Precision Drilling is on track for recovery

Q1 2023 results show promise

Precision Drilling (PD) has suffered from excess debt for several years. Management seems to have had an epiphany and turned their focus on debt reduction since 2020 with a plan to retire some $500 million of debt over a five year period. With only 14 million shares outstanding, $500 million less debt = $36 per share more equity. Priorities are well laid out in Precision’s corporate presentation and management seems serious about their accomplishment.

Today Precision Drilling shares trade about CAD$70 a share for a market capitalization of ~CAD$1 billion with annual cash flows of CAD$300 to CAD$400 million. By most measures, that makes the shares “cheap” although many investors remain skittish about the billion dollar debt pile and have scar tissue from the last collapse in world oil & gas prices and its flow through effect on contract drilling demand which tanked.

Today, oil is struggling to hold US$75 to US$80 a barrel and natural gas prices at Henry Hub have fallen to the US$2 range, putting a crimp in capital budgets for many producers. Low commodity prices and better drill rig efficiencies created a perfect storm for contract drillers short term prospects. So why am I bullish on PD?

The answer is speculative appeal. World oil & gas production is insufficient to meet expected demand and short term investors panic over recession fears (a recession is likely) which typically pummels commodity prices creating the buying opportunity in my view. Recessions don’t last forever and the lack of capital into drilling in the short term compels higher commodity prices farther out and more drilling as the shortage of oil & gas becomes extreme. I expect Precision to benefit from the industry malaise with its high technology drilling fleet operating in U.S.A., Canada and abroad and some signs that drilling isn’t about to fall off a cliff any time soon. High risk for sure. High rewards seem possible as well.

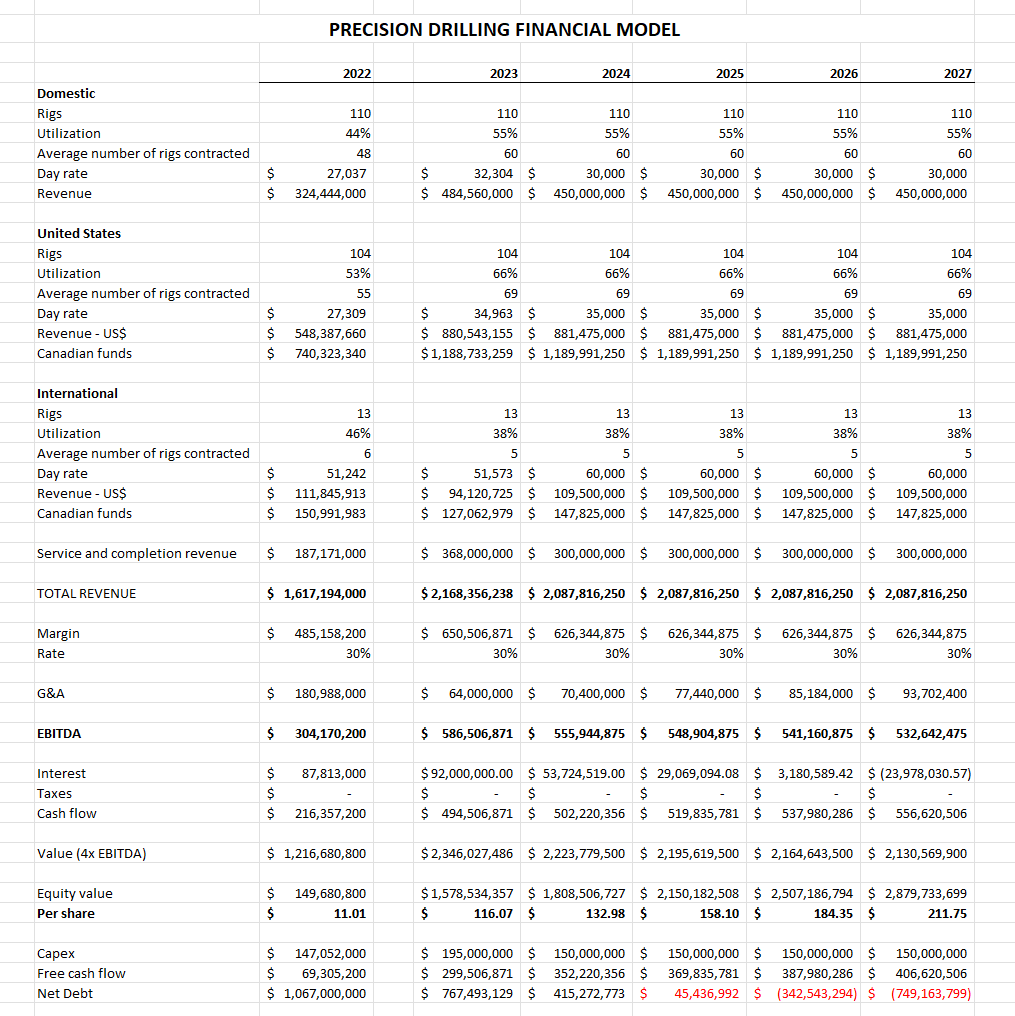

I have a crude model of Precision Drilling (too many moving parts for a detailed model to have value) and based on what I see the company’s shares are more likely to rise than fall in trading prices as excess cash flow retires debt over several years. Here is my model.

I assume flat rig usage, flat margins, and a conventional valuation multiple of EBITDA of 4X. Q1 2023 results came in in line with that model and suggest a trading value of CAD$115 a share is within reason. Many sell-side analysts post higher “target prices” whatever a target price means. For my money (the only money that counts for me) I expect PD shares to trade higher reaching somewhere around CAD$200 a share as the company’s debt disappears and it starts to report cash balances. While below my typical returns on high risk investments, a three year triple is plenty for me so I hold a couple of thousand shares through long dated options. If I am wrong (and I am frequently wrong) my losses will be nominal as the options expire worthless, but if I am right (and I am right now and then) I will enjoy very high returns.

I agree with the author. PD looks 70% undervalued. The debt-to-equity ratio of about 87% is definitely an eyesore but if the company can grow as analyst's predict at 50% a year, this could get paid down/paid off quickly. I see PD as a possible 3 bagger in 3-4 years.

Great article Michael, do you have a positive view on Trican too?