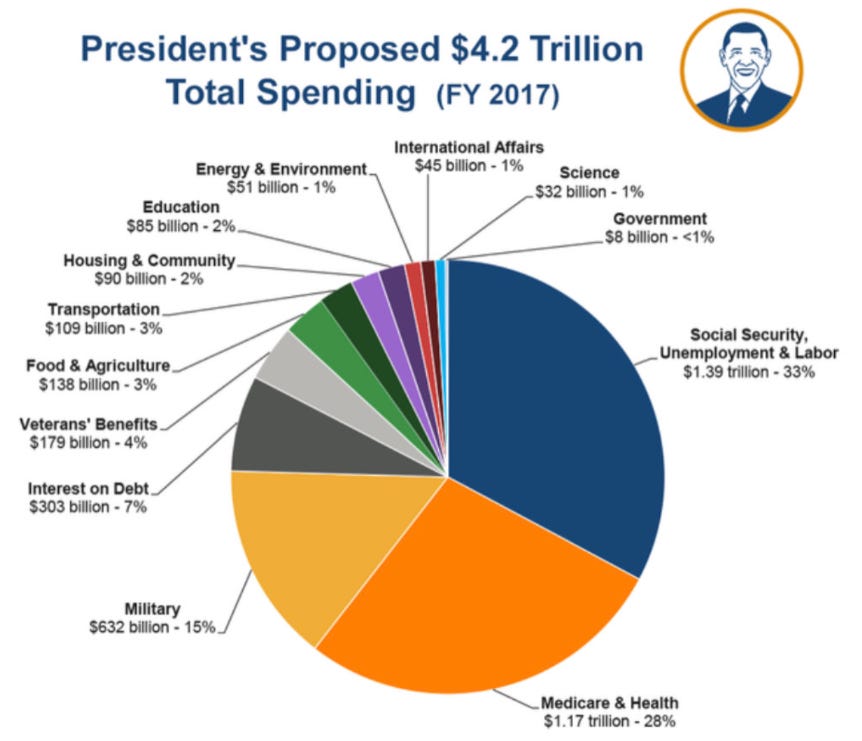

In 2017, the Obama administration budget totaled $4.2 trillion in proposed spending. Entitlements (social security and medicare) comprised $2.6 trillion of that amount and military spending added $632 billion. So-called “discretionary spending” was set at about $1 trillion including $303 billion of interest on the national debt and $179 billion on benefits for veterans of America’s many wars. Actual programs aimed at improving the American economy, improving transportation infrastructure or supporting education amounted to less than 10% of the budget. It is that 10% that Democrats tout as the reasons why voters should keep electing Democratic candidates to Congress or as President. In reality, those outlays are so small they are incapable of making any material difference to U.S. economic performance or bridging the alleged “wealth gap” or “income inequality”. In a nutshell, the campaign promises are hollow and it is no surprise that few of them are enacted post-elections.

Republicans also talk a good line but don’t do any better. Under Trump the U.S. budget was just as large as Obama’s and national debt increased by 25% (Democrats say 40% but like many political claims, that was exaggerated). Under Biden spending just kept growing. If you want to know by how much, don’t ask the White House. Biden’s budget “Fact Sheet” is full of rhetoric but devoid of the amount Biden proposes to spend. You have to dig deeper to find that Biden’s proposed spending totals $5.8 trillion and involves a deficit of about $1 trillion but only if Biden can successfully increase taxes on billionaires to the tune of about $1.2 trillion. Taxes on billionaires may increase tax revenue from that source somewhat, but billionaires have resources and may apply those resources to tax avoidance rather than capital expenditures and job creation. If Biden doubles the tax rate payable by billionaires as proposed, tens of millions of jobs may be lost as corporate payrolls are cut to fund the tax and each million jobs lost will cost the treasury about $40 billion in taxes otherwise payable by those who lose their jobs and the loss of 10 million jobs (about 6% of the 160 million U.S. workforce) would cut the promised benefit by one third directly and likely contribute to an economic contraction. If the best and brightest leave the jurisdiction for less hostile tax regimes, the benefit of a billionaires tax could be “transitory” to use a hackneyed left wing phrase.

A more progressive tax system does make sense nonetheless. The income disparity in America is wide and growing as CEO compensation rages out of control and movie starts and sports heroes coin hundreds of millions in income annually without making any contribution to wealth creation. A gradual and phased-in program to gradually increase tax rates on higher income earners and use the revenue to actually build infrastructure, improve educational outcomes, and attack problems like unattainable housing and homelessness could make the country a better place without throwing the baby out with the bath water. A national value added tax like Canada’s HST (13%) could raise about ~$2.5 trillion based on U.S. GDP of $21 trillion, and the revenue could more or less balance the budget while funding transfers to those with lower incomes. If enacted in tandem with a revised tax code, lower income families can be protected from the higher costs while restoring fiscal prudence in Washington.

On the current path, Democrats will run into the wall of the costs of “entitlements” and Krugman’s confidence the debt is not a problem will evaporate when those “entitlements” consume over 100% of government revenues. That is likely within a decade, earlier if Democrats retain power.