Profit margin inflation is keeping the market on life support

But it won't last forever and 2024 might be a market comeuppance

This chart on U.K. inflation at wholesale and consumer levels shows that wholesale prices are falling faster than retail prices for most of 2023 - that contributes to corporate profits and to persistent inflation.

Sometimes called “inventory profits” and sometimes called “greedflation”, the tailwind from input prices falling faster thanr retail prices won’t last forever and when it stops, profit growth will be reined in.

Many large companies took advantage of artificially low interest rates - the byproduct of the silly Quantitative Easing (QE) experiment - to pump up balance sheets with low cost debt and hold cash or buy back stock. Now that rates are rising again, another tailwind for stocks has been interest earned on that cash or lower interest payment on the refinanced debt balances. About US$200 billion lower outflows for interest charges since the 2017-2018 peak of about US$350 billion has made corporate managers look good and reap large bonuses although issuing debt at low rates created by government policies is hardly genius or brilliant management - just opportunism.

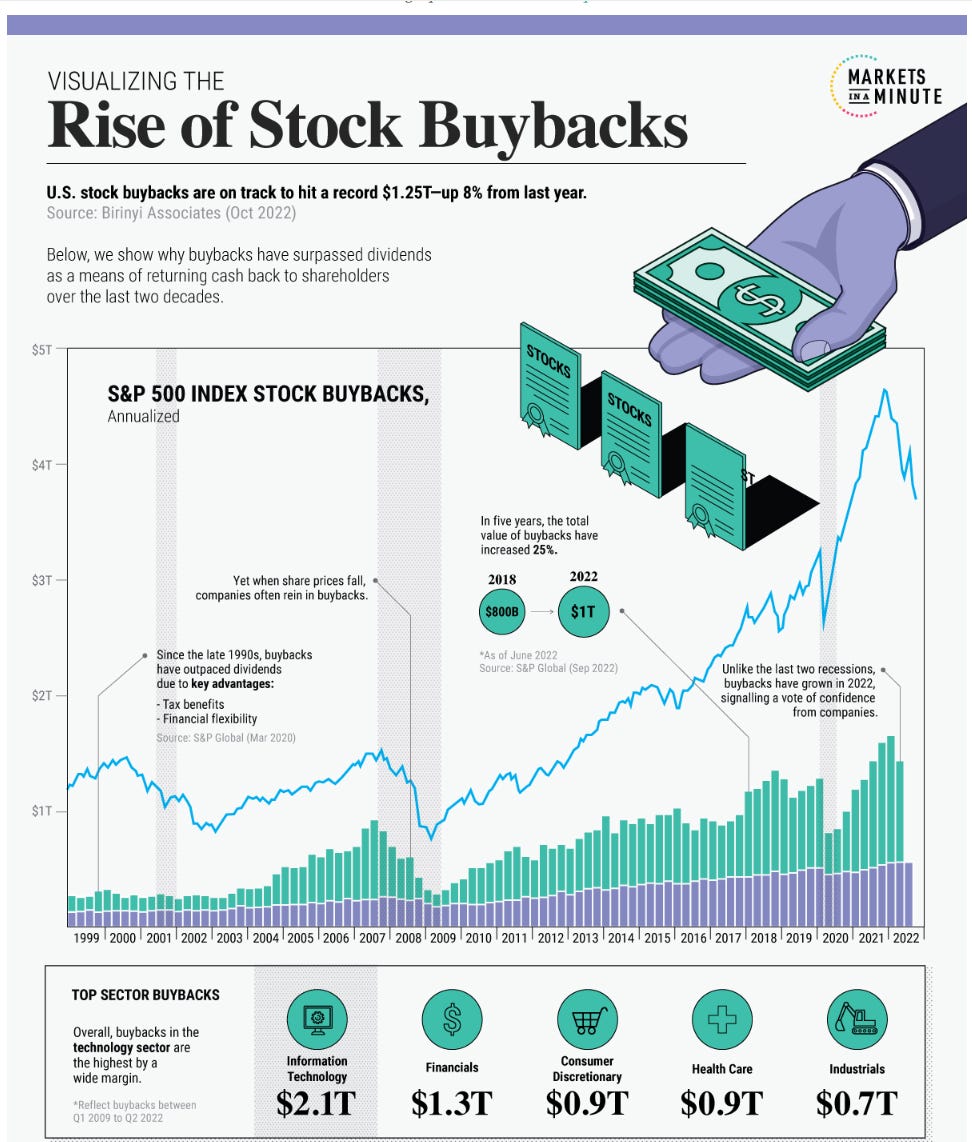

In parallel, corporations bought back record amounts of stock in the past five years, giving investors a one-time boost to reported earnings per share with no improvement in operations. Fund managers loved the buybacks since they combined with low rates and higher multiples to inflate stock prices and generate higher fees for “portfolio management” for the likes of Larry Fink and the whole sell-side industry players who charge a percentage fee for “assets under management” while spending their time on the golf course since no management is needed to reap benefits from corporate treasury manipulations manifested in higher stock prices and higher corporate bonuses.

I am old enough to remember when corporate leaders earned their compensation by investing capital in land, buildings and equipment and employing technology to improve productivity. Why bother with that difficult chore when government policy and treasury actions can pay the freight and you can spend more time working on your handicap?

But like all artificial factors that manifest themselves in higher stock prices, the party ends and reality sets in. The debt has to be repaid or refinanced but now at higher interest rates. The balance sheet has been decapitalized by “buybacks” and new projects that actually involve investment in real assets have to be financed at higher costs of capital. The government policies that led the go-go dance get reversed to curb the collateral damage of inflation, tax rates have to rise to pay the interest on bloated sovereign debt, households struggle to find money to spend on discretionary items as housing costs and credit card fees eat up household budgets and the time comes to pay the piper.

2024 starts next week and investors are wise to invest cautiously since the grim outlook points to lower markets despite the pundits self-interested forecasts of sustained gains based on the latest fad - artificial intelligence, cryptocurrency, or “revenge spending”. Face facts, the risks are to the downside and smart money sits on the sidelines sniping at bargains as the world economy corrects itself.

24 will be very interesting for certain 😢