Peyto Exploration & Development is on a winning path

Repsol acquisition was a brilliant move

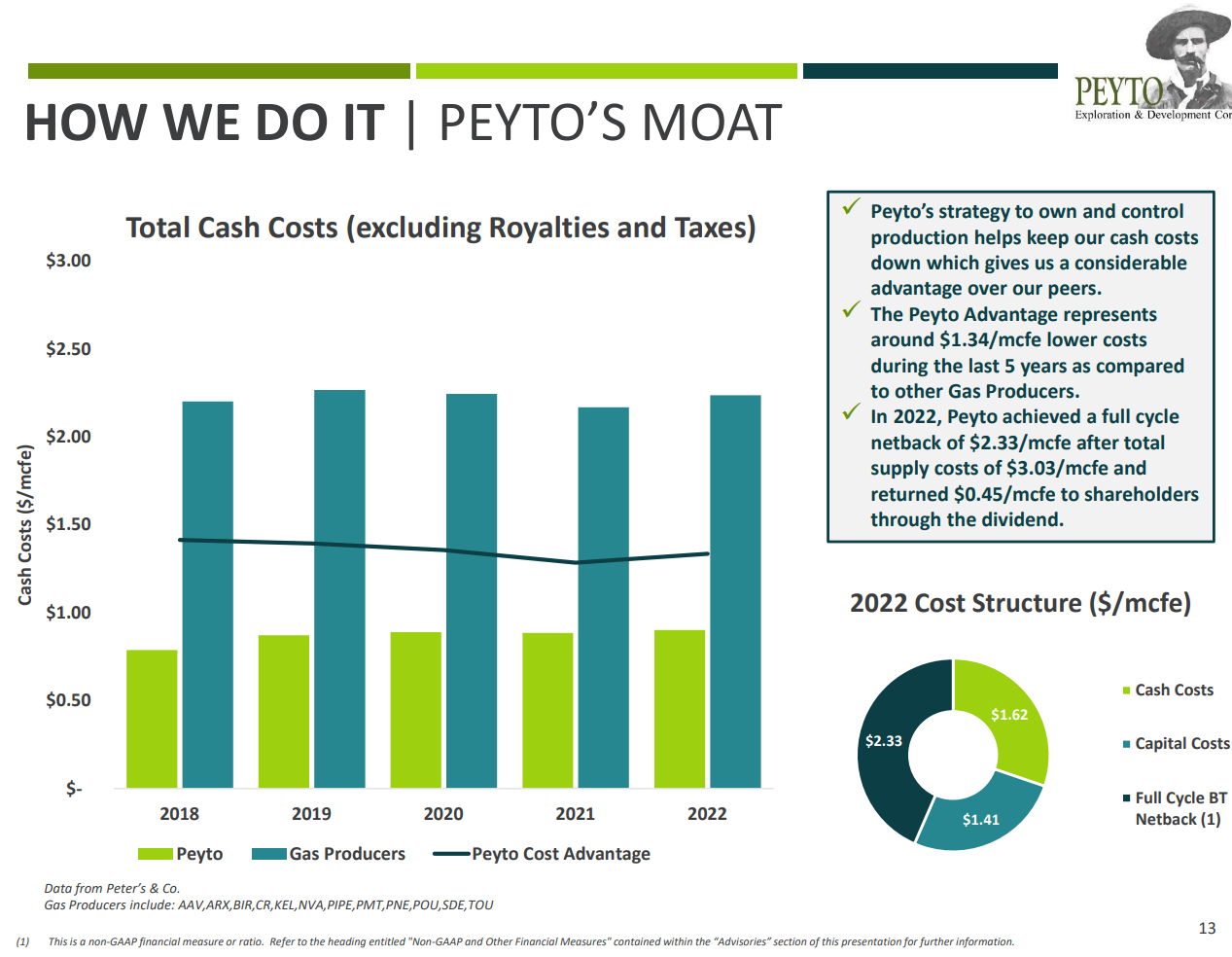

Peyto (PEY.TO) is one of the lowest cost natural gas producers in Canada, and may well be the lowest. The company has concentrated on ownership of its own infrastructure and relentlessly developing its land holdings in the prolific Deep Basin. Repsol was Peyto’s neighbour. In its most recent corporate presentation, Peyto management has posted a comparison of Peyto’s costs in relation to its peers. The numbers are impressive.

Peyto acquired the Repsol assets for US$468 million (about CAD$630 million) and concurrently did a CAD$201 million bought deal financing issuing 16.9 million shares, bringing total share count to about 192 million. The Repsol assets are liquid rich, low decline and come with underutilized infrastructure, a fit made in heaven for Peyto’s long-standing strategy. The immediate effect is to increase annual output from 100,000 Boe/Day to 123,000 Boe/Day with a line of sight to 160,000 Boe/Day within a few short years. The added CAD$429 million debt will fall quickly even as Peyto keeps paying its CAD$1.32 annual dividend (CAD$0.11 a month).

Even at current natural gas prices and with Peyto’s modest hedge book, I see cash flows in 2024 in the range of CAD$1.1 billion, plenty to fund a CAD$450 million capital program (which will not only offset Peyto’s production decline but also increase production to well over 140,000 Boe/Day) while paying out some CAD$250 million in dividends leaving CAD$400 million to retire debt. Within one year, I expect Peyto to be almost 50% bigger without adding materially to debt while paying out dividends of about 10% of the current share price. In terms of value, I value PEY.TO shares at 5 X EBITDA of CAD$1.1 billion or CAD$5.5 billion less the temporary debt bulge of about ~CAD$1.2 billion for an equity value of ~CAD$4.3 billion, mor than CAD$20 a share. The 5 X multiple recognizes the potential growth profile as the company develops the Repsol lands and fills out the unused capacity of the newly acquired infrastructure.

There are few investments that offer high dividends, reasonable growth and sensible credit risk but Peyto is one of them today. I own the stock.

Thanks for mentioning PEY, Ill keep an eye open, I heard and see that Don Gray was selling lots of his Gear and buying shares last week, also lots of buying from insiders using their rights so somewhat positive:) https://ceo.ca/api/sedi/?symbol=pey&amount=&transaction=&insider=

Couple of small Canadian listed companies worth a look, CEI and VLE..

CEI small NGas stock operating in Canada, worth checking out their management and very interesting story(not their first rodeo)

VLE, small oil producer offshore Thailand, no debt, lots of cash, much good news and incredibly cheap, around $7K per flowing barrel. Check them out if interested, I have smallish positions in both as these smaller companies are pretty risky.

The overall markets are looking very soft, Ive been going to high % cash, especially with the(I sort of think of it as cash) 1yr GIC's paying 5.75 at EQBank...

Great timing!!! PEY - T 0.9 13.73 · 13.74 0.9 13.735 1.175 9.4 2,528.6

Although Scotia came out with a big REC today and a target of $23 from $21