Precision Drilling may turn the corner

The global energy shortage can only be solved with more drilling

Drilling service companies have been in the doghouse for years owing to the institutional stupidity of “climate” policies that have driven capital out of the oil & gas industry combined with quite dramatic improvements in drilling technology, both of which resulted in many idled rigs.

PD.TO stock traded north of CAD$800 a share in 2008 (adjusted for splits) and bottomed under CAD$10 a share last year. The shares consolidated 20 for 1 in 2020 so old-time shareholders can be confused by the data. Today there are only 13.6 million shares outstanding and the shares trade just over CAD$80 a share.

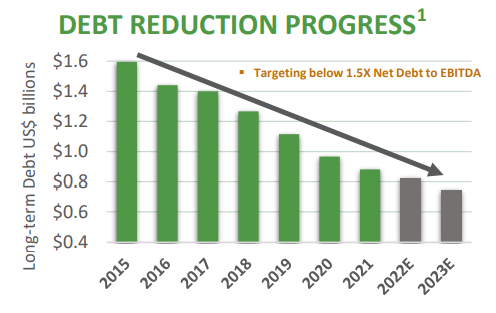

The company was ill-prepared for the downturn in drilling activity and saddled with over CAD$1.5 billion debt but has pared down that debt steadily since 2016.

Precision operates rigs in United States, Canada and internationally and has a strong reputation in the industry. Day rates have been firming and range from CAD$26,000 in Canada to $70,000 for international rigs. Utilization rates remain below 40%. The combination of rising days rates and increasing utilization points to growing cash flow, and the company expects to repay its debt over the next several years. At June 30, 2022 debt (net of cash) was just over CAD$1 billion which is the equivalent of about CAD$75 a share. The company’s plan is to repay CAD$400 million of debt over the next four years which is consistent with their free cash flows net of projected capital expenses of CAD$100 million per year more or less. Every CAD$100 of debt reduction adds about $7.50 to equity value.

I have stayed away from service companies in the oil industry for the best part of the last decade as rig counts fell but rig productivity rose while companies spent less money on drilling. Today, the global energy shortage is reaching critical levels with United Kingdom and European energy prices pushing power costs to record levels and little evidence of any supply response as climate nutters like Biden and Trudeau keep doubling down on their nonsensical climate policies. But, in my opinion, we have reached the point where governments recognize the current situation is unsustainable and more oil & gas will is urgently needed.

The “climate crisis” rhetoric will no be abandoned quickly but we can already see coal making a comeback in Germany; restarts of nuclear facilities being discussed; and, a deepening energy shortage getting worse almost daily. Against this background, I expect to see governments change and policies begin to recognize that the damage being done by a shortage of fossil fuels is far greater than the damage a few more parts per million of CO2 in the atmosphere is capable of doing (not a high bar, since CO2 impact on global temperature is inconsequential whether leaders admit it or don’t). More drilling will result, day rates will rise, and utilization rates will inch ahead.

That is an environment well-suited to Precision Drilling. I have opened a position with 1,000 shares and will add over the next year or two if the environment shows sings of unfolding in line with my expectations. Nothing more elaborate than repaying the current debt over the next decade will see the value of the stock double and that is fine with me. Any increase in utilization and Precision could turn in some pretty good looking numbers. Early days, we will see.