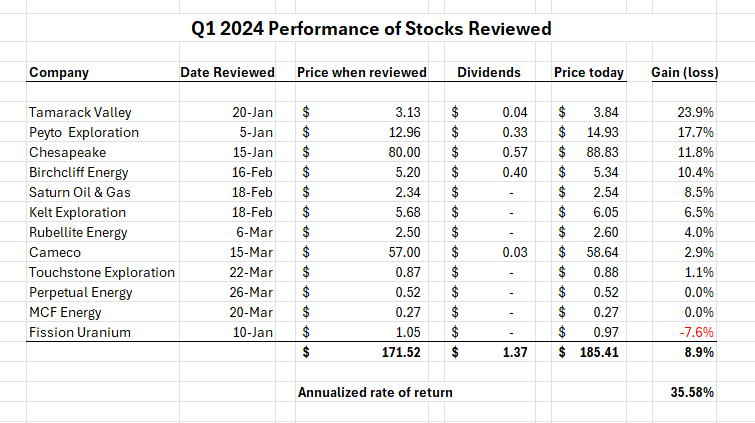

At the end of every quarter, I review the stock market performance of the companies I have written about on SubStack and report those outcomes to readers. Here is the Q1 2024 report

The set of stocks reviewed turned in an annualized rate of return (including dividends where applicable) of over 35%. The best two outcomes were MEG Energy (not on the spreadsheet but up ~32%) and Tamarack Valley. On balance, the rest of the stocks reviewed had good quarters except for Fission Uranium which, in my opinion, remains deeply undevalued.

I have had my share of criticism for my postive views of Peyto Exploration, Birchcliff Energy and Saturn Oil & Gas, but these shares continue to exhibit reasonable returns on my investments in them, made at prices far lower than those at the time of writing the articles reviewed herein.

Perpetual Energy and MCF Energy came onto my radar as investible only late in the quarter and no one should be surprised the share prices have not budged in the handful of trading days since I wrote about them. Both have speculative appeal and we will see how it works out over time.

I don’t hold any shares of Tamarack, Chesapeake, Kelt, Cameco or Touchstone at this point in time but may be a buyer of Chesapeake or Touchstone if they suffer a sell-off since both have interesting futures. I am unlikely to buy into Tamarack Valley or Kelt since I don’t like the emphasis on buybacks or the absence of a meaningful dividend policy in any of them.

Good luck with your investing.

Hi Mr. Blair,

Could you shed some insights on portfolio rebalancing?

Is it wise to take some profits off the table when Brent/WTI are riding high now?

Or is it best to do nothing should the company prospect keeps improving?

Thanks.

MEG?