Persistently high oil prices have made Bonterra Energy a steal

Investors seem overly concerned about its modest debt levels

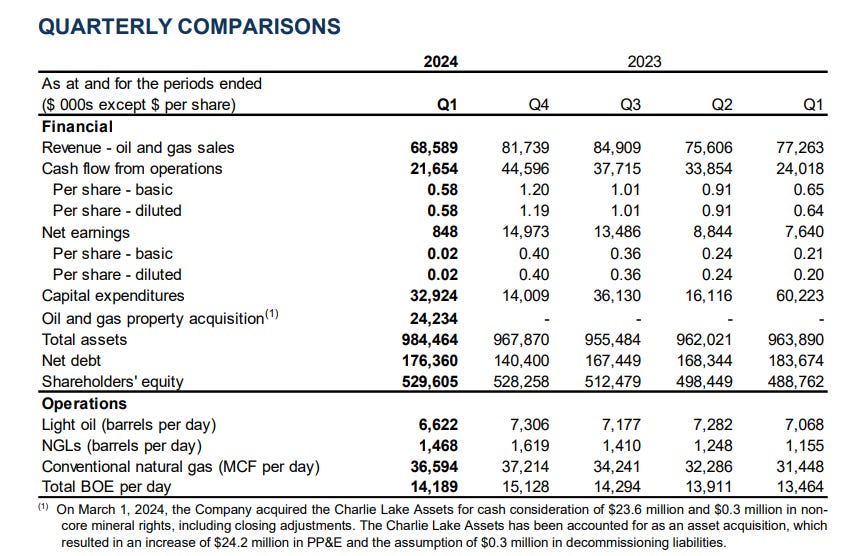

Bonterra Energy (BNE.TO) ended March 31, 2024 with debt of CDN$176 million after spending CDN$24.2 million to acquire additional assets in the Charlie Lake region. With quarterly cash flow of only CND$21.7 million, investors suffered a bit of distemper as the debt level rose to about 2 x cash flow.

The Charlie Lake purchase added some 300,000 Boe/day of oil output, but since it closed on March 1, 2024, only about one third of that output showed up in Q1 2024 results.

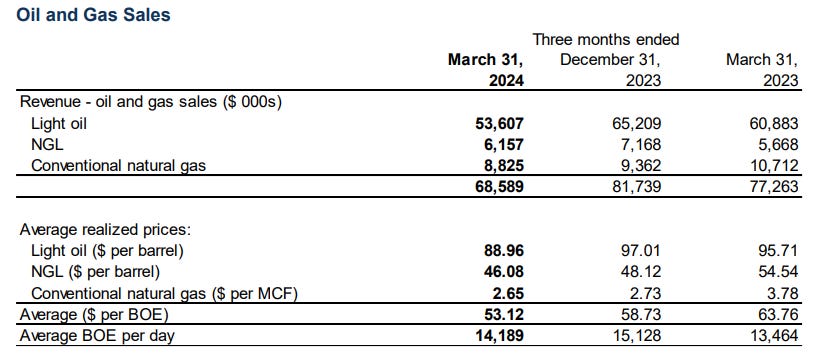

Many investors fail to realize Bonterra is more a natural gas producer than an oil producer, with oil comprising only ~45% of output, with natural gas making up a similar amount and natural gas liduids the balance.

Bonterra’s oil output is light oil, which in Q1 2024 returned CDN$88.96 a barrel. Today Alberta light oil realizes about CDN$107 a barrel. That higher price and slightly higher output, if the price holds, adds about CDN$40 million to annual cash flow.

Bonterra debt is primarily a subordinated debenture owed to former CEO George Fink, and in total carries interest of about 11% with the money owed to Fink the lowest cost.

I model Bonterra 2024 operations with year end debt at CDN$118 million, less than 1 x cash flow, and a simplified valuation of over CDN$14 per Bonterra share.

Bonterra has a clearly articulated return of capital model, published on the company web site. By year end, it is reasonable to expect a dividend and at current commodity prices, free cash flow will approach CDN$40 million indicating an annual dividend on about $0.10 per share is likely in 2025, with the remaining CDN$30 million of free cash flow applied to reduce debt to the CDN$90 million range.

This is a time for the faint of heart to go elsewhere and for long term investors to be patient.

The production numbers seem to be a bit high..??